Updated: July 28, 2023 We’ve had quite the ride over the past few years between wild volatility in the markets, high inflation, interest rate hikes, and a freaky-hot housing market/housing shortage. You name it and it seems like it has happened! And yet throughout it all, there is one friend that we can always count… Continue reading Cash is King – and the Queen, Jack, and definitely the Joker

Tag: cash flow

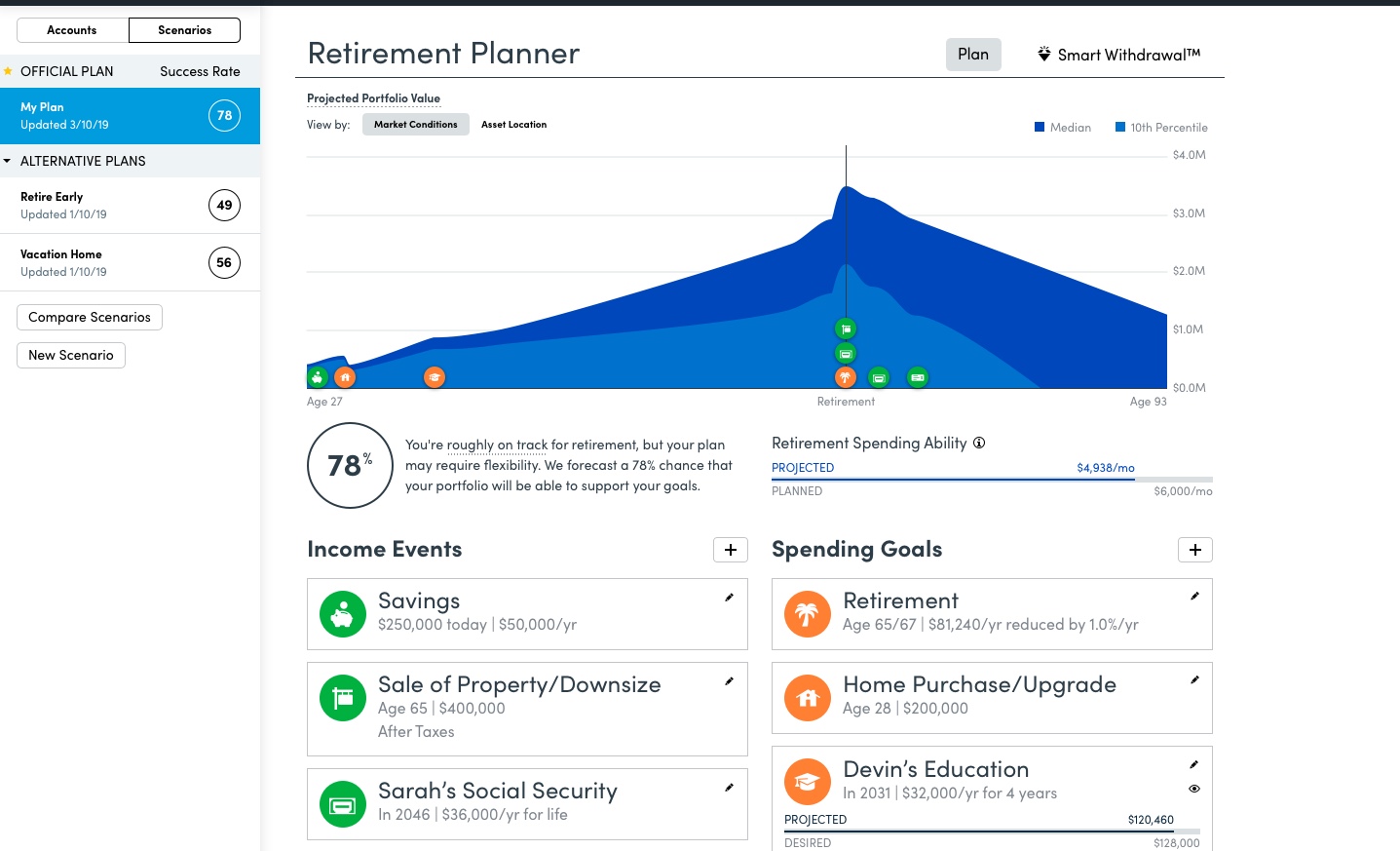

Empower Retirement Planner Review 2025

Empower is the easiest and most convenient way to track your net worth, plan for retirement, and run your day-to-day budget There is a reason that many personal finance bloggers are continuously pushing Empower’s Retirement Planner: it is the easiest and most convenient way to tie together your entire net worth picture, plan for retirement,… Continue reading Empower Retirement Planner Review 2025

The magic of a one-time partial mortgage payment: your net worth increases

Should you pay down your mortgage and live debt free or invest? There is an even better option with a one-time partial payment. Update – April 13th, 2022 A major calculation error in my spreadsheet has shown that the content in this post is incorrect. While I still believe that paying down your mortgage provides… Continue reading The magic of a one-time partial mortgage payment: your net worth increases

Why we decided NOT to invest in a vacation rental

From the moment my Dad lent me his copy of Rich Dad, Poor Dad, I always dreamed about investing in real estate. Not just investing in my primary residence, but utilizing real estate investing to generate passive income that moves you from the left to the right side of Rich Dad’s CASHFLOW quadrant. But as… Continue reading Why we decided NOT to invest in a vacation rental

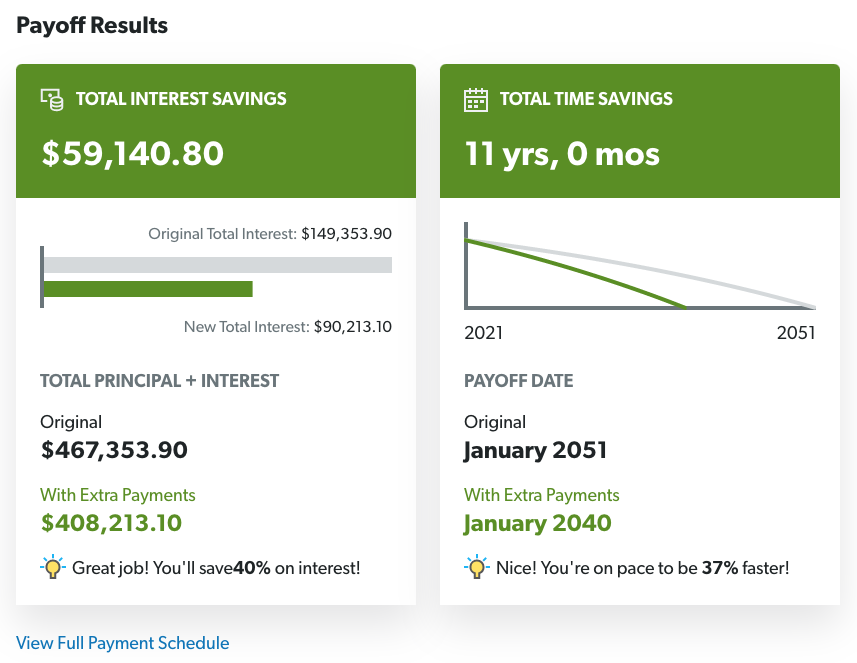

Refinance now to improve your savings rate, cash flow, and overall wealth

Interest rates remain historically low. If you have not refinanced, please do so now! We recently finished up refinancing via an Asset Based Mortgage to save $500 on our total mortgage payment. This was huge for us, especially after Accidentally Retiring. Not only are we now able to save $6,000 a year in total expense,… Continue reading Refinance now to improve your savings rate, cash flow, and overall wealth