Too Much Can Go Wrong Hiring a Financial Advisor: You Should Do It Yourself Updated March 23, 2023 As you can imagine for someone who Accidentally Retired, I managed to earn and save enough money over time to find myself in this position. But it wasn’t easy…I ran a startup and it was a grind.… Continue reading Should I Use a Financial Advisor or Do It Myself?

Tag: investments

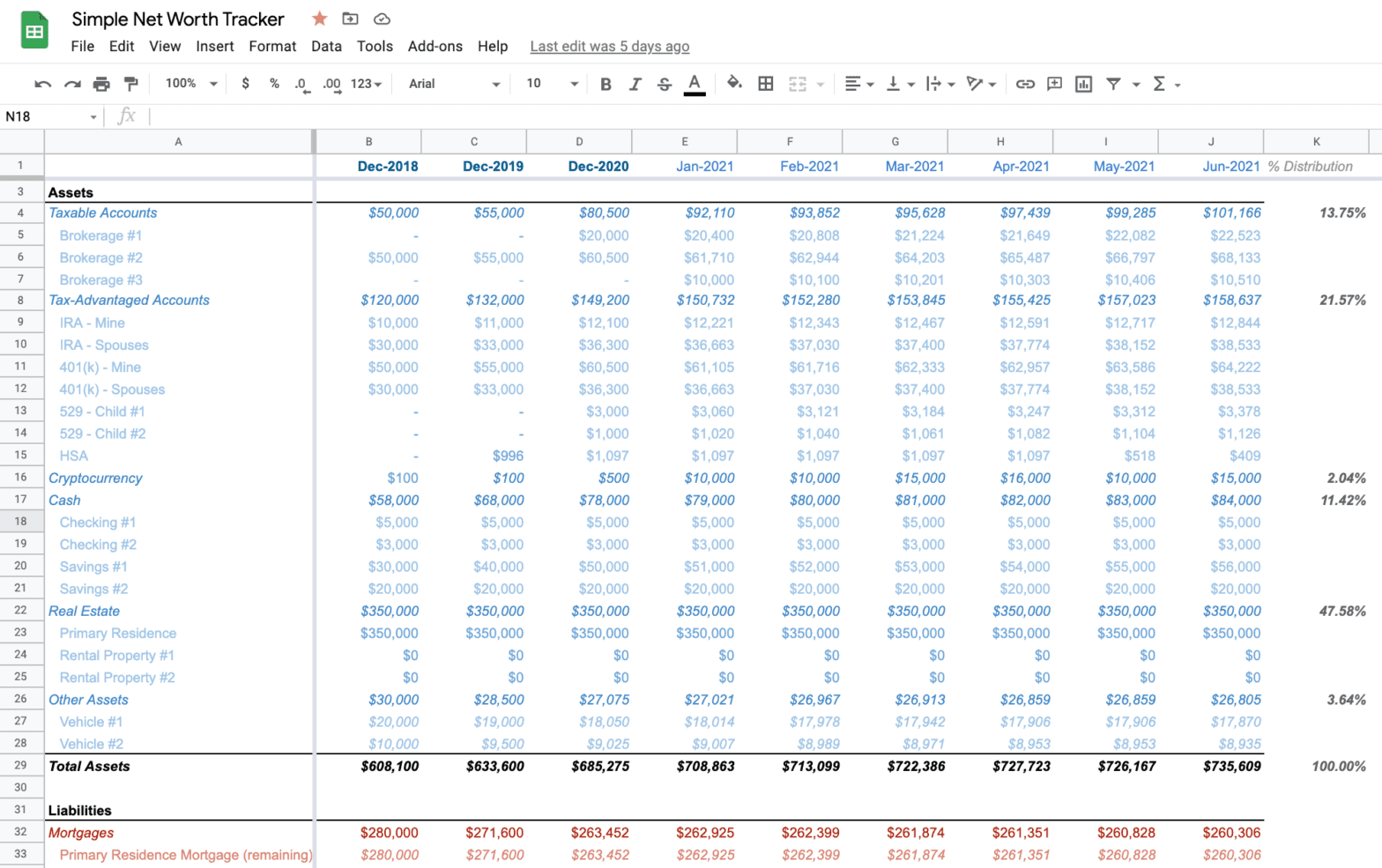

Easy-to-Use Net Worth Spreadsheet 2025 (Template for Google Sheets & Excel)

I believe that one of the most important things that you can do in personal finance is to track your net worth. Now, more than ever, there are so many easy ways to automatically track your assets and your liabilities. I personally use Empower (formerly Personal Capital) to seamlessly track my net worth, asset allocations,… Continue reading Easy-to-Use Net Worth Spreadsheet 2025 (Template for Google Sheets & Excel)

My Failure Resume: The Many Mistakes Made on the Path to Success

Updated: November 16, 2022 My Failure Resume If you think that successful people are void of any failures in life, you are just plain wrong. And what is success anyway? Is it the amount of money in your bank account? Or is it being a valued member of your community? Is it earning accolades, or… Continue reading My Failure Resume: The Many Mistakes Made on the Path to Success

How to keep your money, investments, and cryptocurrency secure; preventing hacking, phishing and other nefarious scams

My wife is deep into the true crime world of podcasts, documentaries, and tv shows. As such, I am used to hearing/watching shows about various murders, rapes, hate crimes, and other generally horrible/disgusting crimes. The other day, we were watching the show, True Life Crime on MTV, when an episode called “The $5 Million Dollar… Continue reading How to keep your money, investments, and cryptocurrency secure; preventing hacking, phishing and other nefarious scams

The magic of a one-time partial mortgage payment: your net worth increases

Should you pay down your mortgage and live debt free or invest? There is an even better option with a one-time partial payment. Update – April 13th, 2022 A major calculation error in my spreadsheet has shown that the content in this post is incorrect. While I still believe that paying down your mortgage provides… Continue reading The magic of a one-time partial mortgage payment: your net worth increases