NOTE: This is not investing advice, nor should be taken as such. The Asset Allocation Spreadsheet is simply a tool for DIY rebalancing!

After becoming Accidentally Retired, I was fed up with my Financial Advisor and decided to fire him.

I was now a DIY investor!

But there is one thing that every DIY Investor needs to know how to do, and that is periodic asset allocation rebalancing.

A simple way to rebalance your portfolio

Whether you rebalance monthly, quarterly, semi-annually, or annually, you need a system to do it. Here’s mine:

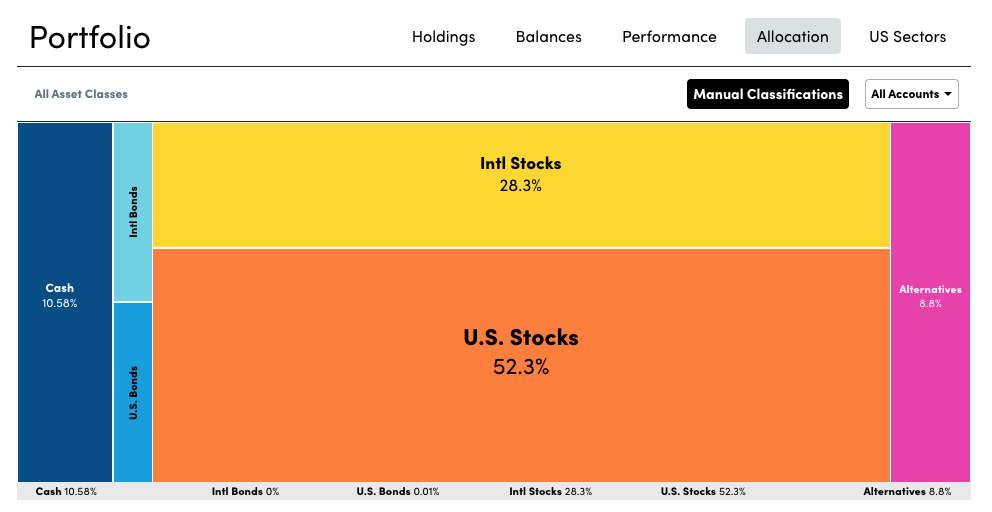

- Using Empower, I log in and view my current allocations (highly recommend for this alone)

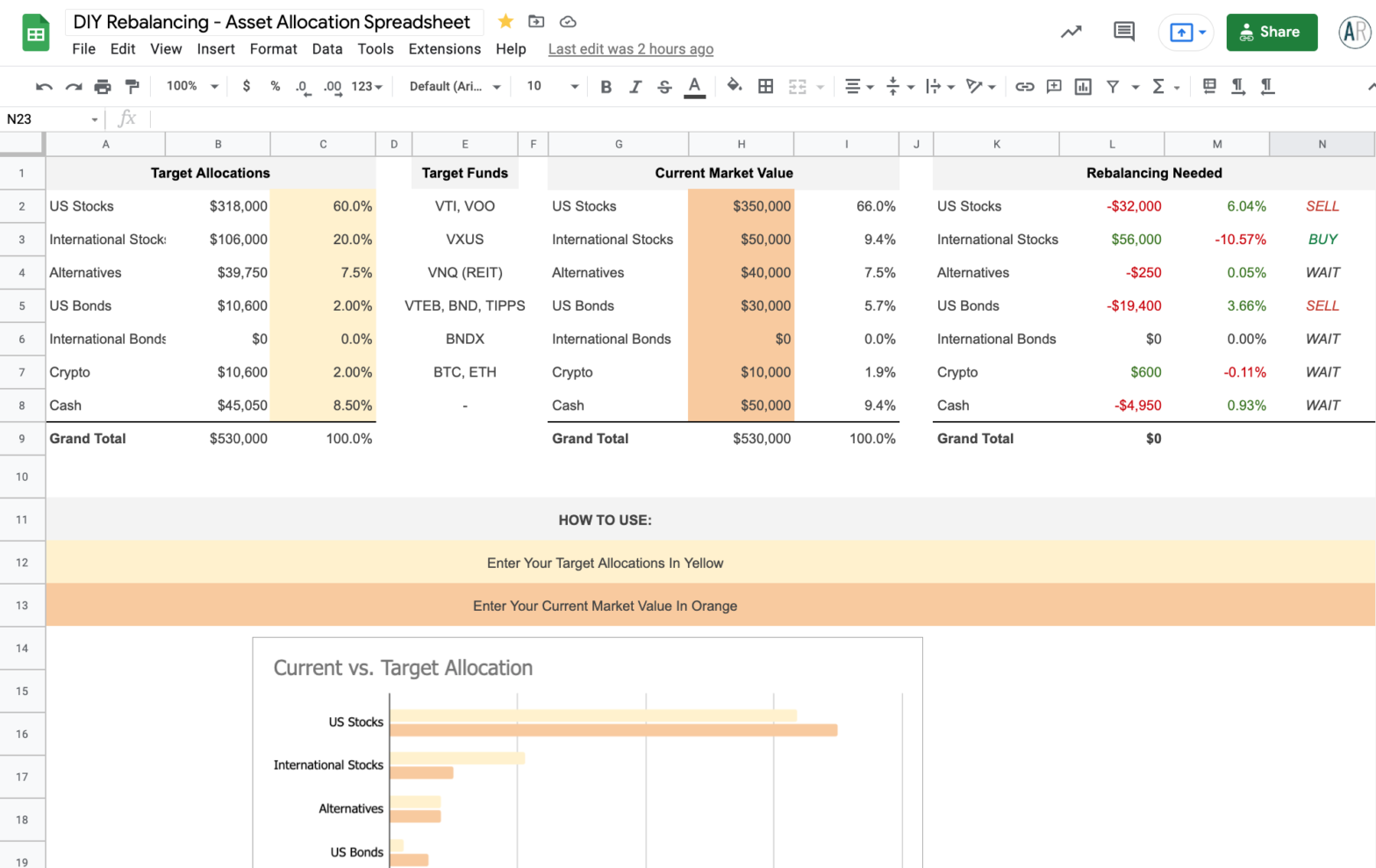

- Then, I head to the Asset Allocation Spreadsheet and enter my “Current Market Value” (Orange column) for each investment type

- Next, I enter my “Target Allocation %” (Yellow column)

- Finally, I see what assets might need to be rebalanced, and check my investments to see how to best manage based on the spreadsheet’s indication

Click here to “make a copy” of the DIY Rebalancing – Asset Allocation Spreadsheet

Step 1: Check allocations using Empower

This step is quite easy thanks to Empower.

You can see my full review here, but for monitoring your asset allocations alone, it is worth it.

Simply log in and navigate to “Investing” and then “Allocation.” Your screen will look something like this:

From here you’ll be able to grab exact market values by asset class.

Of course, you can monitor your asset allocations any way you like. The key is, you’ll want a very accurate picture of the current market values.

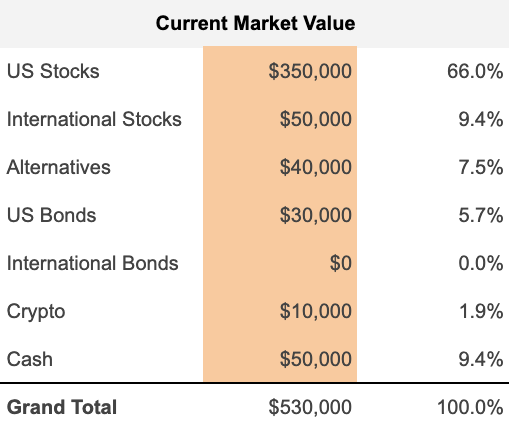

Step 2: Open Asset Allocation Spreadsheet and Enter Current Market Values

Once you’ve pulled up your exact market value by asset class, you can simply copy => paste the values into the Orange column on the spreadsheet:

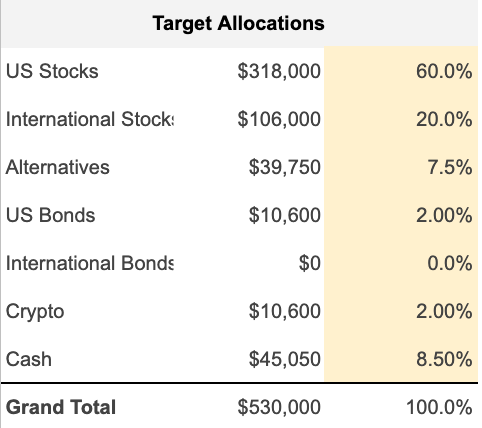

Step 3: Input Your Target Asset Allocation

Next up, you’ll want to navigate to the Yellow column and enter your Target Allocation Percentage:

This is entirely based on your risk tolerance and personal preference (you can see mine here). Whatever YOUR personal target allocation, that is what you enter in this step.

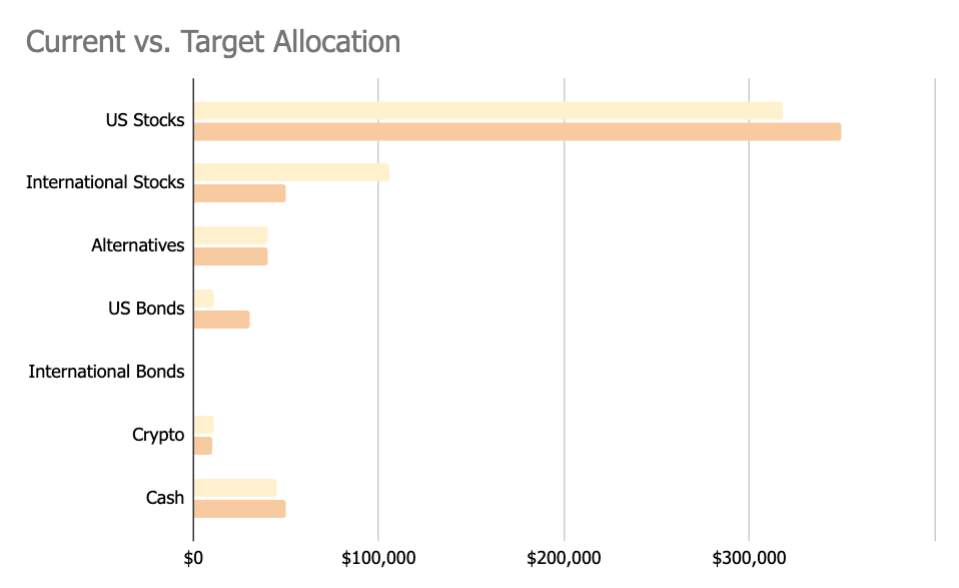

Step 4: Review Rebalancing Recommendations and Make Corresponding Buy/Sell Orders

Review Rebalancing Recommendations:

From there, the spreadsheet automatically creates a “Current vs. Target Allocation” Chart, and shows you any potential differences between the Target Allocation and the Current Allocation:

Recommendations are NOT financial advice, and shouldn’t be considered as financial advice.

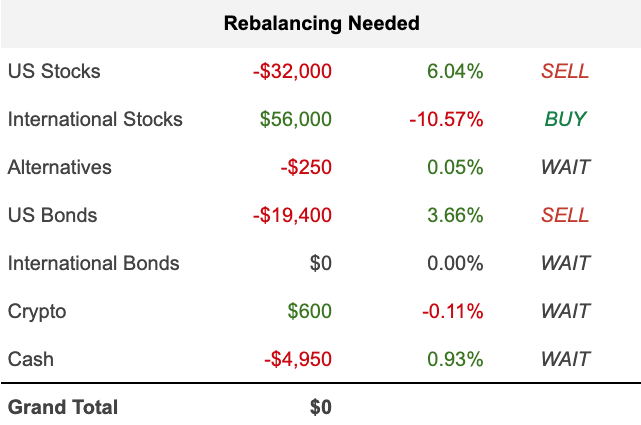

From there, you’ll also see “Rebalancing Needed” – these are rebalancing recommendations that are based on any deviation by 1% or more +/-.

Note: You can adjust the “Buy,” “Sell,” “Wait” column for your own personal preferences. I chose to indicate at +/- 1%, but this is not financial advice in any way.

Make Corresponding Buy/Sell/Wait Decisions

From this point forward, you are armed with most of the information you’ll need to rebalance.

You still will want to consider any potential taxable events (such as realizing capital gains), or see if you can make all of your rebalancing moves in your tax-advantaged accounts such as a 401 (k) or IRA*.

Depending on the amount of deviation, and the tax vs. tax-advantaged account status, you may simply want to leave things be. This is again, entirely up to you.

Lastly, you’ll then want to go into your investment platform and execute any buy/sell orders.

So that is that. Click the button and “make your copy” of the spreadsheet:

*Rebalancing in your tax-advantaged accounts will be much easier, because you won’t have to worry about creating taxable events by selling.

How often should I rebalance my portfolio?

I have rebalanced quarterly, but this is entirely based on my family’s needs and the movement of the current market.

Some folks chose to rebalance yearly, others monthly. It depends on a variety of circumstances:

- How long is your investment horizon?

- Are you retired or saving for retirement?

- Are you living off of your investments or do you have cash flow coming in from elsewhere?

So, as you can see, it really just all depends. Vanguard recommends the following:

Use one of these rebalancing strategies:

Time: Rebalance your portfolio on a predetermined schedule such as quarterly, semiannually, or annually (not daily or weekly).Threshold: Rebalance your portfolio only when its asset allocation has drifted from its target by a predetermined percentage.

Time and threshold: Blend both strategies to further balance your risk.

3 rebalancing tips to fine-tune your portfolio – Vanguard

I use both time and threshold and have been using this strategy and the Asset Allocation Spreadsheet with absolutely no issues since I’ve headed off into the land of DIY Investing.

Good luck! If you have any questions or run into any issues, please leave a comment, and I’ll get it fixed.

Thank you for the detailed explanation and for sharing this spreadsheet, it is amazing!

Thanks for the spreadsheet AR! Extremely helpful for any DIY investor! After I filled out my spreadsheet, I discovered that my actual portfolio was within +/- 5% of my desired allocation. Awesome stuff!

YES! That is what I like to hear!