I believe that one of the most important things that you can do in personal finance is to track your net worth.

Now, more than ever, there are so many easy ways to automatically track your assets and your liabilities.

I personally use Empower (formerly Personal Capital) to seamlessly track my net worth, asset allocations, and eyeball my budget.

But to me, the most important part of tracking your net worth is the act of typing up the amounts yourself. And to do this you will need a spreadsheet.

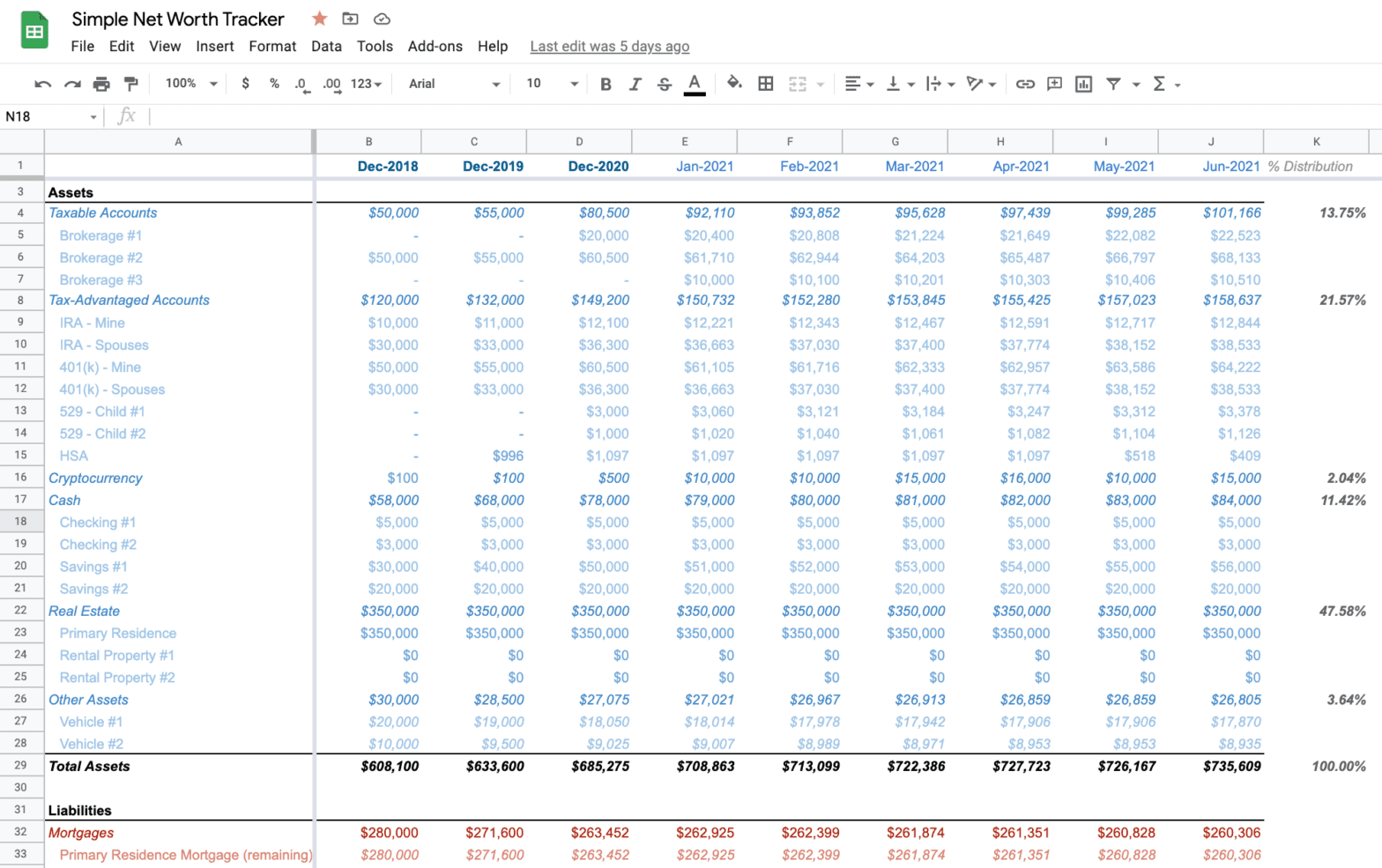

My spreadsheet works with both Google Sheets and Microsoft Excel. It is a simple and easy-to-use template.

How to use the Net Worth Tracker Spreadsheet to Track Your Net Worth

Every month, on the first of the month, I head over to Empower, and I look at the final amounts in each of my accounts to drop into my Simple Net Worth Tracker Spreadsheet.

- For both Google Sheets and Microsoft Excel users, click here to “make a copy” of the Net Worth Tracker Spreadsheet

- For Excel users only, you will then want to click “File” then –> “Download” –> “Microsoft Excel (.xlsx)”

- That’s it then you are off and running!

Even if you don’t use Personal Capital or a similar tool, you can simply log into each of your accounts directly on the 1st of the month (or close to it) and pull your numbers for all of your various accounts.

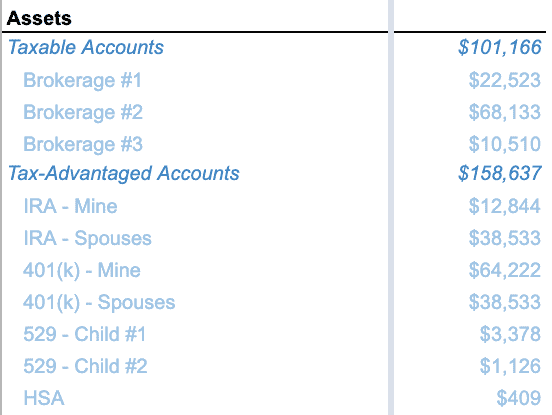

In my case, I have Taxable Brokerage accounts, plus Non-Taxable accounts like my IRA, 401(k), HSA and 529s:

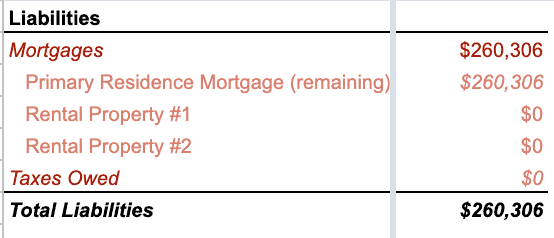

After punching in my assets, I then go in and track any of my liabilities:

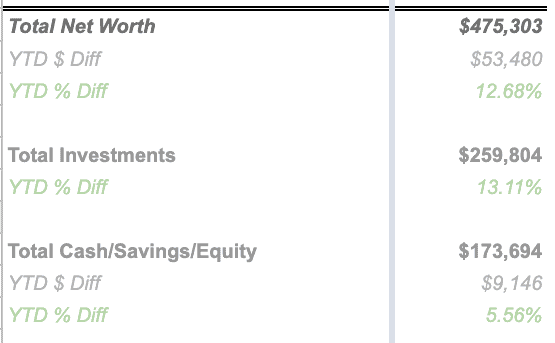

Finally, once you’ve entered all of your information, then the spreadsheet will automatically calculate out your Total Net Worth, and overtime year-over-year increases/decreases:

You can easy add/remove accounts as it suits your needs.

I’ve pre-filled the spreadsheet with example information to make it easy to see how it all comes together.

Why you should track your net worth

I know a lot of folks end up creating fancy net worth trackers, but IMO, this is all you need!

Keep it simple. The best thing you can do is create the habit and go from there!

I like to track monthly and then once some time has passed each year, I go and hide January through November and leave only December visible.

If you have any questions or run into any issues, please contact me, and I’ll get it fixed.

One thing I do differently is to only count real estate equity as part of the distribution percentage – otherwise it’s way out of proportion to the other categories.

That makes sense. At the end of the day, equity is what matters in that calculation.

I have a more comprehensive summary page that I didn’t release, and perhaps I should…on that sheet I have some graphs that show net worth percentages with and without real estate equity. Will update!

I’ve noticed that you entered $0 for rental properties. Have you paid them off entirely, or do you not count their mortgages as part of your own liabilities since they effectively pay for themselves? Curious as I’m trying to figure out how to handle mine.

This was simply a placeholder. I currently do not own any rental properties, but wanted a place for anyone who did to enter theirs in. But you will also want to make sure you also add any mortgages in the liabilities section as well.

I created my own tracker for my net worth, but I have incorporated a number of aspects that you included in yours. The distribution percentage for assets and liabilities is valuable as well as the YTD differential. Thanks!

No problem! Glad you were able to take something from it!

“Brockerage”

Oh man. Spelling without spellcheck is not my forte. Thanks!