If you are self employed or running a small business, then you, like me, want a quick and easy way to generate a P&L.

Of course there are plenty of paid tools that can do it for you, but I find that it is always best to get hands on with the data.

So I built this Profit and Loss Statement Template for myself and have been using it the past few years for our LLC.

Then I realized, that if I needed this, many others probably would too.

So I created an even better version that I am sharing with you today.

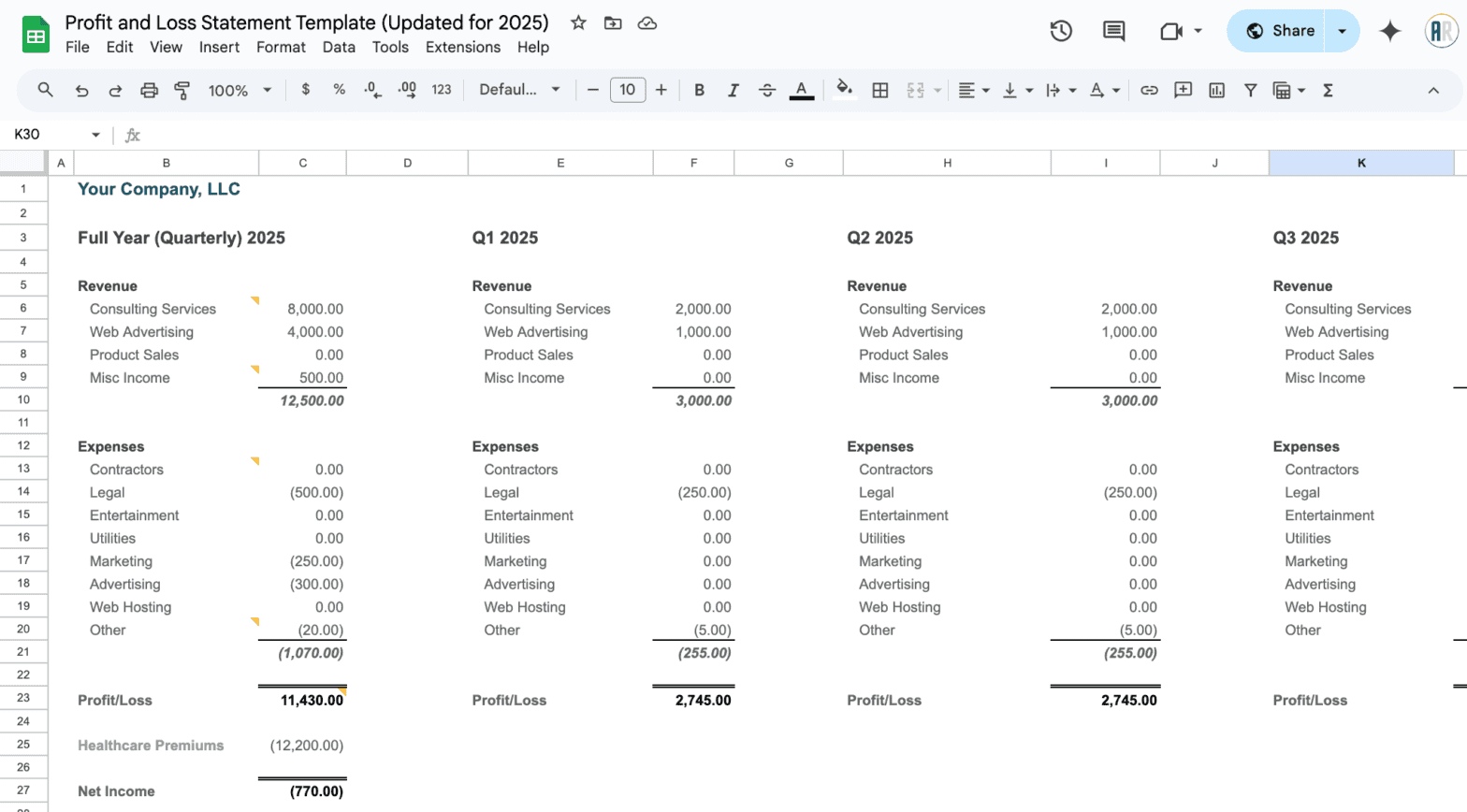

My spreadsheet works with both Google Sheets and Microsoft Excel. It is a simple and easy to use template.

How To Use The Profit and Loss Statement Template to Track Your Small Business Finances

I’ve tried to make this as simple to use as possible. But first things first…you need to download the sheet:

- For both Google Sheets and Microsoft Excel users, click here to “make a copy” of the Profit and Loss Statement Spreadsheet

- For Excel users only, you will then want to click “File” then –> “Download” –> “Microsoft Excel (.xlsx)”

- That’s it then you are off and running!

Depending on the type of business you are running, you may need to change or adjust the revenue and expense categories.

But it’s pretty straightforward to do this. Just head to the “2023 P&L” sheet and update Column “B” – here is an example:

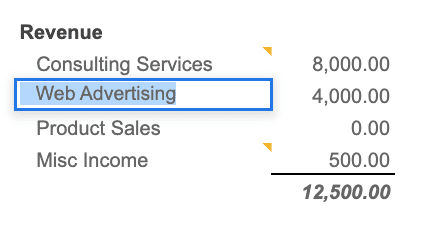

So if for instance, if your business runs primarily off of “Web Advertising” you can go ahead and make this update to the sheet.

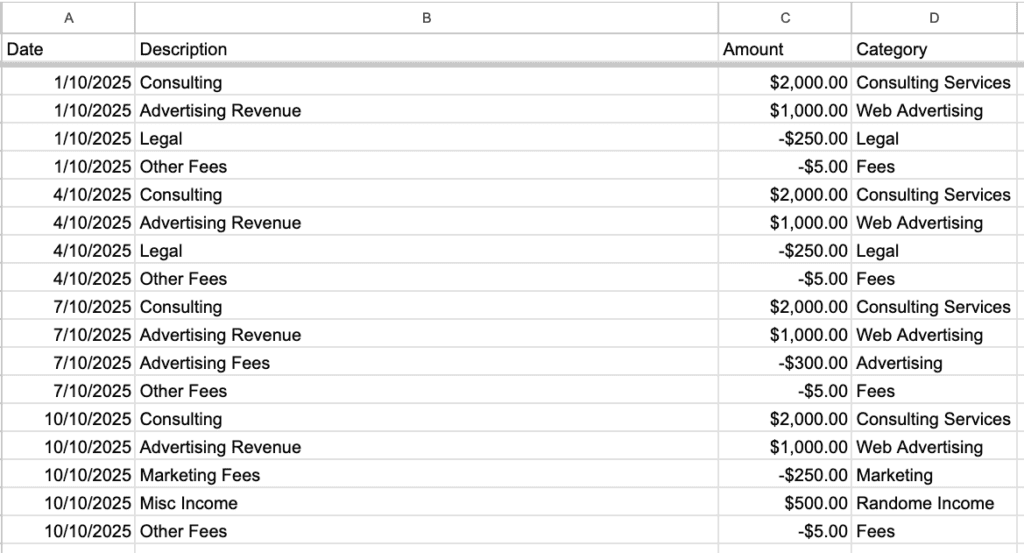

Once you have all of your category names settled, you’ll then want to import all of your banking data into the “2023 Banking Transactions” sheet.

I have both bank account transactions and credit card transactions, so I upload each of these using “File” -> “Import” -> “Import into new sheet.”

You can also copy/paste. Really whatever is easiest for you.

You will want to import any/all transactions pertaining to your business.

The “Banking Transactions” sheet will then house all of the data that populates into the Profit and Loss Statement sheet like so:

A few things to keep in mind here:

- Make sure that you also fill out Column “D” with the proper Category that matches the P&L Categories that you changed earlier.

- You’ll also want to ensure that revenue is positive and expenses are negative.

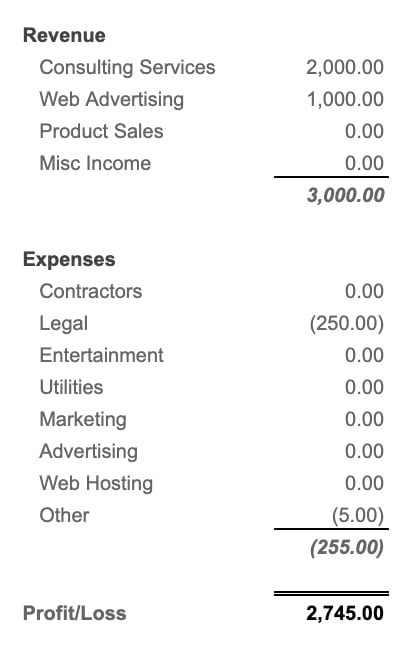

Once you are all done entering everything, your data should begin populating into the P&L:

If you missed labeling any categories, it will be automatically picked up as either Misc Income or Other Expense.

And finally, you can enter in any Healthcare Premiums to help calculate out your Schedule C Net Income.

I’ve pre-filled the spreadsheet with example information to make it easy to see how it all comes together.

Why Do I Need a P&L?

A P&L statement will help you to properly manage your business.

It will help you to track your revenue and expenses and ensure that the business is indeed profitable.

Even if you are simply running a small side-hustle, you’ll want to have an idea of how the business is performing.

I’ve also used P&Ls over the years to catch spending issues, or spot trends in revenue performance that need to be looked into.

And lastly, knowing your net income will help you properly estimate your taxes.

Remember: what gets measured, gets managed!

If you have any questions or run into any issues, please contact me, and I’ll get it fixed.

How do you incorporate credit card expenses?

Simply add them to the banking sheet, and just make sure that they are showing as negatives. AMEX exports for example tend to have credits as negatives and charges as positives.

So just make sure that everything lines up between all of your accounts upon import.

Thank you very much for this P & L template. Do you have any more suggestions on updating for each new year?

You can just duplicate each of the sheets and then run a search and replace “within formulas” on the new sheets to match the name of the new banking sheet.

Thank you.

Do you have anything like this for a household, or recommendations for modifying? I like the projected sheet especially and haven’t found an app that lays it out so simply and clearly. I’m not super experienced with excel.

You can easily adapt this for personal use. In fact, I use it for that too! You’ll want to match up the categories on your credit card and add them in here same as you would for a business.

But if you just want to look at expenses, you can check out this simple budget spreadsheet here: https://accidentallyretired.com/resources/budget-expense-template/2529

Thank you!