Interest rates remain historically low. If you have not refinanced, please do so now!

We recently finished up refinancing via an Asset Based Mortgage to save $500 on our total mortgage payment.

This was huge for us, especially after Accidentally Retiring. Not only are we now able to save $6,000 a year in total expense, but we are able to significantly improve our cash flow and redirect the savings toward growing our overall wealth.

I was surprised by not only how much money we were able to save with the percentage point improvement from 3.75% to 2.75%, but also the ease in which we were able to get the mortgage, especially once I finally found the right lender who would lend to someone in early retirement with no current W2 income.

Refinance and use the savings to pay down your mortgage to build wealth

Before interest rates dropped in 2020, we had been slowly working to pay down our mortgage balance. We had contributed about $40,000 towards that cause.

So, what are we going to do with our $500 in savings? We are going to pay $500 extra per month towards our principal.

David Ramsey has a great calculator here, that I have been using for years.

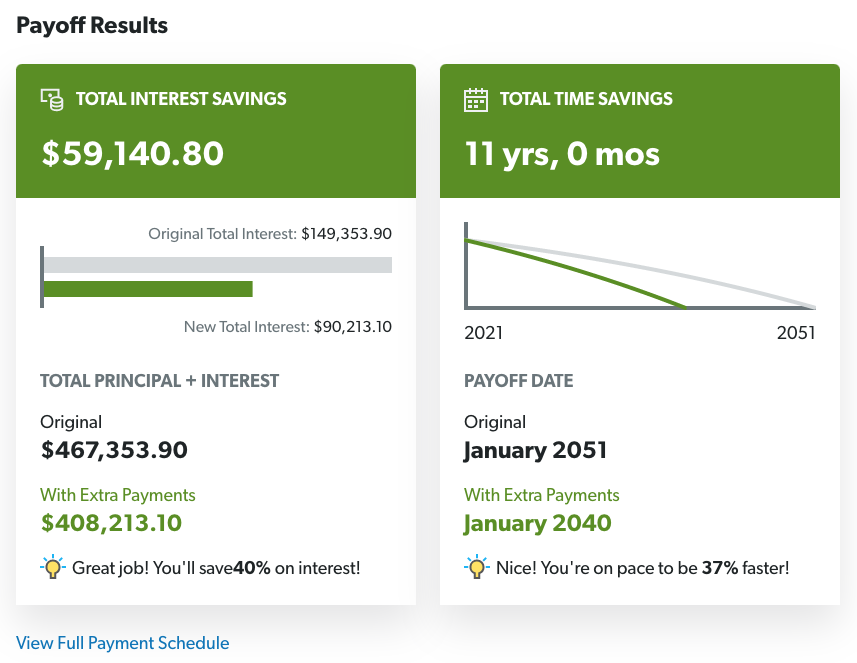

Using his calculator, and contributing our $500 per month, we will be able to trim down our 30 year mortgage to a 19 year mortgage, saving 11 years and $59,140.80 in interest:

Over the next 10 years, we’ll create $68,971 in additional equity

By contributing $500 per month to our mortgage principal, we’ll be saving $6,000 a year via our mortgage.

We will then make an additional $8,971 in interest savings that are converted into principal.

This is a really simple and easy way to save money. Because it is illiquid, you won’t be able to make any rash decisions with it. You simply continue to pay down your mortgage $500 at a time, and in 10 years we’ll have built $68,971 in new wealth.

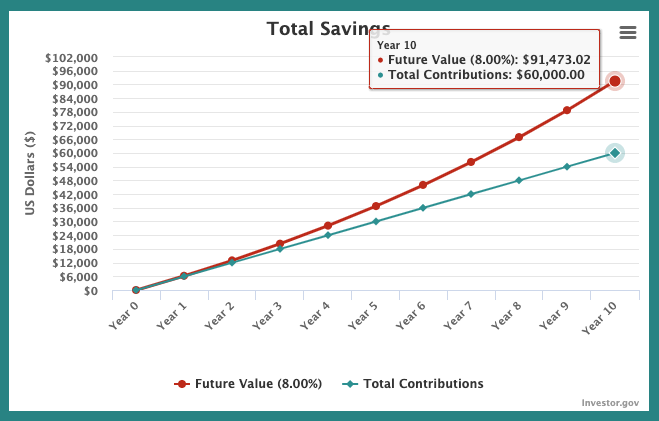

Invest the mortgage savings into index funds to build $91,473 in new wealth

Or, if you want to be more aggressive, you could redirect your funds to your investment accounts, and automatically invest $500 every month for the next 10 years.

Investor.gov has a great tool, in which you can see the power of compound investment. For these purposes, I set the returns to a constant 8%.

If you invested in VTI or VTSAX (both Total Stock Market Indices), you would be passively invested in the entire stock market, and over the course of 10 years, you will certainly benefit even more than putting the savings into your mortgage:

Refinancing your mortgage, and use the savings to build wealth

So this is all really a no brainer, IF you can save enough money to be worth the hassle of refinancing.

But clearly a one percentage point difference for us on our mortgage, is going to help us create additional wealth. We hope you decide to pay down your mortgage or invest your savings as well.