Today, I am officially celebrating my 1 year anniversary of leaving my CEO gig to retire early!!!

I honestly cannot believe that it has been a year since I left my job and headed out to my mini-retirement.

You guys know how the story goes…guy leaves CEO gig to take a 6 month mini-retirement. He takes over his personal finances, and realizes that he doesn’t *need* to work anymore. He realizes that he accidentally retired. Then he does what any sensible person would do in this situation. He starts a websites called Accidentally Retired.

And the rest is history…

One year later…the details

One year later, it is safe to say that in my first year of FIRE I did not miss the hassles of corporate america. Not. One. Bit.

I didn’t have to go into the office and have casual small talk with my employees to get to know them better. I didn’t have any 5 or 6 AM meetings with my European colleagues. I didn’t have to worry about potentially needing to fire anyone or fight anyone for whom to hire and when.

All those hassles are so long gone.

I don’t miss the title.

I don’t miss the money.

None of it.

I am just so thankful to be past all of that.

Early retirement still has its own stressors

But it doesn’t mean that there are no stresses in my life.

I have two small children who are non-stop.

We’ve had COVID linger far longer than I initially anticipated.

I have had the worst year of my life for family relationships. Some have deteriorated so bad in the past year, that it will take years to recover them to their previous levels.

And because I didn’t really plan on retiring early, there have been some money stresses and other things along the way.

I’ve spent too much time stressing about where/how to move money, and figuring out a proper plan of action financially.

So while most of my stress has melted away, there is certainly still stress there. Early Retirement is not a holy grail stress reliever…for me at least.

Early Retirement: I wouldn’t change it for the world

Yet, the good outweigh the bad.

For the first time in my adult life, I was able to take some unburdened time for me. I started to journal every morning and look inward, to both figure out what I wanted to do next in my career, but also because I could.

I was able to spend an enormous amount of time with my kids. I’ve been taking them out in the afternoons after school on bike rides, hikes, golf, etc.

I can play golf mid-week with no issues.

Vacation planning now revolves around my kids schedules and not my work schedule.

Happiness

My happiness has markedly improved. I know this, because I track my happiness and stopping work alone improved my happiness by 23%.

If you don’t believe me, you can see it visualized with so many more dark blue (happy days) and less orange (bad days):

What I have learned over the years via tracking my happiness is that happiness is a choice and something that has to be worked at.

Happiness isn’t something that can be improved overnight. You have to work at it, day after day.

Managing expectations is one of the most important aspects of happiness. I have had some great days in which I sit around doing nothing. Not expecting anything and being grateful for what I do have always helps.

I don’t want to fool myself though…clearly not having to work has been a huge benefit to allow me to sit around without a care in the world.

Health

My health has remained mostly the same, but I’ve gotten into a better workout routine and have been much more active between taking my kids out on bike rides, golfing, hiking, etc.

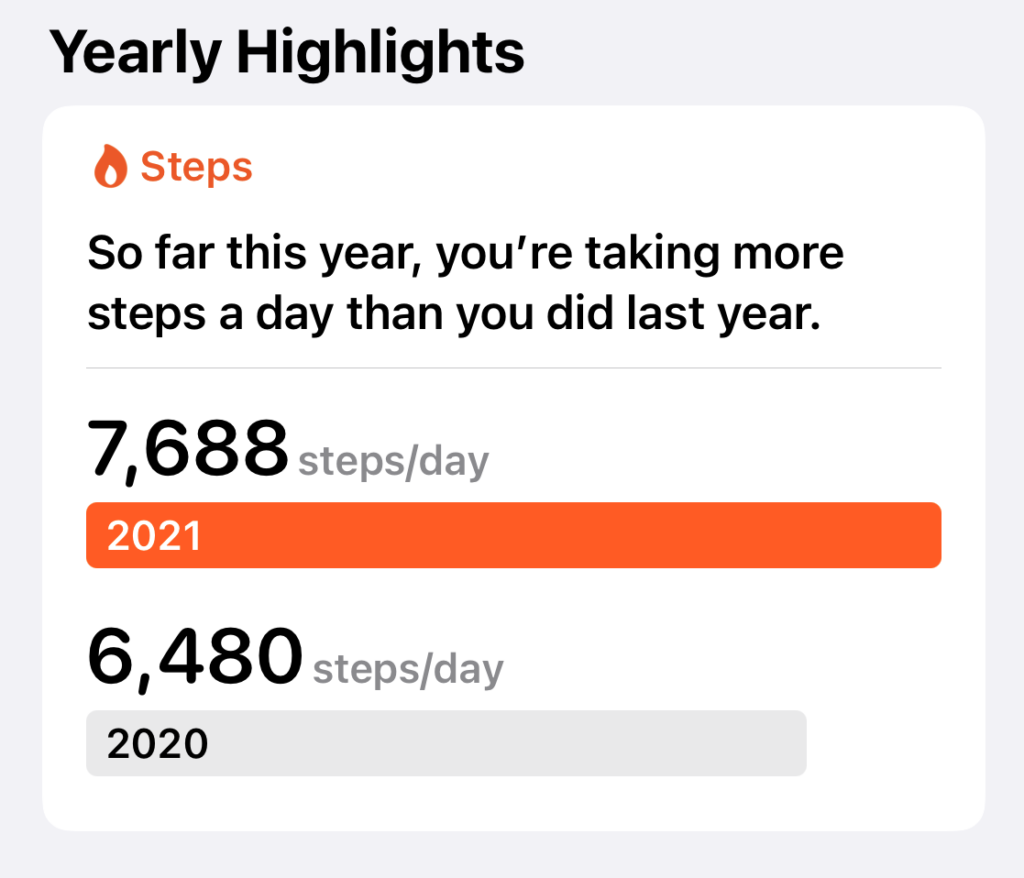

Steps wise I have had a 21.5% increase in activity since I’ve left work. You can see the difference between 2021 and 2020:

There is certainly room for improvement. Once my youngest child goes to school this fall, I will have even more time to be active, workout with my wife, go on longer walks/hikes, etc.

My general diet hasn’t changed at all. My wife is an excellent home chef, and won’t even let me near the kitchen. So 80% of our meals are home cooked meals, a lot of which have come from Hello Fresh which I highly recommend if you are looking for a quality box delivery service.

Wealth

Net Worth – Now this is where things get interesting. From the time since my last paycheck, our net worth has increased by 18.17%. VTI by comparison was up 39.5% during that time, but this makes sense in that we were invested far too conservatively with our former financial advisor and a majority of the move was made away from him in December and January.

Financial Advisor –Thankfully, with newfound time, I was able to invest more time into reading books and blogs that gave me the courage to write a personal financial plan, fire my advisor, and take over my own investments. This has been much easier than expected, now that I wholeheartedly believe investing only in low-cost index funds.

Retirement Withdrawal Plan – So while not a home run by any means, our net worth certainly didn’t suffer in my first year of early retirement, and hopefully my withdrawal plan will stave off any sequence of return risk.

Mortgage – I also refinanced our house by securing an Asset Based Mortgage. The plan is to at some point in the next few years pay down 50% to significantly speed up our mortgage.

Expenses – Just to do a quick sort of annual review, I double checked our expenses for the year, and we are on track to hit our spending target. No issues there at all. Next year, we likely to be able to save money on healthcare, which is by far our biggest runaway expenditure.

Taxes – In 2020, we ended up locking in some gains to be able to take over more of our own money management. This bullet hurt a bit, but ultimately was able to unlock a majority of our taxable investments. For 2021, we are targeting $0 in taxes, even while also selling off $110K in long-term gains.

Work

Now that I no longer have a job, I have time to pursue other interests…and that is ultimately the entire reason for early retirement.

I still want to be a productive member of society, but I want to do it on my terms.

Writing – I have always wanted to write a book, but wasn’t sure what exactly I would write about. During the first six months of my mini-retirement, I picked up a copy of The Artist’s Way: 25th Anniversary Edition by Julia Cameron, and started to journal via morning pages. This helped me to discover that I wanted to write this blog.

Investment Properties – I was initially interested in purchasing an investment property, most likely a vacation rental. I spent significant time on this, including reading real estate books, looking at properties, building out a comprehensive investment property calculator, and speaking with mortgage companies. In the end, I came to the conclusion that this was more work than I needed at the current moment, given the current market, and the returns for the area I was looking at. But I’ll revisit this in future years.

Consulting – Because my Accidental Retirement plan involves the need to make a little bit of income to reduce sequence of return risk, I have taken a stab at consulting. I have had a few gigs, but my expertise is very industry specific. So far I have only eked out a few thousand dollars and some headaches.

Buying a Website – This is largely where I have determined that I can get the most bang for my buck. I have spent a lot of time looking at potential web properties and figuring out what type of business I like and don’t like. Ultimately, I may end up purchasing a content business to pair with Accidentally Retired. This way learnings on one site, can be applied directly to another. Plus, the yields on purchasing a web property far exceed an investment property, likely for the same initial workload. However, similar to real estate, there are many trade offs to each individual property, and I haven’t quite found the right fit for my price range.

Family & Friends

As I mentioned earlier, early retirement is not entirely without stressors. I have had some relationships that unfortunately deteriorated. This has been the bad. It had nothing to do with my early retirement, but it happened and it affected my year. My hope is to rebuild these relationships in the coming months.

Despite that, I’ve also had relationships flourish. My wife and I are closer than ever. Hopefully my wife feels more supported by me now. There are of course still things that can be improved and worked on in our relationship, but early retirement has helped put us more on the same page.

My kids and I have spent a ton of time together. We have continued to build our bonds. One of the primary reasons for retiring early is to spend time with loved ones and I try to maximize my time with them every day.

Fun

What is the point of early retirement, if it’s not about upping the level of fun and enjoyment in your life?

Travel – We love travel and we aren’t afraid to spend money to indulge in experiences. Even despite the pandemic, we tried to make the most of COVID safe travel. In the past year we have rented a beach house in California, gone camping three times, headed to the mountains twice, rented a tiny house for an anniversary trip, and most recently took a three week road trip.

Hobbies – I grew up golfing, and played on the high school golf team. But it is a hobby that I haven’t quite indulged in as much as I would have liked due to a hectic schedule. In my first year of retirement, I was able to make it out on the course 2-3 times a month with a hiatus during lockdowns. Certainly, I would like to do it more going forward, but I only like to play if I can keep my round costs low ($30 max), which is hard to do these days.

I continue to write in my morning pages every day, and find it a great way to touch base with my thoughts and feelings. I do this first thing in the morning while drinking my coffee. It’s been a great way to get everything frustrating out onto the page and then be able to move forward with my day. It also sometimes leads directly to blog posts, brainstorm sessions or gratitude lists. Depends on the day.

Books – In total, I read about 20 books in the past year. By far and away, the most impactful was The Little Book of Common Sense Investing, by John Bogle. This really opened my eyes further to a sensible way of investing that I had mostly turned a blind eye to previously.

Real estate wise, I was really impressed with Crushing it in Apartments and Commercial Real Estate, by Brian Murray and also learned a lot from The Book on Rental Property Investing, by Brandon Turner.

I like to dive into some more spiritual/philosophical and thought provoking topics and Rediscovering Life: Awaken to Reality by Anthony De Mello, Loving What Is by Byron Katie, and On The Shortness of Life by Seneca did not disappoint. I probably learned and inferred the most from Loving What Is.

My favorite book of the last year was Sapiens: A Brief History of Humankind by Yuval Noah Harari. It just blew my mind in so many different ways from a historical perspective to philosophy and the future of Humankind. You will learn something new every chapter in this book.

And I also like to read for fun. I just finished Dune by Frank Herbert, and I enjoyed Stardust and The Graveyard Book by Neil Gaiman.

There were others, but those were the highlights.

Early retirement: year 2 goals

This morning as I reflected on the last year, I realized that I can’t reflect without looking forward to the future and setting some goals for the next year of my retirement. As you know, I love to lists and creating life mantras and goals, to help me to better enjoy my life and increase my happiness.

Early retirement should be treated the same. When I write down goals, I somehow manage to make them happen. Maybe not in the initial timeline I envisioned, but mostly they find a way to actualize.

Goals for Year 2 of Early Retirement

In no particular order:

- Continue to manage my finances and grow portfolio by 10%

- Purchase & run a cash flow positive web business

- Manage capital gains and income to achieve paying $0 tax for the year

- Improve my relationships all around; family, friends, kids, wife, etc.

- Have fun and enjoy running AR. Write what I want, when I want.

- Play more golf – let’s target 3-4 times a month

- Go on more hikes – let’s target 2 per month

- More travel – back to pre-COVID levels

- More date nights – back to pre-COVID levels

- Be more present and mentally available with everyone.

I had a great first year of retirement, but I am even more excited for whatever this next year will bring!

Congrats! And thank goodness for a bull market! I decided to “go back to work” by working more on Financial Samurai.

I figured, if I was going to get locked down, I might as well make some more money!

Sorry to hear about family relationships deteriorating. What do you think could be the cause how can you fix it?

Sam

Thanks Sam! You are making the most out of your situations, and I hope now enjoying your sabbatical.

As for my family relationships. I hope time will fix it. I just didn’t put enough effort into my friendships and sibling relationships, and am now realizing the costs of that lack of effort. I focused my efforts around my wife, my kids, my job, etc.

But if I had one word of advice for others….don’t sleep on your other relationships, no matter how busy you get in life.

Looks like a pretty awesome year–and a good reminder for me to get back on that Happiness Tracker (I started a few weeks ago and didn’t stick with it). I need to be more intentional about what exactly makes a particular day good or bad. That’s an awesome visualization you included. Keep up the good stuff here!

Thanks! Yeah, the tracker like any habit takes time to build into something more automatic. Let me know if you end up sticking with it and how it works for you? I am trying to gauge how others are doing with it. Potentially thinking about a future app and/or text service if people are liking it.

Congratulations on year one of retirement! Sounds like things are generally better all the way around, enjoy year two and beyond!

100% – Year 2 here we come!

Congratulations on 1 Year in retirement!! 🎈🎉🎊🍾

It’s fun to hear what you’re up to and how you’re staying busy. Cheers to the next awesome year ahead!

Joel

Thanks Joel!

You are making the best of the old saying that “Money is a good

slave – but a BAD master !. Keep making it work for YOU. Crack on !!.

Haha thanks! Appreciate it.