The Pitfalls of Playing the Stock Market: Why Index Funds Win Every Time

Updated May 11, 2023

In late 2020, after spending significant time talking with fiduciaries and reading The Little Book of Common Sense Investing by Jack Bogle, I fired my financial advisor, and took over my investments.

My mini-retirement had finally given me the time to really learn more about investing, and after taking many months to soak up as much knowledge as I could…it all led me to the conclusion that low-cost index investing is the simplest and easiest way to earn better than average returns.

Yes, I am a Boglehead!

So after firing my advisor, I put together a financial plan, and have tried to stick to it as best as I can.

I’ve worked quite hard to manage capital gains from the transfer, sell out of expensive mutual funds, and manage an out of control portfolio of 80+ stocks.

Then I made a bad decision.

False Logic and FOMO

Already owning 80 stocks that I wasn’t going to be able to sell out of anytime soon, I figured “I should pick some stocks that I believe in” to supplement my personal mutual fund:

I created a small play portfolio consisting of growth stocks that I believed in and wanted to invest in for the long run.

So against all Boglehead advice, I took about 1.5% of my total portfolio and invested in these stocks.

My intentions were pure. I really believed that I would own them for at least 5 years, come hell or high water.

But I was using false logic to justify my play portfolio.

My logic was backasswards. I was chasing a sunk cost. My sunk cost in this was the 80+ stocks that I already owned and couldn’t sell off.

I thought that I could help round out my portfolio.

I thought that I should at least get to choose some growth stocks that I would be stuck with for the long run.

I was wrong. I could feel it in my gut. I just didn’t listen.

Finally, I Trusted My Gut.

A few months into this experiment during a minor market correction, I wanted to look and see if there were any expensive mutual funds that I could sell off and “save” on capital gains tax.

Then I noticed that most of my “play portfolio” stocks that I added earlier in the year had all taken a beating.

I considered if I should sell some to take losses. I already had sold a few in the months prior to take some short-term losses and allow me to sell more of my 80+ stocks that I didn’t want.

But I needed to listen to my gut.

Was going against my investment philosophy by investing in these stocks in the first place?

I had to think long and hard about it, but the answer was yes.

False logic. FOMO. Sunk cost fallacy. Whatever, you want to call it, I was using it.

Simplicity beats complexity in investing

We could cue in a comment from Warren Buffet, Mark Cuban, Charles Schwab, Jack Bogle, etc. They all say that the average investor should invest in Low-Cost Index Funds. Every. Single. One.

It’s fun to play around…it’s human nature to try to select the right horse … [But] for the average person, I’m more of an indexer….The predictability is so high….For 10, 15, 20 years you’ll be in the 85th percentile of performance. Why would you screw it up?

Charles Schwab via The Little Book of Common Sense Investing

Why would you screw it up?

Maybe I did end up choosing the right horses…But maybe not. Why was I bothering with something that is a tried and true method? Set it and forget it.

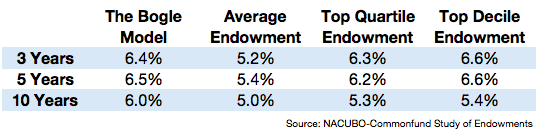

Ben Carlson, shows how simplicity beats complexity in real-life in “How the Bogle Model Beats the Yale Model” – he compares “The Bogel Model” of passive index investing with “The Yale Model” of actively managed endowment funds.

The results speak volumes:

This has nothing to do with active vs. passive investing. This is all about simple vs. complex, operationally efficient investment programs vs. operationally inefficient investment programs and high-probability portfolios vs. low-probability portfolios. Investing is hard enough as it is before introducing a complex, inefficient, low-probability investment style.

That’s why the simple, efficient, high-probability Bogle Model wins.

How the Bogle Model Beats the Yale Model – A Wealth of Common Sense

If endowment funds can’t beat index funds in the long run, then there is no way in hell that I will be able to.

So why was I thinking that I could beat the stock market?

And for what? More stress, more decision fatigue. More trying to figure out when to sell, when to buy? What to buy? It’s all effin stressful.

Making one decision that led to more decisions

I wrote a while back about 10 ways to overcome decision fatigue. I should heed my own advice.

Holding individual stocks was not only likely going to be non-impactful on my total returns, but it was causing a heck of a lot of decisions that needed to be made.

In fact, taking over my investment portfolio itself has caused my decision load to go way way up in the short term.

I want to be making less decisions not more!

My decision to start a play portfolio, in hindsight led to more decisions in the future.

Holding an individual stock is much different than holding an index.

You have to sell an individual stock at some point.

The shelf life of a company is not as long as the shelf life of the index.

So my one decision to buy individual stocks, created an infinite potential of decisions needing to be made in the future.

It’s not worth it!

Would You Rather Bet on a Player, a Team, or a League?

I feel confident in my decision to ditch my play portfolio.

I’ll not only sleep better at night, but I’ll likely have better returns in the long run anyway.

As Warren Buffett said to Jack Bogle in 2006:

A low-cost index fund is the most sensible equity investment for the great majority of investors. My mentor, Ben Graham, took the position many years ago, and everything I have seen since convinces me of its truth.

Warren Buffett in The Little Book of Common Sense Investing

This whole thing made me think about betting.

When you are investing in individual stocks, you are making actual bets. It is a gamble. No doubt about it.

Betting on Players

In the case of individual stocks, you are betting on the player.

Some players have great careers.

They may be hall of famers.

They may earn all of the accolades from Rookie of the Year to Most Valuable Player, to Defensive Player of the Year, All-Star teams, etc.

But injuries happen and all playing careers come to an end.

And this is the same for compares or individual stocks.

They may have a great run of 5, 10, or 20 years.

Once in a blue moon perhaps they’ll go 100 years, but eventually, it will come to an end.

Do you want to bet on something that has an expiration date?

Betting on Teams

So maybe it is more sensible to bet on a team?

Teams aren’t reliant on one player.

Even the Chicago Bulls’ dynasties primarily powered by Michael Jordan, were team efforts:

- Scottie Pippen

- Dennis Rodman

- Toni Kukoc

- Horace Grant

- AND Michael Jordan

So sure, you can bet on a team and they may create a dynasty and win for years…BUT all dynasties eventually come to an end and teams then have to go through a rebuilding phase.

Teams are like sectors.

They come and go.

They win some, they lose some.

You can’t predict it in the long-run.

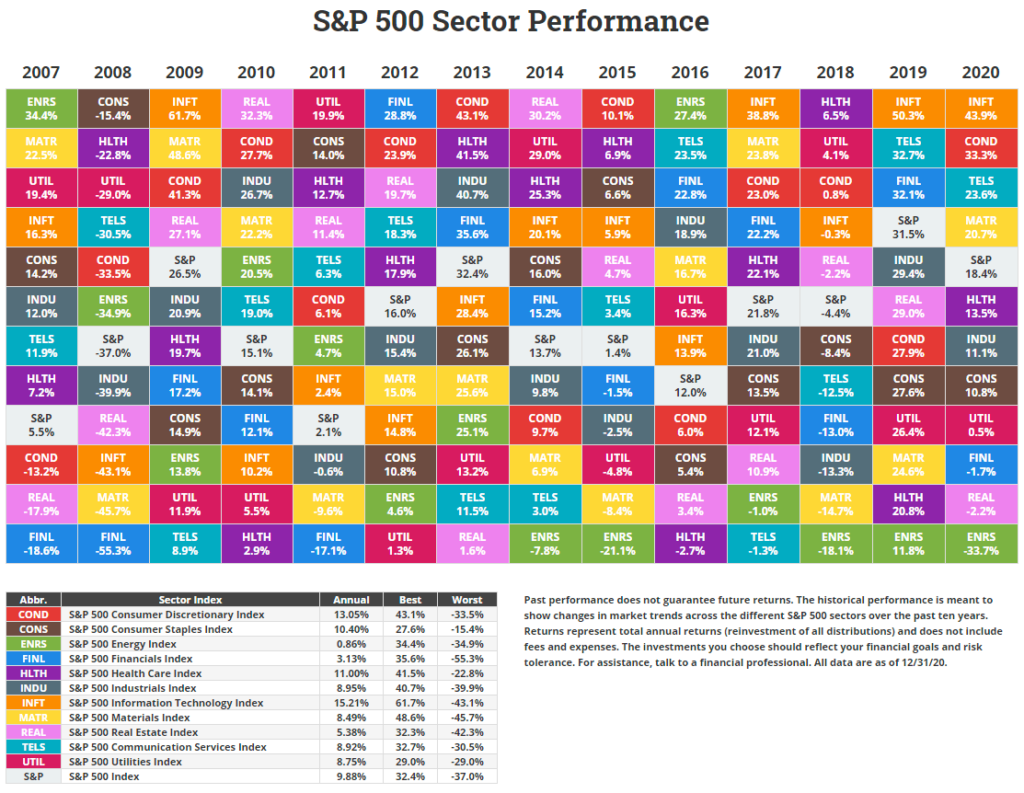

Just look at this chart from Novel Investor of S&P 500 Sector Performance:

As you can see, there is nearly no rhyme or reason for which sector will win in a given year.

And even if a sector does perform year after year, all dynasties come to an end.

You can’t be on teams either.

Betting on The League

Finally, there are the leagues.

Someone is going to win a championship every year in every league, rain or shine.

Not even the pandemic could stop that from happening!

The popularity of each league continues to grow, year after year, even despite more things for people to watch and do.

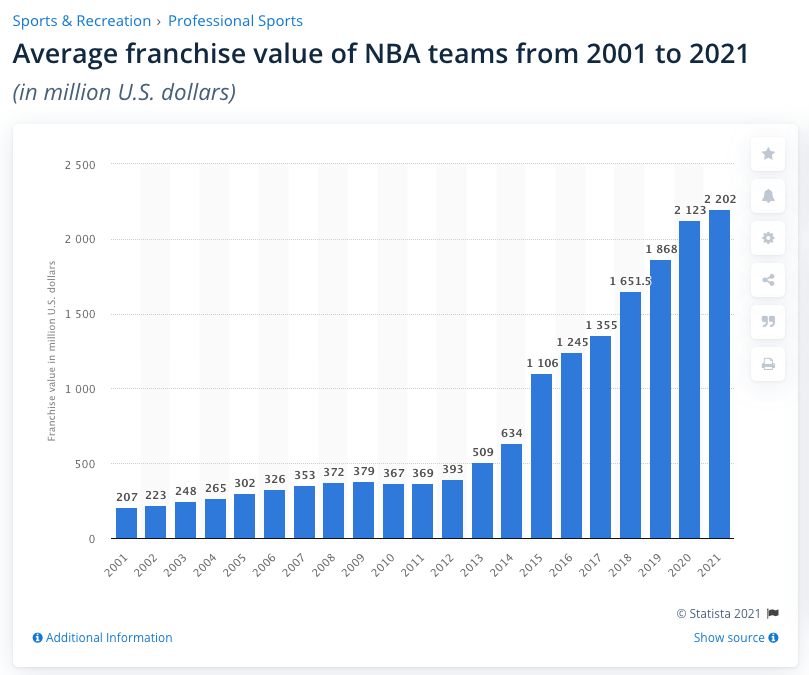

And as the popularity of each league grows, so does the average franchise value:

Clearly, betting on the league is going to get you the most consistent bang for your buck.

Year, after year, popularity and value increase.

Clearly, you want to invest in the league, NOT bet on the players!

Leagues, as you may have noticed, are like Low-Cost Total Market Index Funds.

It doesn’t matter what team wins every year.

It doesn’t matter who is MVP of the league.

It just doesn’t matter. You still win!

Clearly, the only bet to make is to bet on the league.

Thank You Common Sense

Thankfully, I came to the realization pretty early into my investing career that I need to simplify my portfolio, not make it more complex.

I want to invest in the league and NOT bet on the players.

I want to utilize the common sense imparted on me by Jack Bogle, and invest in low-cost index funds.

I trusted my gut. And it feels good.

It doesn’t matter to me what happens with certain stocks now.

It only matters how the market is performing over the course of decades.

We’ve had a few up and down years, but I know in the long run the market is only going to go up.

That is why every time I even think about betting on sports, I am going to take that money and invest it in $VTI instead.

Gambling of any kind is no get-rich-quick scheme. And play portfolios aren’t get-rich-quick schemes either.

That was a really good analogy comparing betting on a team to index funds. I really enjoyed the S&P Sector Performance graphs as well – tech stocks have been dominant in the past decade. Love your tweet, I shared it with my friends that constantly gamble. I also came to the realization that men in general love to take action. Holding a stock and not taking any action completely goes against our instincts, but it’s ideal the way to make the most money possible.

Yeah, you are right about the taking action thing. You feel like you need to be in control and the one thing you can control is to buy/sell. This is also why I love Indexing, it takes that completely off the table as far as strategy goes. Sure you can tinker with your allocations, but at least you don’t inadvertently fall into that action trap!

Holding is an action as well…it just doesn’t feel like it at times.

Betting on a whole league is amazing. At that point, you’re literally betting that America as a whole country will do well. America might be on the decline in a century, but it’s unlikely that it will be.

Why only bet on one horse when you can bet on every horse in the track and still be offered profitable odds?

Yeah, but the great part about betting on the league, is that there are a few leagues. This is why 30% of my portfolio is International Index Funds. While it may mean slightly lower returns in the short-term it does hedge any potential US market slides.

I felt this in my bones. I have been making a lot of player/team bets lately and have been reminded why I am an indexer. I recently put a little more than I’m comfortable with in growth stocks, but fortunately that portion of my portfolio rebalanced itself for me by promptly losing 30% haha. My time horizon upon purchase was 3-5 years, so I’m going to grin and bear it–it seems with minimal grinning in the short term. Otherwise, I totally agree. The fun that I extract from individual stock picking does not quite outweigh the stress that it causes me, knowing I could just set and forget (and achieve better results).

Oh yeah the auto-rebalancing of growth stocks would do it for you!

Honestly for me it wasn’t even about the short term. Sure I had some losses due to the timing, but I am confident those stocks will come back big.

It was more the over complication of my entire portfolio. It’s sort of similar to remodeling a house. You just want to do the floors, but then you have to rip out the base boards, then you need to repaint. Cascading issues. And I don’t need to be remodeling my portfolio too often!

Using gambling, a negative sum game, as an analogy to investing, a positive sum game, is clever. The correct answer to your question is that you’d be an idiot to bet on sports regardless of how you did it. Unless, of course, you enjoy it as a form of entertainment. In that case then the goal isn’t making money but having fun. And that’s the real point of having a play portfolio anyway, isn’t it? Not to make money, but to have fun gambling? I don’t think losing money is fun so I neither gamble nor have a play portfolio, but it’s a fine entertainment pursuit for many. Great post on why it is a poor choice for maxing returns.

Thanks Steve! While my goal was to buy and hold the stocks long term, the stress and extra time it was causing me now and in the future was just not worth it to me.

I agree that the point of the play fund should be to have a small percentage that you make strategic bets/gambles on. Betting on sports is not for me, and stock picking as I learned is not for me either!

Ultimately, I just want to simplifying things for now. My portfolio is already complicated enough as is.

That’s my attitude with my play portfolio. I enjoy the “action” but know my risk adjusted returns are lower than index etfs. I think of it as similar to me playing $5 BJ tables in Vegas.

Indexing, for better or worse, guarantees average results. Average results are better than most would get from stock picking.

If you want to be above average, you have to pick some winners. I think you must also concentrate your portfolio. Said differently, if you recreate an index, what’s the point?

Stock picking is very hard for most individual investors, but outperformance is achievable IMO. The challenge, this plays out over years and underperformance will occur in the short term from time to time.

A few percentage points over an index annually, increases the number of doubles you get over a lifetime.

Yeah and it’s funny, because I did pick up Roku stock recently after your recommendation and it is a company that I like, use, and believe in.

But your right, I was recreating a growth index of sorts, and to me that just didn’t make sense to chase after it due to the stocks I already own. My strategic bet and real play money is on Bitcoin and Ethereum. So I’d rather focus my risk there and let the indexes to do the work for me in my portfolio.

I like the comparison to betting on a player / team / league and the injury scenario. That’s an interesting analogy.

I bought some individual stocks last year but have since sold them all except one. On one hand it was somewhat fun / exciting but I noticed I spending A LOT of time thinking about the stocks I picked and checking them often.

Much simpler and far less stressful to pick a few index funds and use the time saved more productively.

Oh yeah. The amount of time checking price, even if just curious, was way out of whack with the potential overall benefits to my portfolio.

My goal is to simplify as much as possible at this point. It’s already complicated enough trying to drawdown and manage that accordingly.

Glad you ditched the individual stocks too!