Book Review, Highlights and Quotes from The Little Book of Common Sense Investing by John C. “Jack” Bogle

Love, love, love, love. If you are wanting to read just ONE book about investing, this should be it: The Little Book of Common Sense Investing, by John C. “Jack” Bogle

Admittedly I have not read THAT many investing books over the years. I have read the likes of The Millionaire Next Door, by William D. Danko, Rich Dad Poor Dad: What the Rich Teach Their Kids About Money That the Poor and Middle Class Do Not! by Robert T. Kiyosaki, and The Only Investment Guide You’ll Ever Need, by Andrew Tobias.

And they are all great books, but The Little Book of Common Sense Investing is the ONE book that I would recommend to anyone wanting to truly understand the stock market and become a better investor.

This book is the reason why I not only fired my financial advisor, but took over my finances. I realized that investing can and should be simple.

Jack Bogle is the founder and former chairman of the Vanguard Group and the inventor of the Low-Cost Index Fund. His book builds a thorough case for why all of us average investors should invest via Low-Cost Index Funds. The simpler the better.

I powered through the book and it thoroughly changed my perspective on investing, de-mystified it for me, and sent me on the journey that I am now on.

AR’s Book Score: 10 out of 10

Key book highlights from The Little Book of Common Sense Investing

The Little Book of Common Sense Investing‘s subtitle covers the overarching theme of the entire book:

The Only Way to Guarantee Your Fair Share of Stock Market Returns

The answer is a Low-Cost Index Fund. And Bogle systematically shows why Index Funds are the easiest and best way to guarantee that the average investor like you and me can get our fair share of stock market returns:

- He shows that stock picking doesn’t work. Even for professionals. Neither does fund picking.

- “Most investors turn a winner’s game into a loser’s game”

- Mutual Funds are too high cost and too inefficient. Even if they outperform the market, the costs alone will eat into your portfolio:

- “Fund performance comes and goes. Costs go on forever.”

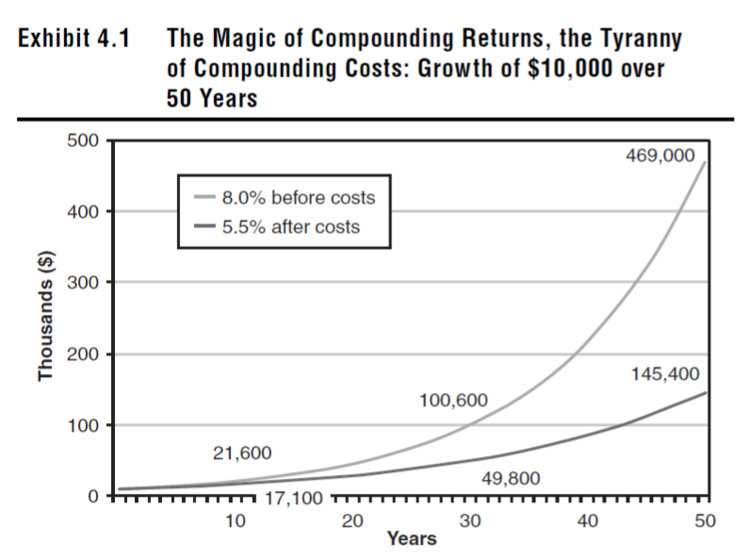

- “In the investment field, time doesn’t heal all wounds. It makes them worse. Where returns are concerned, time is your friend. But where costs are concerned, time is your enemy”

- Financial Advisors costs, area also too high, and their performance is also ineffective:

- “As vital as those services may be, advisers as a group cannot be credibly relied upon to add value by selecting funds that will beat the market.”

- Simplicity beats Complexity: Invest in Index Funds

- “Your index fund should not be your manager’s cash cow. It should be your own cash cow.”

- “Whether markets are efficient or not, indexing works”

- Don’t just take Jack Bogle’s word for it. He sprinkles each chapter will brilliant quotes to support Indexing from the likes of:

- Warren Buffett, William Bernstein, Don Phillips, Benjamin Graham, Charles Schwab, Peter Lynch, and more!

The book also contains many great Exhibits that prove out mathematically all of Bogle’s points. In this case, showing what happens when fees eat into your returns:

Best quotes from The Little Book of Common Sense Investing

Don’t look for the needle in the haystack. Just buy the haystack!

The Little Book of Common Sense Investing by Jack Bogle

The grim irony of investing, then, is that we investors as a group not only don’t get what we pay for, we get precisely what we don’t pay for. So if we pay for nothing, we get everything.

The Little Book of Common Sense Investing by Jack Bogle

In the investment field, time doesn’t heal all wounds. It makes them worse. Where returns are concerned, time is your friend. But where costs are concerned, time is your enemy”

The Little Book of Common Sense Investing by Jack Bogle

The expectations market is about speculation. The real market is about investing. The stock market, then, is a giant distraction to the business of investing.

The Little Book of Common Sense Investing by Jack Bogle

Too often, the market causes investors to focus on the transitory and volatile short-term expectations, rather than what is really important – the gradual accumulation of the returns earned by corporate businesses.

The Little Book of Common Sense Investing by Jack Bogle

A low-cost all-market fund, then, is guaranteed to outpace over time the returns earned by equity investors as a group. Once you recognize this fact, you can see that the index fund is guaranteed to win not only over time, but every year, and every month and week, even every minute of the day.”

The Little Book of Common Sense Investing by Jack Bogle

The record can hardly be clearer: The more the managers and brokers take, the less the investors make. Again, if the managers and brokers take nothing, the investors receive everything (i.e., the total return of the stock market).

The Little Book of Common Sense Investing by Jack Bogle

As vital as those services may be, advisers as a group cannot be credibly relied upon to add value by selecting funds that will beat the market.

The Little Book of Common Sense Investing by Jack Bogle

Do not adhere rigorously to spending rules such as 4 percent annually. Maintain a level of flexibility in your retirement spending plan. If the markets are particularly bad and your spending rule would take too large a bite out of your portfolio, tighten your belt and draw down a little less.

The Little Book of Common Sense Investing by Jack Bogle

More John C. “Jack” Bogle

- Wikipedia: John C. Bogle

- Vanguard Profile: A look back at the life of Vanguard’s founder

- Unrelated, but related: Bogleheads Forum

- Additional Books on Amazon

- Videos/Interviews:

Love books? Get Unlimited Reading/Listening:

- Start a free trial of audible to get access to podcasts, best selling audio books and more

- Start a free trial of kindle unlimited to get unlimited reading and listening on any device

I have to admit, you left out one of my most favorite quotes from the book. “Don’t look for the needle in the haystack. Just buy the haystack!” That quote alone had me sold on index funds. Why do we look for the best stock out there, when we can buy them all? Bogle was a great man that started something to help out the fellow man. I am glad this book changed your life. It has changed mine as well.

Ah yes that’s a great quote! I’m sure I am missing even more great nuggets. My issue was I had nearly every page tabbed for one reason or another and most of the book is straight gold.

If anyone has any other quotes I missed let me know and I’ll add them!

I’ll add it to my reading list for sure. I’ve been investigating swing trading , perhaps this book will convince me not to. I think I’ll do a side by side experiment.

Yes…I would read this before doing anything fancy. At the very least it opened my eyes and helped me to think more clearly about investing.