Too Much Can Go Wrong Hiring a Financial Advisor: You Should Do It Yourself

Updated March 23, 2023

As you can imagine for someone who Accidentally Retired, I managed to earn and save enough money over time to find myself in this position.

But it wasn’t easy…I ran a startup and it was a grind.

I can’t tell you how many vacation days were interrupted to handle this issue or that issue. It was as if fires appeared the minute I walked out the door!

After years of hard work and grinding, we finally did end up selling our business.

We didn’t make a ton of money, but it was still more than we’d ever had by far!

So we did what we thought was best at the time, we went out and hired a financial advisor…

This advisor was recommended to me by a very picky family member, so I figured that if this person thought the advisor was doing a good job, then this was the right person for us as well.

Then we put our investment money out of sight and out of mind.

We trusted our advisor had our best interests in mind...what could possibly go wrong?

Are Financial Advisors Worth It? 4 Big Issues to Consider

In general, setting it and forgetting it is a great way to become wealthy over time.

Sometimes ignorance is bliss, but when it comes to investing, I can promise you that it is not!

After I took my mini-retirement, I began to re-learn about investing (I was a finance major after all). But the more I dug in, the more red flags started to appear.

Financial Advisor Issue #1: You could Be Investing Too Conservatively.

We paid so little attention to our money and ignored its existence, that we also failed to realize that we weren’t properly allocated.

Not being properly allocated, cost us hundreds of thousands of dollars in returns over the years.

How could that happen?

Well, our advisor had us allocated as you would two 80-year-old retirees – NOT two folks in their 30s.

The silver lining was that we were at least invested, but we missed out on a massive bull run, and I estimate that we likely missed out on a 50% increase in our net worth had we simply invested a bit more aggressively.

This was a huge mistake in that we paid so little attention we had no idea what we were actually invested in.

Our allocations were misaligned with our goals.

Financial Advisor Issue #2: You are Paying Higher Fees Than You Think

As if our 80-year-old asset allocation wasn’t bad enough, there were more issues.

We knew we were paying fees, but I don’t think we really comprehend how much.

It turns out, it was greater than 1.2% per year!

Not only were we paying high fees to the financial advisor, BUT we were also paying additional mutual fund load fees AND high expense ratios.

How could this happen?

Well, it was all hidden, because the mutual fund fees were NOT SHOWN on the monthly statement.

So we had wrongly assumed we were actually getting a “Family Discount” when it turns out that all of the fees were simply being hidden.

And the worst part of this is that, fees compound over time.

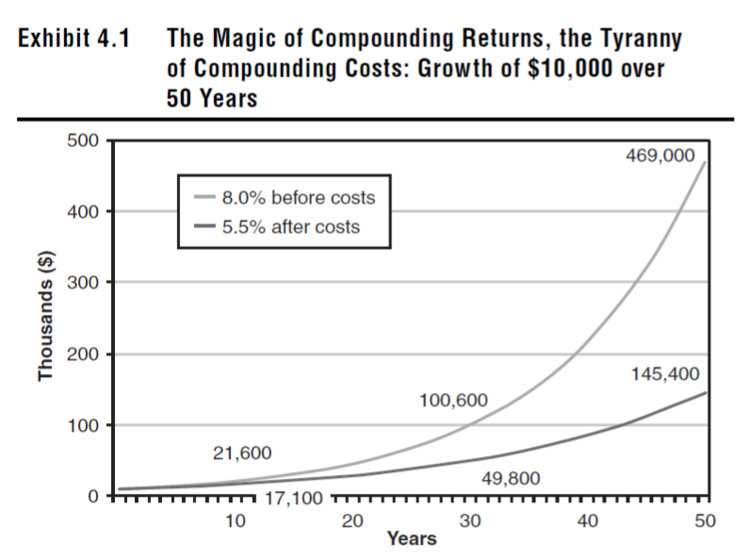

You can see in this chart just how much costs will hurt you over time in this chart from The Little Book of Common Sense Investing by Jack Bogle (review here):

As you can see, overtime costs really drag down your portfolio.

In this example, the person with the high fee portfolio ends with barely a fraction of the non-fee portfolio.

So we were not only paying higher fees, but we were losing the benefits of compounding returns by over 1.2% per year!

Also See: Investment fees over time could cost you millions.

This is why I now only invest in low-cost index funds like Vanguard’s or Fidelity Zero Fee Funds – can’t get any better than zero fees right?

Financial Advisor Issue #3: You May Not Be Able to Move Funds Without Selling Them First and Taking Capital Gains

This is something I would have never thought about that, but the portability of your investments matters.

Being able to say “I want to change advisors and move to a different firm,” AND being able to actually move those funds, matters.

Not having portable investments will force you to sell your assets and take capital gains when you least want to.

In our case, we had a huge amount of money tied up in proprietary funds that could not be moved anywhere else.

So we were forced into either selling and taking capital gains, OR holding them at the current brokerage until such time it made sense to sell.

Unfortunately for us, we had to do a combination of both.

In fact, even after moving 90% of our money, we still had 10% hung up in proprietary investments that took another year and a half to finally remove from our portfolio.

Don’t invest in proprietary funds and expect to be able to easily get your money out!

Financial Advisor Issue #4: You May Need To Pay Extra Taxes Just To Re-Allocate Your Portfolio

Once I finally decided to fire my financial advisor, then I was left trying to figure out what to do!

Even though a majority of our portfolio was in those expensive mutual funds, we also owned 80+ individual stocks.

I knew that I wanted to move my entire portfolio to Low-Cost Total Market Index Funds. But how?

So I did what any DIY investor would do…I built a Portfolio Asset Allocation Spreadsheet…and analyzed the results.

I would need to sell a majority of my assets in order to reallocate properly and move away from the risks associated with carrying individual stocks.

As it turns out, even a mismanaged portfolio will have gains over time. And gains might mean more taxes.

Thankfully, capital gains taxes are a pretty great deal (as far as taxes go).

You will only have to pay taxes on your gains after you exceed a certain amount ($44,625 for singles, and $89,250 for married filing jointly).

So taking gains isn’t horrible, but once your portfolio is large enough this is going to come into play.

The Lesson: You NEED To Be More Involved With Your Own Investments

No matter, how frustrating all of the above might seem, the worst offender in dealing with my finances, was myself.

Our strategy to invest for the long term and forget about the money was sound, but I made the mistake of not paying attention to pretty much anything once we had selected our advisor.

Of course, I realize now that it is our job as consumers to educate ourselves.

Whether you choose to use a financial advisor or not, the only person responsible for your money is YOU.

You should never rely solely on an advisor’s advice without doing your own research and asking the right questions:

- How will our relationship work? How often will I be hearing from you?

- How do you get paid?

- What are your qualifications?

- How will my money be invested?

- What type of allocation is best for my age and risk tolerance?

- Are there fees associated with any of my investments beyond your advisory fee?

- etc.

Should You Use a Financial Advisor or Do It Myself?

After reading everything above, I hope you now realize that is probably best to figure out how to manage your own investments yourself. As JL Collins puts it:

If you are a novice investor you have two choices:

JL Collins

You can learn to pick an advisor.

You can learn to pick your investments

Clearly, I agree.

The best way to work with a financial advisor, in my opinion, is simply don’t pick one. Instead, focus on teaching yourself to manage your own investments.

The good news is that picking investments in 2023 is now really, really, easy.

The best resource for this, that I can recommend is The Little Book of Common Sense Investing by John C. Bogle, the Founder and former Chairman of the Vanguard Group.

It is short, and it is brilliant. A must-read, before making any decision to invest, period.

I also recommend JL Collins’ The Simple Path to Wealth: Your road map to financial independence and a rich, free life.

Both books are great and will get you started with DIY investing.

Also See: Best Books on Investing, Wealth Creation, Business & Entrepreneurship, and Enjoying Life

And finally, be sure to start tracking your net worth. If you need help getting started, you can download my net worth tracker here, or you can sign up with a 3rd party service like Empower to seamlessly and automatically track everything for you.

When Does it Make Sense to Work With a Financial Advisor?

If you really, really, must work with a Financial Advisor, then I recommend the following:

- Make sure you are not paying more than 0.5% (this is advice straight from Mr. Bogle).

- Make sure you are using a fiduciary. And thoroughly vet out your advisor with questions and a formal interview before you hire them.

- Know what your money is being invested in. Is it in stocks or funds, ETFs, or some combination?

- Ensure that no matter what you are invested in, you can move it elsewhere for no fees and no portability issues.

- Make sure that you have the right allocation for your age. You can get an understanding of this, by looking at target date funds for your projected retirement date and ensuring that your allocations are similar.

- Sign up for Empower (formerly Personal Capital) to track your investments yourself. If you don’t like using 3rd party services, then download my Net Worth Tracker here.

I can also say after having done a thorough search for a replacement financial advisor, that Vanguard’s Personal Advisor Services meets the above spec.

There are plenty of robo-advisor services popping up, but if you want to work with an actual person and only pay a small fee of 0.3%, then Vanguard is likely a good fit for you.

Conclusion

I am sure I could go on here for days, but I won’t.

Should you use a financial advisor or do it yourself? The answer is clear: you are the best person to manage your finances.

Even if you do choose to hire a financial advisor, you NEED to make sure that you are aware of what is going on, how your money is being invested, and what type of fees you are paying.

Don’t be like me and learn this the hard way. Only YOU are responsible for you!

Do you have any further suggestions, comments, or financial advisor issues that I missed? Let me know!

Update (March 23, 2023): I have been managing my own finances for nearly 2.5 years now. While the initial transition away from my financial advisor was a pain, it is really easy to manage your own investments when you invest in low-cost index funds. I rebalance quarterly and otherwise can continue to set it and forget it. Highly recommend!

Couldn’t agree more. Took me a decade to realize how much even my tiny 15k Roth IRA had been eaten alive by fees at Edward Jones–including put into American Funds that carried a 5.75% load fee. When I finally started learning about this stuff I legitimately felt like I had been robbed. And I had been!

Yeah I had an investment account that I hardly paid attention to when I was in my early 20’s with $15K or so in it. I am not sure it even grew at all. I think it was so fee heavy that any gains were offset. I wish I had paid more attention, but better late than never!

It’s amazing that financial advisors are actually allowed to charge more than 100 bps for their fees. For underperforming the market.

So glad that personal finance websites really educate us on the perils of having too many fees in our investments. Just as compound interest works for us, it can work against us.

I think it just comes down to education. Thankfully personal finance blogs are doing a great job of helping to solve that problem. But you have to be out looking for it. If you were like me, you grew up with financial advisors in your life and trusted they knew what was up. It took me a long time to realize that there was no secret sauce. The only secret sauce is getting yourself up to speed!

I’m sorry you went through the experience you did with your advisor, that sounds awful. For the “Average Joe” type the simplest investment may be a target date fund but with just a little bit of self-education, they could improve over the target date fund with a simple index portfolio. Hopefully your story can help others avoid what you went through.

It’s all good. Hopefully, it does help. If I can wake up some other folks who are smart, but busy, to do a bit more digging into their portfolios and advisors it will be a big win.

I agree that a target date fund that automatically shifts allocations is probably the simplest way to go for most investors. That is part of what convinced me. My 401 (k) was outperforming my taxable portfolio by a large margin. Simplicity over complexity. Every time.