This post is part of the “How to invest money“ put together by Wall St. Nerd.

Many times over the years in business and now in investing, I have come back to one simple acronym that we all know: KISS or Keep It Simple Stupid.

Too often you can get lost in the weeds at work, in life, and definitely in investing.

But my wife who loves true crime podcasts, reminds me that more often than not, the simplest explanation is usually the correct explanation.

And this goes for business and investing as well:

Simplicity wins the day time and time again.

As much as we like to overcomplicate things and drum up conspiracy theories, life is not as complicated or conspiratorial as we think.

There are edge cases and unique situations. Yet we give them credit like they are the 99.9%, and not the .01%.

And when it comes to investing for the average investor, it is no different.

Don’t let the edge cases fool you.

Why try to hit the elusive home run, when hitting a double every year – year after year, produces excellent results?

Here is how I turned around my investments by investing as simply and inexpensively as possible…

Over-Complicated Investment Mayhem

I see people on social media arguing all the time over which dividend stocks are better, which cryptocurrencies will win the day, or what type of marketing works best.

But it’s all just so much foam, fluff and noise. It doesn’t matter to us. We’re in it for the beer!

– JL Collins, The Simple Path to Wealth

JL Collins is right. None of the daily chatter matters, nor has it ever mattered. It is over-complicated mayhem in my opinion.

The more inundated with social media and news we get, the less likely we are to ever have the correct or right information to make educated stock picks.

The market as a whole will balance itself out, but we as individual investors, are simply gambling when we try to “beat” the market.

Warren Buffett is famous for saying “The stock market is a device for transferring money from the impatient to the patient.”

So taking Buffett’s advice, I want to invest as patiently as possible, and the best way to do this is with Low-cost Index Funds.

People do not want the mathematically optimal strategy. They want the strategy that maximizes for how well they sleep at night.

– Morgan Housel, The Psychology of Money

Yes, you can do analysis.

You can make gut calls.

And certainly some do beat the market some years.

But over time, investing simply will win – and you’ll sleep better at night for it:

A low-cost all-market fund, then, is guaranteed to outpace over time the returns earned by equity investors as a group. Once you recognize this fact, you can see that the index fund is guaranteed to win not only over time, but every year, and every month and week, even every minute of the day.”

– Jack Bogle, The Little Book of Common Sense Investing

So I want overcome this mayhem and voodoo stock picking.

I want to invest in the entire market. Patiently.

No frills.

No active managers.

No Individual stocks.

How I Invest as Simply as Possible

The only way to truly learn something is by doing it.

– Naval Ravikant, The Almanac of Naval Ravikant

In a way, investing simple has always been my norm.

I’ve never concerned myself with the ups and downs of the market. In fact, I paid a financial advisor to do that for me.

But over the years, I became increasingly frustrated with the lack of simplicity, care, and planning coming from my advisor. It was all just mediocre, mediocre, mediocre.

I have since fired my financial advisor, and taken over my own finances, but I still want to keep it simple.

Simple DIY Investing

The best way to keep it simple when it comes to investing is to invest in Low-Cost Index Funds. Period.

But upon taking over our investments, our portfolio was anything but simple.

After firing my financial advisor, I realized that we owned 80 individual stocks and many more mutual funds…

The great irony of successful investing is that simple is cheaper and more profitable. Complicated investments only benefit the people and companies that sell them.

– JL Collins, The Simple Path to Wealth

So I set out on a three year plan to divest our portfolio of any individual stocks that we can, and spent a full year converting mutual funds into Low-cost Index Funds.

So now our core investments are as follows:

- Vanguard’s Total Market US Index Fund ETF (VTI)

- Vanguard’s Total International Market Index Fund ETF (VXUS)

- Vanguard’s Real Estate Index Fund ETF (VNQ)

- Cash

Simple Costs

Low-cost Index Funds inherently keep costs low.

Using Empower’s Fee Analyzer tool, (Empower review here), we went from paying 1+% AUM fees to an average of 0.04%.

I mean the cost savings are incredible! Especially over a long-term horizon in which we expect to be growing our portfolio.

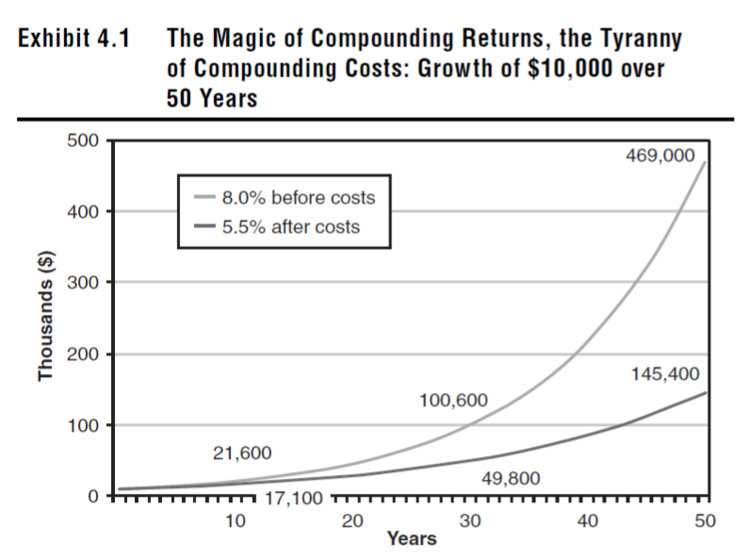

Jack Bogle has a great section on this in The Little Book of Common Sense Investing. Over a 50 year time horizon, you can see what he calls “The Tyranny of Compounding Costs:”

So saving 1% in fees was probably the single biggest thing that moving to this simple portfolio has helped to accomplish.

It has completely reduced the drag on the portfolio.

The only way to get better than 0.04% fees, would be to have only stocks in your portfolio, which as we already learned comes with its own inherent risks akin to gambling.

Asset Allocation

Possibly the toughest thing to determine for any investor is how much risk to take on in your portfolio.

When we worked with our financial advisor, I just kept feeling that we should have been more aggressive for our age range and time horizon.

However, the advisor kept talking me out of it.

As you can imagine the more risk in a portfolio, the more likely it is for the client to bail during a bad downturn.

So it is in the financial advisors’ best interest to do everything they can to keep you invested with them, and that may actually mean recommending more conservative investments.

Anyways, this is all a long winded way of saying that given my age (37) and long-term horizon, I feel that taking on a certain amount of risk is actually not risky at all, but simply normal and logical.

We want our portfolio to continue to grow, not just stay afloat.

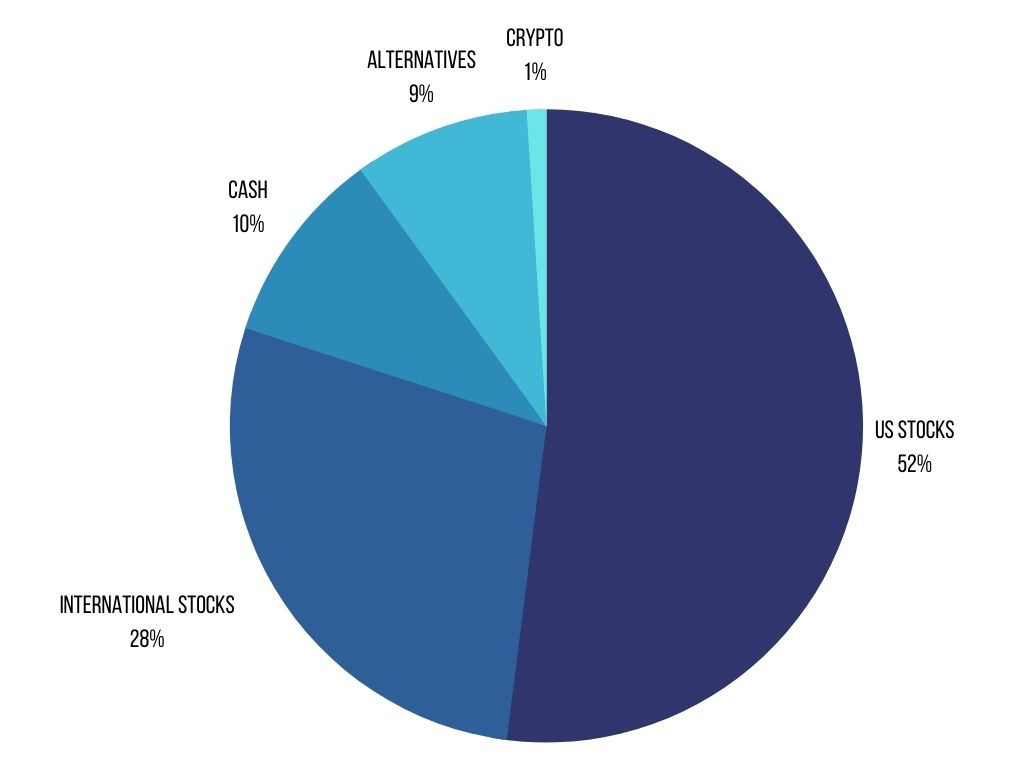

So we’ve settled on the following allocations:

- 80% Equity

- 52% US Stocks

- 28% International Stocks

- 20% Defensive

- 10% Cash

- 10% Alternatives & Crypto

I go much further into depth on the individual plans for each asset class in our entire retirement withdrawal strategy here, but as you can imagine, my overarching goal is to try to keep it as simple as possible.

Cash – We hold 10% cash, because cash is king – plus it also turns out to be a great strategy to help us mitigate sequence of return risk in early retirement.

Alternatives – Alternatives include mostly VNQ (Vanguard REIT Index), but late last year, we also purchased a website.

I know you are thinking that owning a website is not simple. It isn’t. But the website doubles as both a cash generating asset and a portfolio diversifying asset.

And to be completely frank, it was more complicated and time consuming than I estimated it would be, so I’ve had to lean into and focus a lot of my time on the past few months.

Crypto – Last, but not least is crypto. We are lightly invested in crypto, but I truly believe in decentralized finance and Web 3.0.

Cryptocurrency investments will be as commonplace as stocks in ten years (or one and the same), and I want to make sure to capture part of the market that Index Funds currently do not capture.

Even so, continue to try to keep it simple, by investing in only what I know – Ethereum and Bitcoin.

Day-to-day Management

And that brings us to the day-to-day management of our asset allocation.

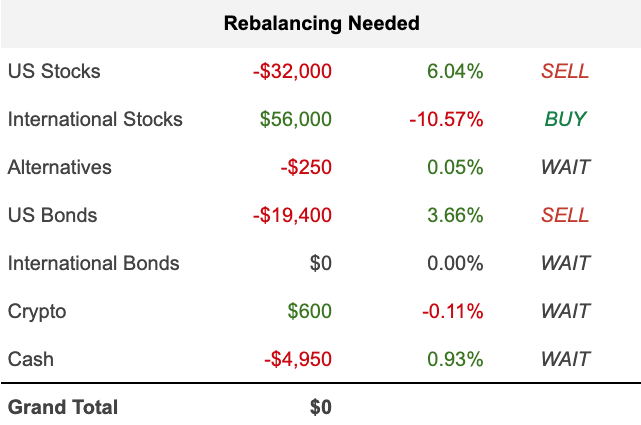

To keep things simple, I’ve created a simple Portfolio Rebalancing Spreadsheet.

All I do is hop into my spreadsheet, load up my Allocations in Empower, punch in the updated investment numbers, and let the spreadsheet do all the magic for me. Example here:

From there, I can determine whether to Buy, Sell, or Wait.

I’ve decided to rebalance quarterly, but I also try to be flexible. As ERN covers in his Safe Withdrawal Series, flexibility is key to any early retirement plan.

Most of all, I don’t tinker. I check our net worth monthly to track progress, but that is it.

Then I make asset allocation decisions on a quarterly basis. No tinkering!

Conclusion

In my opinion, simple investing, is the best investing.

Everything I do, I try to figure out how I can simplify the process and simplifying my portfolio over time has allowed me take over my own finances and see the dividends pay off immediately:

- I invest simply with Index Funds

- I’ve lowered our fees to near nothing

- Asset allocation is done with a simple DIY spreadsheet

- I don’t tinker

Keep it Simple Stupid.

This post is part of the “How to invest money“ put together by Wall St. Nerd.

I used to believe simplifying was the best method but now that I’m learning more about alternative investments, I’m also creating a sleeve for that as well in my portfolio.

For sure. I think alternatives are important, though I think the benefits of diversification are slightly over-billed since the various asset classes seem rather correlated these days. But I do want access to the entire market, and that is why I invest a small part of my portfolio into crypto, REITs, and a website. But the website is offering me the most bang for my buck, as I can grow and appreciate it even when markets are down. It isn’t going to be completely recession proof, but there is a better factor of direct control which I do like.