Ever since I read Good to Great by Jim Collins, I’ve been fascinated and even a bit obsessed with The Flywheel Effect.

In short, it is the perfect explainer for how you can achieve exponential growth personally, professionally, and in business.

Each turn of the flywheel builds upon work done earlier, compounding your investment of effort. A thousand times faster, then ten thousand, then a hundred thousand. The huge heavy disk flies forward, with almost unstoppable momentum.

– Jim Collins, Good to Great

Once you build out your flywheel and tap into The Flywheel Effect, you can see how easy it is to grow with astounding speed.

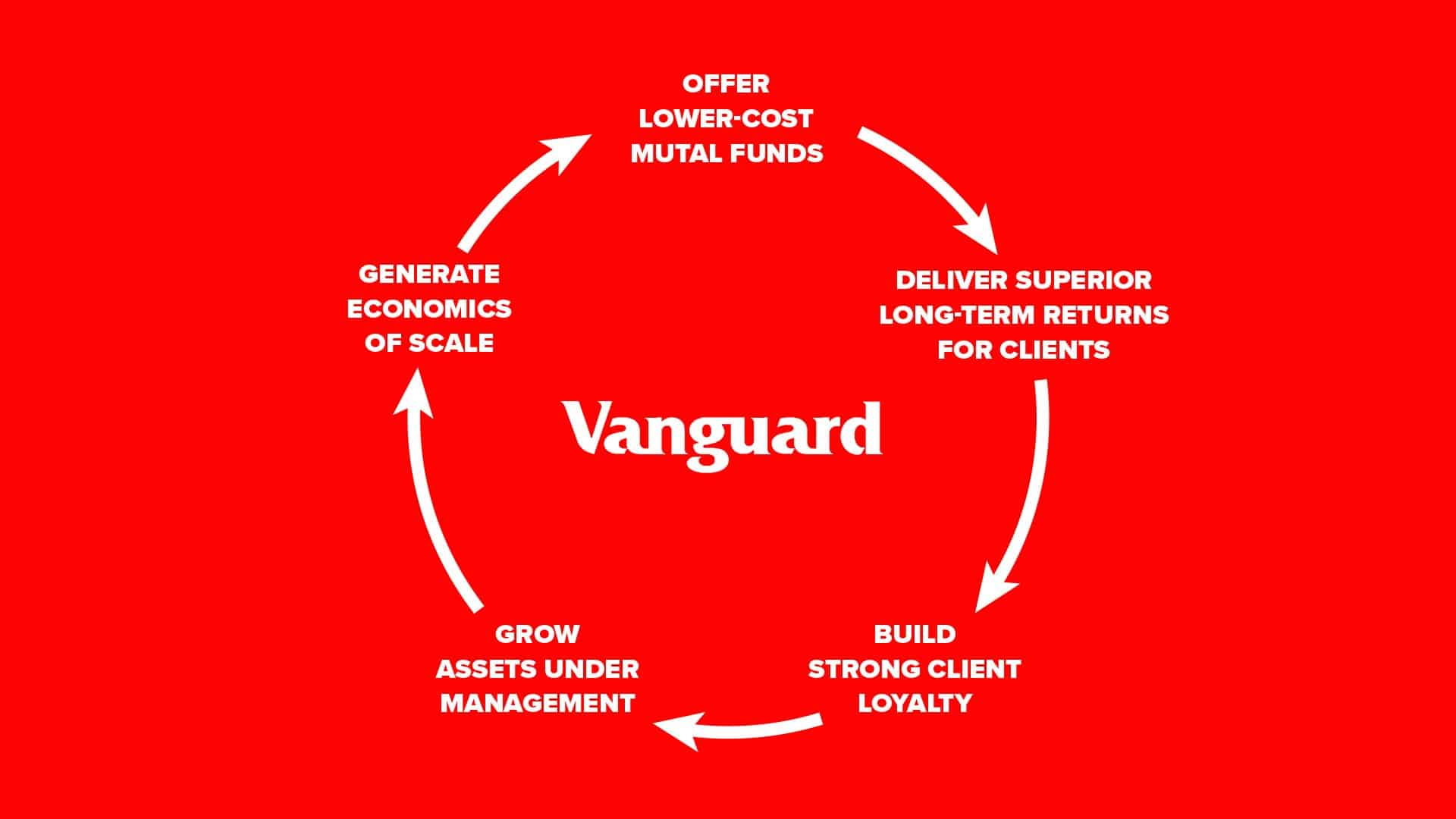

Vanguard for instance created the perfect flywheel by doing the following:

- First, they offered low-cost mutual funds –>

- Next, they deliver superior long-term returns for clients –>

- This in turn builds strong client loyalty –>

- That allows them to grow their assets under management –>

- Which generates further economies of scale –>

- And again, they can offer even lower cost mutual funds and take another turn around the flywheel —————————–>

When you look at what Vanguard has done, you can instantly see how they have constructed a seamless strategy that builds on itself each time around the flywheel.

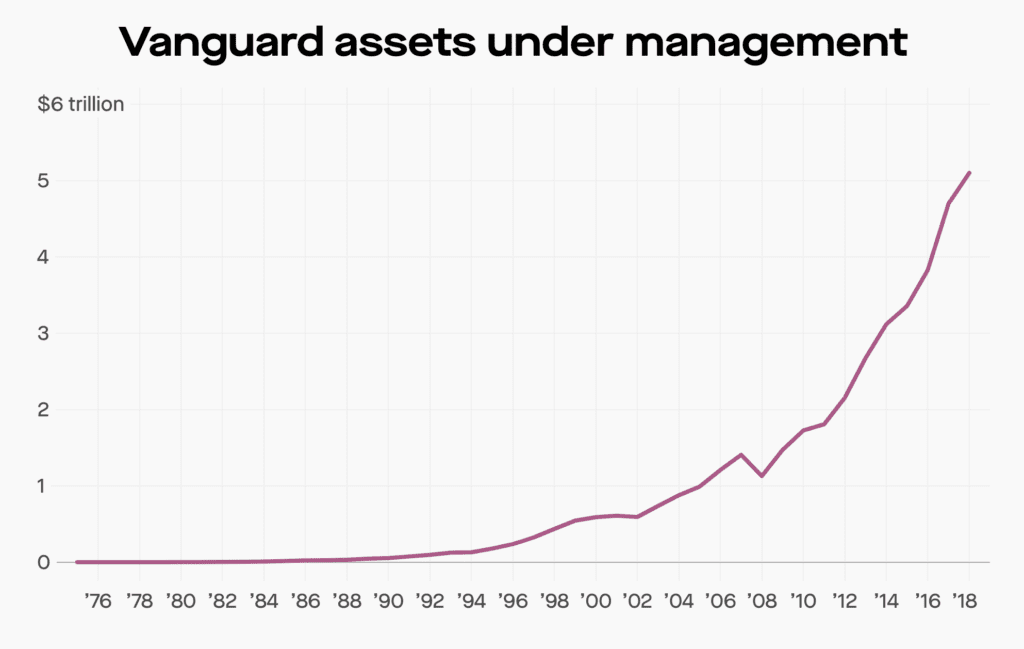

The strategy is so good that it compounds at an astounding rate. Their Assets Under Management clearly shows the exponential growth in action here:

Clearly, building the right flywheel personally OR professionally can create a compounding effect that cannot be stopped.

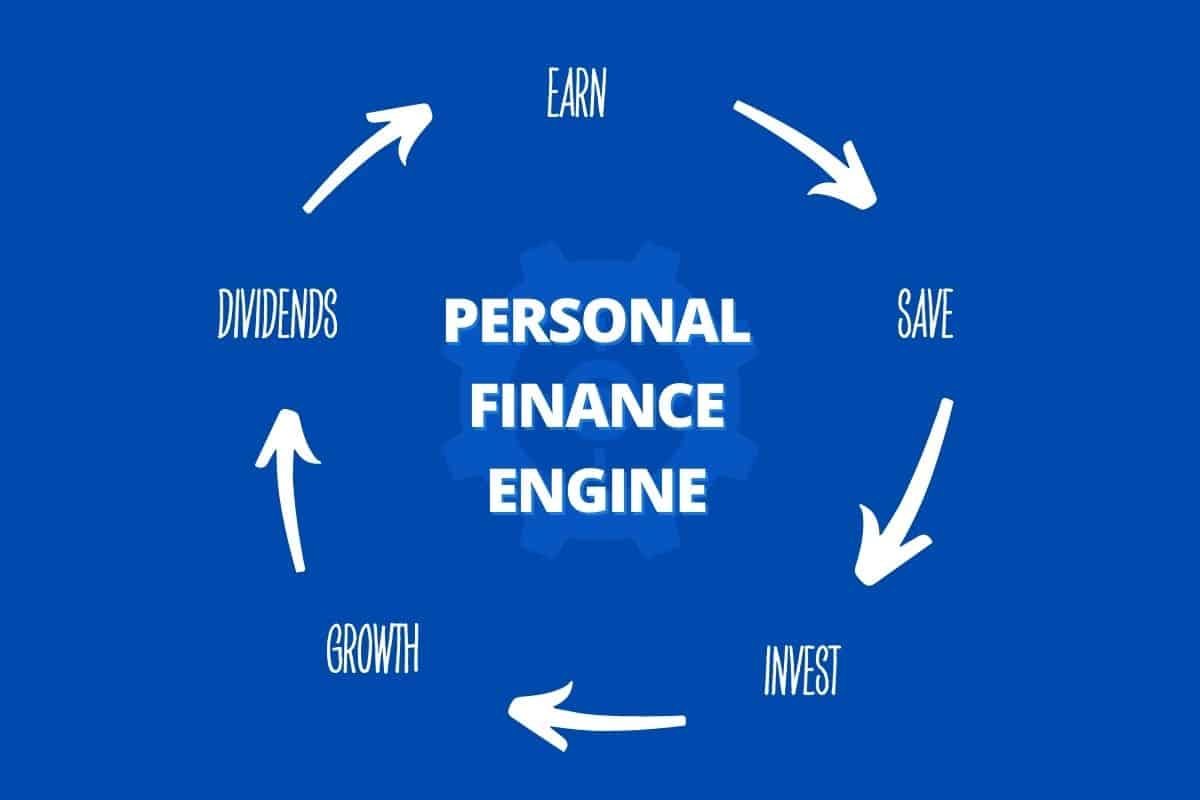

Building your own Personal Finance Engine

The Flywheel Effect works for more than just businesses like Vanguard’s. It works in personal finance as well.

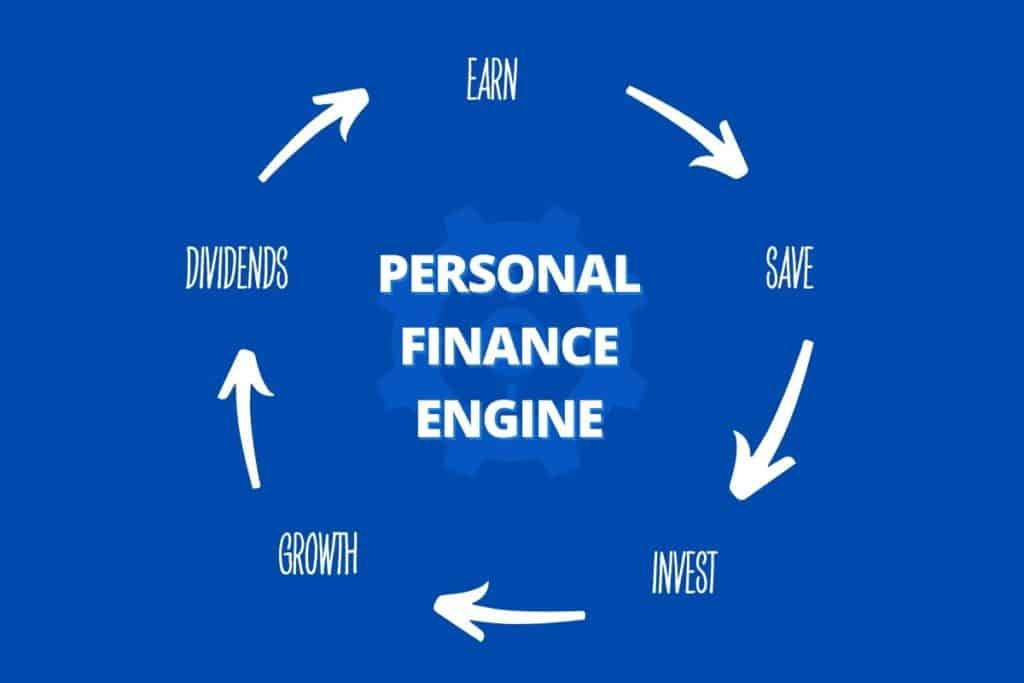

I like to think of it as building your own Personal Finance Engine.

Once you build a Personal Finance Engine and get it moving, it becomes an unstoppable force that will allow you to quickly reach all of your personal finance goals.

The goal is to not only let our money compound, but make the process as seamless as possible.

The paths to wealth are endless, and there are many different ways to build your Personal Finance Engine. But a few time tested rules still apply:

- No Unnecessary Debt – “Never spend your money before you have it.” ― Thomas Jefferson

- Earn Money – “The secret to wealth is simple: Find a way to do more for others than anyone else does. Become more valuable. Do more. Give more. Be more. Serve more.” ― Tony Robbins

- Save Money – “It is not how much you earn but what you do with it that determines your end.” ― Olumide Emmanuel

- Saving & Invest Money – “It is tempting to try to get rich quickly, but the process of getting rich slowly and steadily via saving and long term investing is tested and reliable.” ― Nimi Akinkugbe

- Investing Money – “The great irony of successful investing is that simple is cheaper and more profitable. Complicated investments only benefit the people and companies that sell them.” ― JL Collins

- Compounding/Growth – “When it comes to compounding, don’t trust your intuition – you have no idea how powerful it is.” ― Manoj Arora

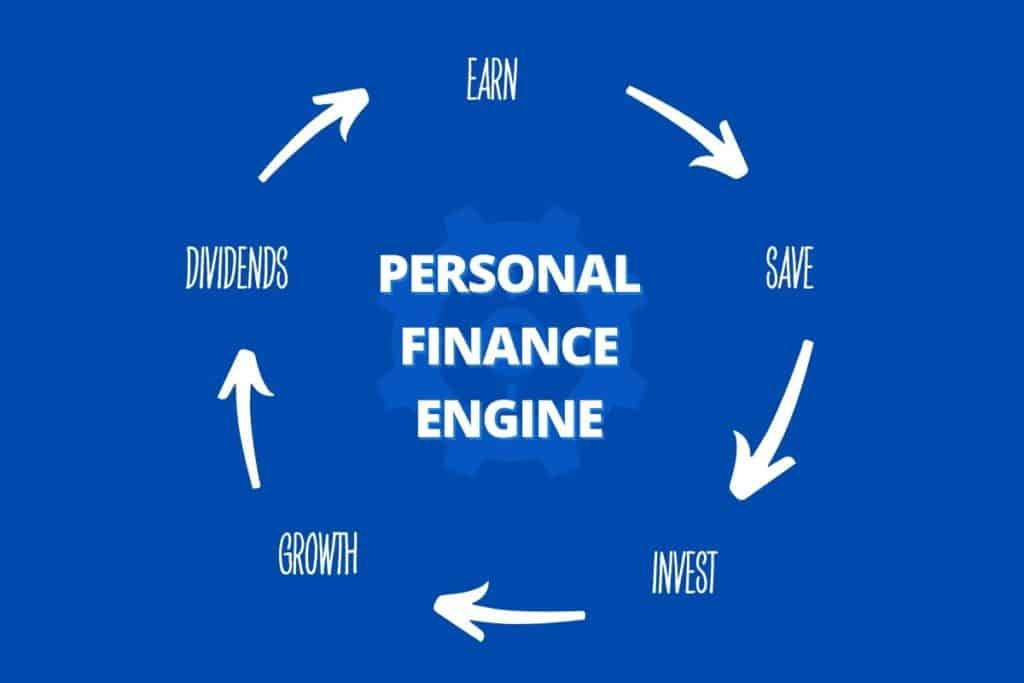

Here is what the Personal Finance Engine looks like in practice:

You can’t save any money unless you earn it. —>

You can’t invest any money unless you save it. —>

Once you invest your money, it will start to grow. —>

Eventually it will pay dividends (or rent checks if real estate). —>

Dividends restart the entire process again. ———^

Getting the Personal Finance Engine started

All of us already have a Personal Finance Engine – but it might not be running yet if it is getting snagged somewhere along the flywheel.

If you are earning, but not saving –> snagged.

If you are saving, but not investing –> snagged again.

If you are investing, but it’s not growing –> oooof.

If you are earning dividends, but not reinvesting –> snagged.

In order to get the Personal Finance Engine fully up and running, you need to get rid of any and all snags.

Fine Tuning Your Engine

Once you get your Personal Finance Engine up and running, now it is time to fine tune the details:

Earnings

There are many different ways to earn money.

I earned a majority of mine by starting and selling businesses. But my wife earned a majority of hers working a 9-5 job.

No matter how you earn, you can fine tune your earnings over time.

You can bolster earnings by doing any of the following:

- Work a side hustle (Financial Panther has some great ideas and resources)

- Climb the corporate ladder

- Job hopping to increase your salary

- Own Equity in a Business

- Become an Expert in Your Field

The nice part is that in most careers, pay increases with time and expertise increases – even for mediocre employees.

Saving

While earning is important, what you save is arguably more important.

It should surprise no one that many of us are bad at savings and investing for retirement. We’re not crazy. We’re all just newbies.

– Morgan Housel, The Psychology of Money

Early in our careers, we usually don’t have a ton of wiggle room in our budgets. Some of us have taken on massive amounts of debt.

Yet, choosing to maximize your savings early in your career is going to have a huge impact on the momentum of your Personal Finance Engine.

While my wife and I weren’t the most aggressive savers early on, we always made sure to save as much as we could. Early on this was 15%, but then later on down the road as our earnings grew, we were able to eventually get this up to 55%.

One of the best ways to turbocharge your savings is to maximize your 401(k), if you have one. In fact, 5 years of maxing mine will make me ~$1.4M by the time I can withdraw it!

The concept of “Pay Yourself First” is the BEST strategy for maximizing your savings. What you don’t see, you won’t spend.

Simple tools and strategies to save more:

- Pay Yourself First

- Create a Budget (try a Budget Template from Budgets are Sexy)

- Ruthlessly cut unnecessary expenses

- Track Your Net Worth in a Spreadsheet or with a tool like Personal Capital

Invest

Even if you are saving a ton, and believe that Cash is King, it is no use to you if you aren’t investing.

Especially in today’s high inflation environment, any cash you are holding is losing value.

Don’t get me wrong, we hold a fairly large emergency fund, but it is only a part of our investment strategy.

Things you can and should do to maximize your investments:

- Invest first an foremost in Low-Cost Index Funds

- Consider Firing Your Financial Advisor and minimizing fees

- Optimize your Asset Allocations (I use this Asset Allocation Spreadsheet)

- Write a Personal Financial Plan to better prepare and strategize

Growth

The best way to track growth is to track your net worth monthly.

For that I recommend using a spreadsheet. You can find my Net Worth Spreadsheet here. I track everything monthly. On the first of the month or close to it, I go and enter everything in.

I also utilize Personal Capital to easily get an overview of our investments without needing to do the full monthly analysis.

Ultimately, the key ingredient to any investment growth, no matter if it is real estate, index funds, stocks, bonds, crypto, is time.

The more time your investments have to grow and compound, the better off you’ll be.

Dividends

Now we’ve reached the pièce de résistance of the Personal Finance Engine. This is where your investments are generating income for you.

Ideally, you’ll want to do nothing but reinvest this money back into the engine.

But if you are someone who wants to be a more active investor, you can actually do something about this by optimizing your investment strategy to generate more cash flowing assets.

Ideas include Real Estate strategies like BRRRR to supercharge your portfolio or purchasing a website (like I did).

Just keep in mind that…

The more an investment cash flows, the riskier it is likely to be.

No matter how you slice it, when you reinvest dividends or cash flow back into your investments, you are building on the momentum from your last rotation through your Personal Finance Engine.

The Personal Finance Engine

The Personal Finance Engine allows you to achieve your dreams at scale, faster than you could ever have imagined.

It takes discipline every step of the way.

Yet, you don’t need to be perfect for the engine to work.

- You can be better at Earning than Saving.

- You can be better at Saving than Earning.

- You can be better at generating Dividends than Growth.

No matter what, if you want to achieve your financial dreams, you need your Personal Finance Engine optimized and running as smoothly as possible.

So ask yourself this – how is my Personal Finance Engine running these days? What, if anything can be optimized?