Maxing out your 401(k) will supercharge your wealth

Look, I’ve never lauded myself as a financial expert. I’m not.

I see people arguing on social media all day about whether to invest in your 401 (k), Roth IRA or a Taxable account.

Certainly there are always edge cases, but when you receive a company match, there is no reason not to take advantage of your 401(k).

If you have a 401(k) with a company match, there is absolutely no reason why you shouldn’t take the free money.

Just do it.

401(k) – A real life example

Prior to my company being acquired, my wife and I had funded my wife’s 401(k), though not as aggressively. I also had a Rollover IRA with $8,264 in it at the time, but I had been working for startups that did not offer benefits and I also made the mistake of not taking advantage of either Roth or Traditional IRA contributions even though I should have!

So when my company was acquired in mid-2015, I immediately started to contribute to my 401(k). My strategy over the last 5 years of my employment was as simple as could be:

- Fund my 401(k) to the full employer match, and then all the way to the max.

- Anything else leftover went into taxable accounts and savings.

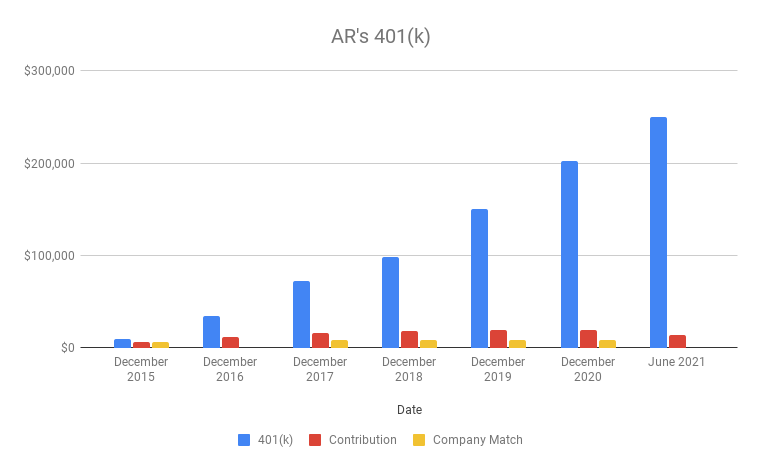

Here is what this looked like in practice:

As you can see, strong and steady growth. My account benefited greatly from a strong bull market – even so, the additional benefits from maxing out my 401(k) are clear.

Here is the full breakdown of the numbers:

| Total Contribution | $90,462 |

| Company Match | $38,411 |

| Total Invested | $128,873 |

| Total Tax Savings | $28,311 |

| Current 401(k) Value | $250,133 |

Company match earned me an additional $38,411 during this period, and even better I was able to save (or at least defer) $28,311 in taxes (high tax brackets).

In the end, I only invested $90K of my own dollars, which now has turned itself into $250K.

The crazy part about all of this, is that I didn’t even fully max out my 401(k) the entire time. In reviewing the data, I only contributed 36% of the max in 2015, and 65% in 2016. It was during that time, I realized the full benefit of maxing out my account, and then did so from 2017-2020.

Converting my 401(k) into a Roth IRA

My former 401(k) has now been rolled over into a Traditional IRA. It was a very easy process, and if you have not yet done this after leaving your employer, I recommend.

Even though I was invested in VTSAX the entire time, there were additional fees charged to my account quarterly as part of my former employers plan. There was absolutely no need for me to stick with that.

Rolling over into a Vanguard account was as easy as I could have hoped.

But at this point, I still owe taxes on this money. This is a huge disadvantage of 401(k)s and Traditional IRAs.

There is a very easy way to rectify this via a Roth IRA conversion. Investopedia breaks down the Roth IRA Conversion Rules as follows:

- “You can convert all or part of the money in a traditional IRA into a Roth IRA.

- Even if your income exceeds the limits for making contributions to a Roth IRA, you can still do a Roth conversion, sometimes called a “backdoor Roth IRA.”

- You will owe taxes on the money you convert, but you’ll be able to take tax-free withdrawals from the Roth IRA in the future.”

So in future years, while my income is low during my early retirement, I will look to convert my Traditional IRA into a Roth IRA in chunks via a Roth Conversion Ladder (nice explanation by Choose FI), but possibly faster if the math makes sense.

Future Tax Advantaged Growth

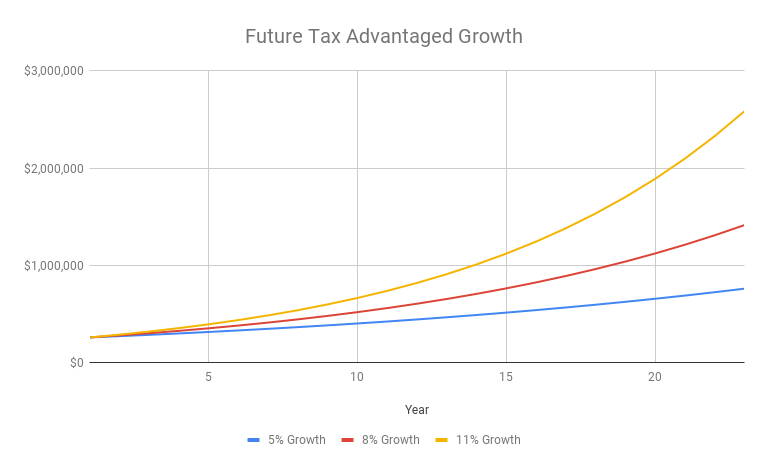

Either way, wether in a Roth or a Traditional IRA, my former 401(k) is going to continue to grow without fail until I can begin to withdraw the money in 22 1/2 years when I am 59 1/2.

To show the full power of tax advantaged growth, I ran through a couple of scenarios: 5%, 8%, and 11% average annualized growth.

Here are my assumptions:

- Dividends will be invested automatically.

- No amounts will be withdrawn until after 59 1/2

- I don’t add another dime to the account

We all know the true power of compounding, but looking at the potential amounts are nuts.

- At a bare minimum with mediocre 5% returns, we’ll still end with $761K.

- Average level 8% returns will grow the account to $1.4M

- Great, but not unrealistic 11% returns, would supercharge the account to a whopping $2.58M

Even if the worst case scenario occurs, this is still a great outcome for $90K in investments.

By comparison, $90K invested over the same time period from (2015-2044) at 5% returns would end up being only $350K.

This is the power of a 401(k). Even at a bare minimum, it likely created surplus of $400K additional dollars, simply by maxing out my company match and deferring my taxes.

If you have a 401(k) with a company match, there is absolutely no reason why you shouldn’t take the free money.

Just do it.

Early Retirement Considerations

Availability of funds is largely why in the social media arguments for folks eyeing early retirement like to argue against 401(k) and Roth IRA accounts and focus on pushing funds into taxable accounts.

But clearly the power of maxing out your account for even a short period of time has clear benefits. Even if I never contribute another dollar to my Tax Advantaged accounts, I will end up a 401(k) millionaire.

Coast FI or Coast 401(k)

I’m not sure if what I have done is technically considered Coast FI or not. I am going to call it Coast 401(k). According to The Fioneers,

Coast FI is when someone already has enough invested in their retirement accounts that would grow to provide them with a comfortable traditional retirement. They wouldn’t need to add another dollar. If someone has achieved Coast FI, it means that they only need to cover their actual costs of living with active income.

Coast FI: A Better Path to Financial Independence – The Fioneers

In my case, since we have already achieved FIRE, I am looking to let my 401(k) coast along until official retirement age, but in the meantime live off my taxable accounts and other passive income sources.

So if you are looking to achieve FIRE, you should not ignore your Tax Advantaged accounts. But you also shouldn’t only rely on them either.

How to maximize your Tax Advantaged Accounts

In JL Collins’ Stock Series Part VIII, he lays out perfectly the strategy for maximizing Tax Advantaged Accounts:

- “Fund 401(k)-type plans to the full employer match, if any.

- Fully fund a Roth if your income is low enough that you are paying little or no income tax.

- Once your income tax rate rises, fully fund a deductible IRA rather than the Roth.

- Keep the Roth you started and just let it grow.

- Finish funding the 401(k)-type plan to the max.

- Consider funding a non-deductible IRA if your income is such that you cannot contribute to a deductible IRA or Roth IRA.

- Fund your taxable account with any money left.”

If you follow this strategy for years, you will end up with “F-U Money” as JL calls it. You will be Financially Independent and won’t be living life on anyone else’s terms.

Then if/when you do decide to call it quits, you can let your Tax Advantaged accounts grow unconstrained until you reach retirement age.

Full Breakdown of Tax Advantaged Accounts

I referenced Tax Advantaged accounts several times, and realized that I should provide more info. But since there is already plenty of literature on this, no need for me to regurgitate. JL Collins again summarizes the various Tax Advantaged Investment buckets better than I ever could:

- “401(k) / 401(b) / TSP = Immediate tax benefits and tax-free growth. No income limit means the tax deduction for high income earners can be especially attractive. But taxes are due when the money is withdrawn.

- Roth 401(k) = No immediate tax benefit, tax-free growth and no taxes due on withdrawal.

- Deductible IRA = Immediate tax benefits and tax-free growth. But taxes are due when the money is withdrawn. Deductibility is phased out over certain income levels.

- Non-Deductible IRA = No immediate tax benefit, tax-free growth and added complexity. Taxes are due only on the account’s earnings when the money is withdrawn. Contributions can be made regardless of income.

- Roth IRA = No immediate tax benefit, tax-free growth and no taxes due on withdrawal. A better Non-Deductible IRA, if you will. But eligibility phases out over certain income limits.”

Conclusion

Maxing out my 401(k) for 5 years or with $90K in personal contributions will likely end up producing between $1-2M in wealth by the time I hit traditional retirement age.

Taxes are the elephant in the room here, but I am going to do my best to mitigate the deferred taxes of my 401(k) by converting into a Roth IRA over a period of years.

If done correctly, I may not have to pay any taxes at all, or at the very least defer taxes from a very high bracket to a very low tax bracket.

Bottom line. If you want to supercharge your wealth, you should be utilizing your 401(k) and other Tax Advantaged accounts.

Tracking Your Accounts

I use Empower to track all of my Taxable and Tax Advantaged accounts all in one place. They could not make it easier to get a good overview of all of my assets in one place. But the biggest benefit is the ability to track my allocations seamlessly, making rebalancing a breeze. Click here to sign up and check it out Empower yourself.

More from Accidentally Retired

- Best Books on Investing, Wealth Creation, Business & Entrepreneurship, and Enjoying Life

- Betting on a player. Betting on a team. Betting on a league.

- Should you manage your own investments or hire a financial advisor?

- The F.I.R.E. Planner: A step-by-step workbook to reach your full financial potential

Coast 401k is a nice term to add the personal finance lexicon! Compound interest really is the eighth wonder of the world. I think a lot more people would get started a lot earlier if they had a better understanding of just how much their initial investments would be worth when they reached retirement.

Yeah exactly. That is why when I projected out the numbers I knew I had to share.

It doesn’t take much to end up with a nice retirement later on down the road. And even if you maxed out for ONLY 5 years and then it Coast, you’ll be in great shape.

Coincidentally, my 401K was worth $1.4 million when I retired slightly early five years ago. I also had a similarly sized taxable account and some ROTH accounts, some traditional IRA’s and some inherited IRA’s and ROTH ‘s and several other investments. But the fact that you’ve projected $1.4 million, I thought that was interesting. As someone who started decades ago when salaries and contribution limits were smaller, it’s even easier now to get to a 7 figure 401k, as you have shown.

That is a coincidence! And thankfully contribution amounts are much higher now, because it makes playing catch up a much easier thing. Even though I didn’t start maxing out until I was in my early 30s, I just imagine what it could be if I had started earlier.

I never saw it like that. A 90k investment turning into $2.6MM by the time to retirement. No need for social security (more than likely).

Anyone can find dollars to invest $90k into the market. However, the number of people retiring with $2.6MM in their 401(k) is abysmally low. People are not taking advantage.

If you are a high income earner, there is absolutely no reason not to max it out. It’ll defer taxes, as you can see in my case $28K and your company match will likely be worth a lot more.

This is money that I did not miss either. We lived off of a smaller paycheck, but guess what? We never, ever, missed this money and it’ll set us up in the event our taxable account starts to deplete in 20+ years.