Updated October 5th, 2023

If you happen upon my site or even my twitter account, you’d probably notice that I don’t really talk about investing all that much.

The truth is that while I am fascinated by investing, I just don’t have to think about it much.

I created a financial plan, and besides periodic modifications – I stick to it.

Day to day, there is literally nothing for me to do or to talk about (investing-wise).

And this is the beauty of investing in Low-Cost Index Funds.

Your funds do all of the heavy lifting for you, and there is no day-to-day activity.

Sure occasionally I will write about personal finance and investing… roughly 20% of my content so far has been financial related.

I’ve shared my Net Worth Spreadsheet, advice about cash, why I fired my financial advisor, and plenty more.

I just choose NOT to get pulled into all the day-to-day stress, drama, and overreacting that is the stock market.

We Want The Beer, NOT The Foam And Fluff

It’s all just so much foam, fluff and noise. It doesn’t matter to us. We’re in it for the beer!

– JL Collins, The Simple Path to Wealth

This is where a lot of us often get it wrong. Not only in investing but in life…we are drawn into the drama.

If you watch the news, it is always dramatic and urgent! Crisis after crisis it seems bombards us!

But the reality is that 99.999% of the time, all of the dramatic, urgent, and timely drama is nothing more than foam and fluff.

And like JL says, we want the beer!

Too often, the market causes investors to focus on the transitory and volatile short-term expectations, rather than what is really important – the gradual accumulation of the returns earned by corporate businesses.

– Jack Bogle, The Little Book of Common Sense Investing

The Amplification of Social Media

And these days, most of what we have going on day-to-day not only investing, but in our lives is nothing more than that foam and fluff that we really don’t want.

Social media has amplified this for us in every way:

- The stock market has a pullback –> “Stocks are on sale”

- The stock market reaches all-time high –> “Just wait, the crash is coming”

- Bitcoin crashes –> “It was a bubble”

- Inflation –> “Don’t hold cash, it’s eating you alive!”

And these are just a few of the themes of the last year.

But literally, none of it matters. It isn’t the beer!

When Do You Need Your Money Anyway? Zoom Out!

When you are investing, you are investing towards a future goal – retirement, generational wealth, or more flexibility in your future life.

Even if you are living off of your investments, at that point you are living off of 4% of less, so you’ll never actually need a majority of your money at any one time.

We are all investing for tomorrow, but acting crazy today.

And yet, we all continue to get sucked into the drama.

The solution is pretty simple.

As Jesse @ The Best Interest says, “When in doubt, Zoom out!”

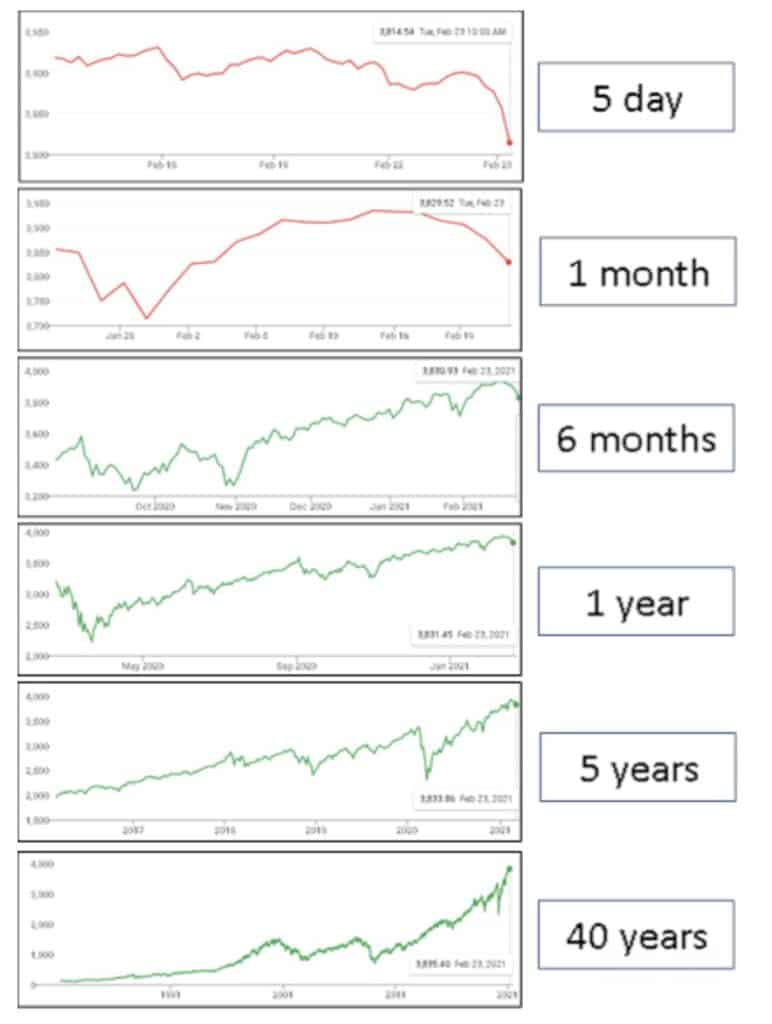

When you look at that chart of the stock market over the course of 40 years (most of our time horizons), we are seeing nothing but spectacular returns

Day-to-day, month-to-month, and even over one year, you can see all sorts of volatility.

The Further You Zoom Out, The More You See The Truth

The average investor will win by doing nothing, but by being invested as long as possible. That. Is. It.

I don’t talk about investing much, because I don’t want to work myself up over the daily drama, worry myself over picking the right stock, or anything else.

While I do have some active investments, such as the website I just purchased, I still prefer to have the rest of my portfolio sitting around in good old-fashioned Low-Cost Index Funds.

I can afford to not be the greatest investor in the world, but I can’t afford to be a bad one.

– Morgan Housel, The Psychology of Money

I don’t want to be thinking about my investments much.

I don’t want to be talking about them.

I don’t want to get wrapped up in the drama.

And, I can’t afford to be a bad investor.

That is why I settle for the “average” returns of Index Funds.

Over a 40-year time horizon…I’ll take my consistent returns ANY day of the week – you just won’t hear me talking about it.

“Minimize Drama!” is my mantra in all aspects of life, so you can enjoy the beer!

Thats a great mantra! I need to consider adding that to my credo/life mantras list!

I stay even further from my investments by letting Vanguard, Personal Capital and Betterment figure out what to buy, when to rebalance and how to tax loss harvest. Of course I pay a lot for those services. So far its been worth it to me, I’m just too lazy.

I like that. That was me for the last many years, but I was so far removed that I didn’t pay any attention at all. That was my one regret of using an advisor, was not being more proactive. Do you use all three services?

Same. I stay away from financial news as much as I can for this reason–way too much drama that has no material impact on me anytime soon. I do pay attention to interest rates and tax policy, but that’s about it. I actually kind of laugh every time I see someone trying to make a prediction about the markets as if they have a crystal ball. Do people actually listen to those predictions as if they’re valuable?

I think we all just get sucked into this at one time or another. Eventually, you just have to see through the madness for what it is. Drama. If you want the beer, focus on the beer!