What do you do when you are left holding many, many, individual stocks? I fired my financial advisor last fall, only to find that I now own my own a mutual fund of 80 stocks. So if you were wondering what happens if you stick your head in the sand. Now you know. This is… Continue reading Do I own my own mutual fund?

Financial Independence

Camping is not so different from investing

My family and I are heading camping soon, and for some reason it dawned on me that camping is a lot like investing. There are a lot of people who just will never, ever, go camping, because sleeping outside, getting out of their comfort zone, and any sort of risk taking are just not for… Continue reading Camping is not so different from investing

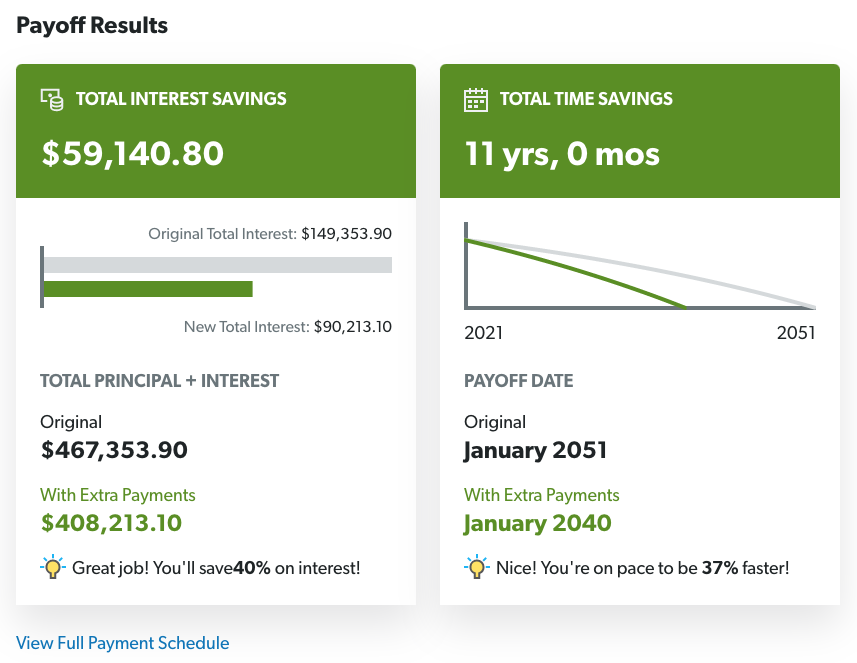

Refinance now to improve your savings rate, cash flow, and overall wealth

Interest rates remain historically low. If you have not refinanced, please do so now! We recently finished up refinancing via an Asset Based Mortgage to save $500 on our total mortgage payment. This was huge for us, especially after Accidentally Retiring. Not only are we now able to save $6,000 a year in total expense,… Continue reading Refinance now to improve your savings rate, cash flow, and overall wealth

I decided to fire my financial advisor…now what?

How to manage the transition away from your financial advisor Late last year, after I Accidentally Retired, my wife and I finally pulled the plug and fired our financial advisor. There are so many reasons why we decided to fire our financial advisor, and now we were left dealing with the aftermath. Here were the… Continue reading I decided to fire my financial advisor…now what?

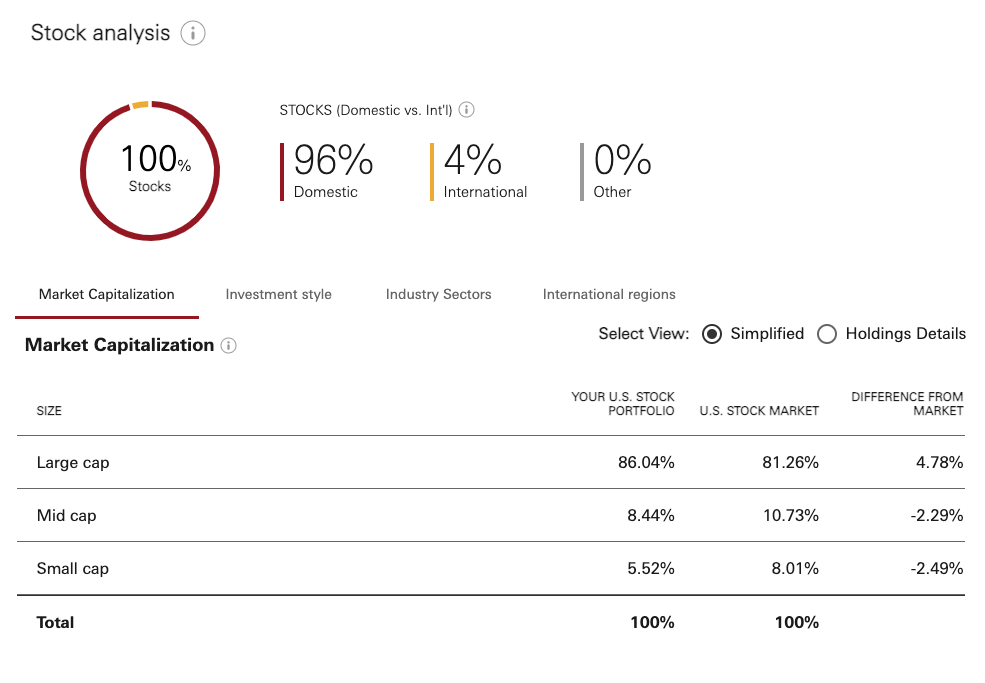

GameStop manipulation proves why individual investors should avoid stocks and invest in the entire market instead

GameStop’s stock surged yesterday, on the backs of Redditors, Robinhood investors, and Elon Musk But seriously. This business with GameStop, while sort of comical, is not that shocking. Sure it might be fun in that that professional investors got their butts handed to them by Redditors and Robinhood investors, but this is a warning sign… Continue reading GameStop manipulation proves why individual investors should avoid stocks and invest in the entire market instead