How we plan to pay $0 in taxes in 2021

This is neither tax nor investment advice and is for informational purposes only.

One of the big challenges that I have had in my first year in early retirement is managing taxes and capital gains.

You would think that taxes wouldn’t be such for someone who is not earning much income, but because we fired our financial advisor, and were stuck with high paying mutual funds, I decided it was best to sell off anything that couldn’t be transferred.

My thinking was that I would rather take long-term capital gains and pay taxes in 2020 and 2021, and save on investment fees over the long-term.

The impact of costs on your portfolio cannot be minimized.

Costs will eat away at your investments

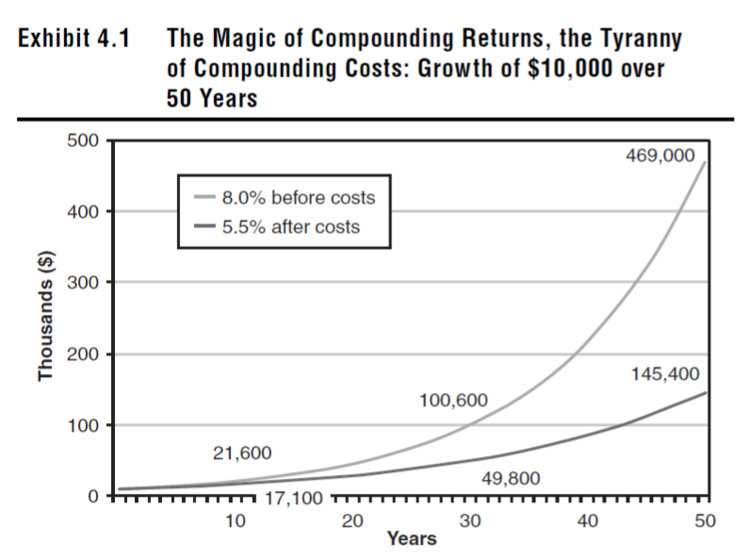

I fully started to grasp the fact that the high fees we were paying to our financial advisor were a big problem last fall after reading The Little Book of Common Sense Investing by John C. Bogle.

“Where returns are concerned, time is your friend. But where costs are concerned, time is your enemy”

The Little Book of Common Sense Investing by John C. Bogle

One of my favorite graphs in the book shows the before/after of what Bogle calls “The Tyranny of Compounding Costs:”

You can see clear as day that in the first 10 years costs don’t hurt you all that much, but over the course the remaining 40 years, the results are shocking.

For early retirees, investment fees will eat away at your returns. It is a non-go for me.

Analyzing your investment fees

If you are curious how investment fees are impacting your portfolio, I recommend Empower’s Investment Fee Analyzer to assess your investment fees. I was shocked, and I mean SHOCKED, when I used the tool to assess my own fees!

Tax Planning for 2020.

With the impact of costs in mind, I didn’t need to do any fancy cost-benefit analysis or anything like that. I fired my financial advisor and decided that I needed to move as much as possible out of there.

I downloaded our holdings by lot, and systematically went through each holding to determine its potential tax impact.

Fortunately (or maybe not) I was able to bring 80+ individual stocks over to our new brokerage without any issues. Then I had to determine how to get the best bang for our buck (tax wise) for 2020 and 2021.

For 2020, we decided to take the tax hit.

I called my accountant and we went through various scenarios to figure out how much I could sell and the impact on our taxes.

Thankfully, we were able to sell off a majority of our bond holdings and some stocks with minimal tax impact.

We already were in the 15% long-term capital gains bracket for the year, so we optimized it as best as we could and paid roughly $10K more in taxes than we would have otherwise.

Still when you consider the long-term impact of fees on our investments, it was clear that ridding myself of those fees was the best thing to do in 2020, to set ourselves up better in the long-run.

Tax Planning for 2021

Now enter 2021. As early retirees, we have an opportunity to pay $0 tax, because we have very little earnings at the current moment.

But the problem remains: we still want/needed to sell off our remaining high-fee mutual funds.

Using Physician on FIRE’s guide to a no-tax retirement, I downloaded the TaxCaster App and started to do some estimating.

The TaxCaster App: Estimating 2021 Tax

So my big questions is “how much long-term capital gains can we manage, while still paying $0?”

Here is our potential breakdown for the year:

- Income:

- Our estimated earned income is at $0 or close to it.

- Long-term Capital Gains (would like to take at least $100K if possible)

- Dividends – $10,000 estimated

- Interest Income – $500 estimated

- Deductions and Credits:

- Standard deduction of $25,100

- We’ll receive two child tax credits $3,000 and $3,600 each ($6,600 total)*

*The child tax credits, are supposedly going to be partially paid out monthly starting in July. Calculator here.

The long-term capital gains 0% tax bracket for 2021, Married Filing Jointly is $0-$80,800.

With our standard deduction AND credits, we should be able to take a decent amount of long-term gains.

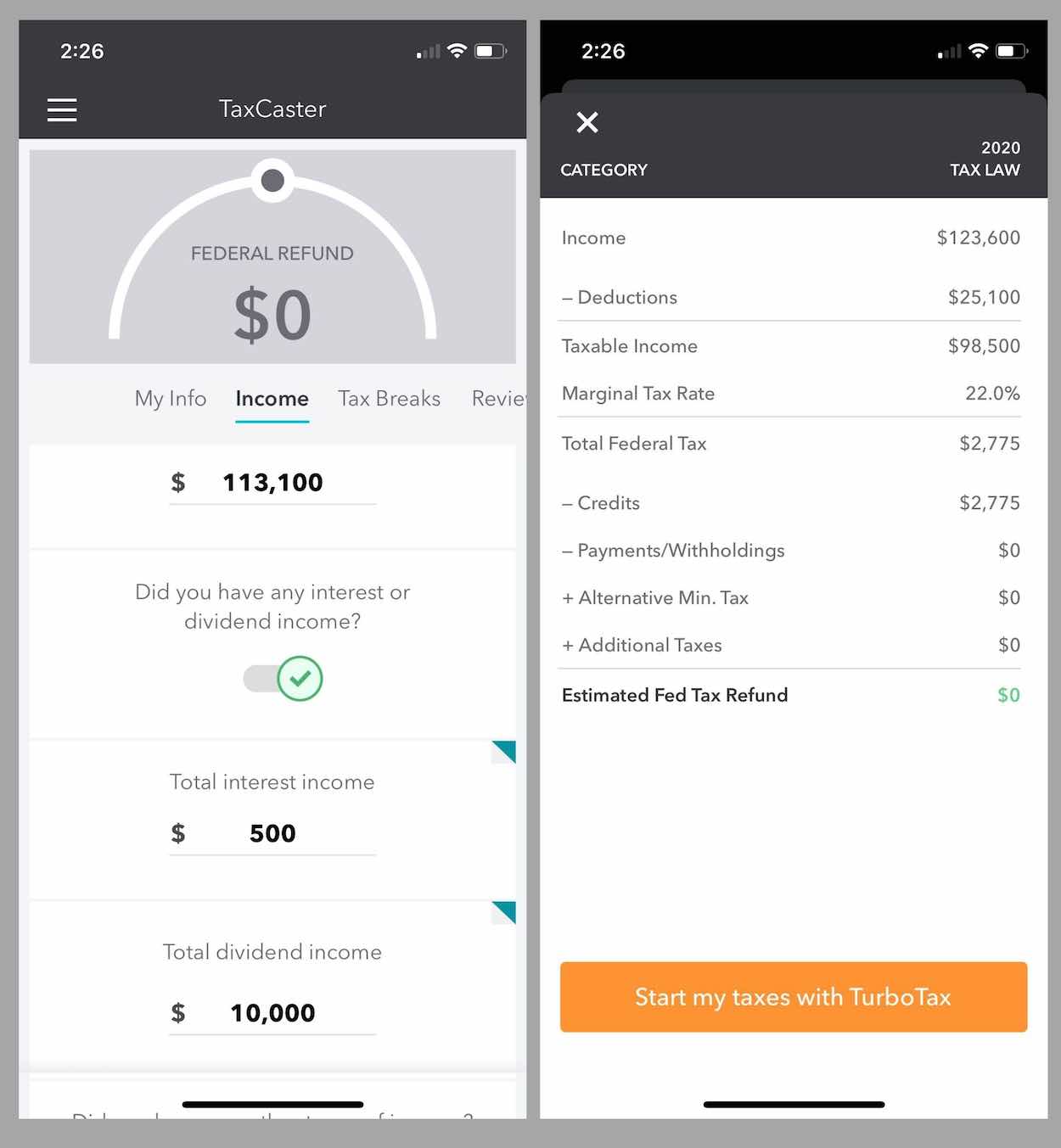

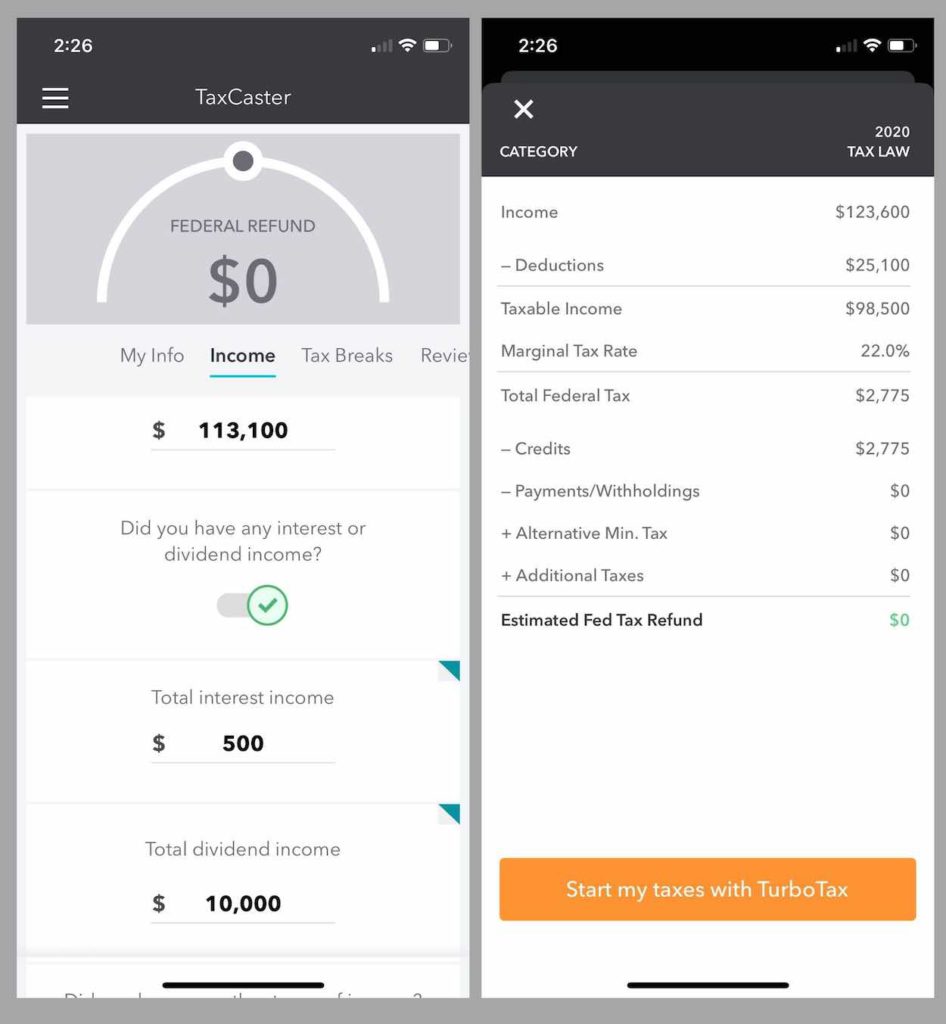

TaxCaster is still calculating out on 2020 tax law, but we can still use this app to help make a solid plan as to what to do capital gains wise.

Let’s plug this all into TaxCaster

I started off by plugging in $113,100 in long-term capital gains, $500 in interest income, and $10,000 in estimated dividend income:

As you can see on the right hand side, even though we end up in the 22% marginal tax bracket, we would owe $0 tax in this scenario.

The great part about TaxCaster, is that it is very easy to toggle your earnings up/down.

As soon as you setup all the remaining variables, you can easily estimate your taxes under various scenarios.

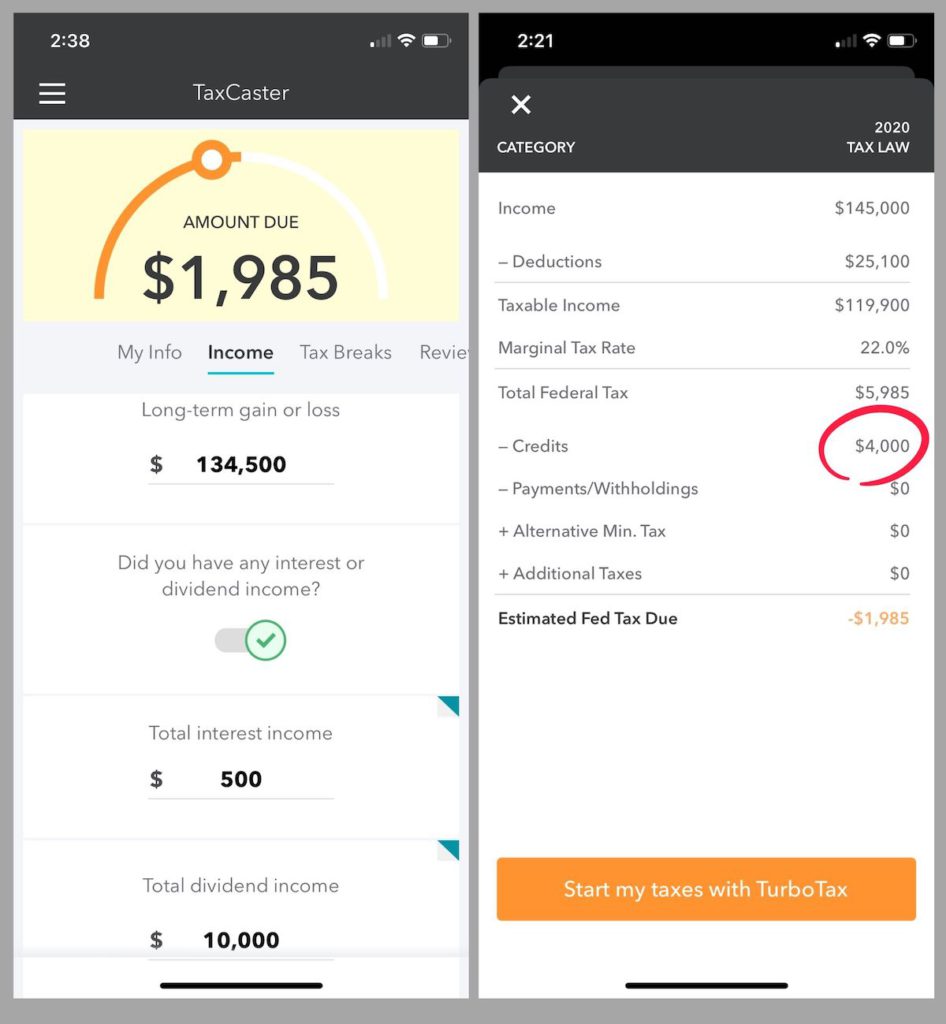

So for Scenario 2, I was able to toggle our capital gains income all the way up to $134,500 for the year. This is still including $500 in interest income and $10,000 in dividends.

In this scenario, because TaxCaster is still using 2020 data, it is assuming a $4K child tax credit (we actually have up to $6,600 in 2021).

It seems pretty safe to say, that in this scenario, we would still pay $0 taxes.

So that means that we can take up to $134,500 in long-term capital gains this year and possibly a bit more (depending on how dividends and earned income shake out).

Should I use TaxCaster?

I will still end up running all of my numbers with my accountant, to double check my work, but TaxCaster is a very easy to use app that could theoretically replace an accountant if you are comfortable with that.

TaxCaster proves to be great tool to plan out long-term/short-term capital gains for the year.

I recommend TaxCaster, and will be using it even more as our numbers become more clear towards the end of the year!

As a bonus, here is a great video I found showing TaxCaster in action, so you can get a better feel for how easy it is to use:

PS: I do not currently receive any affiliate income from TaxCaster. However, I do recommend Empower’s Investment Fee Analyzer to assess your investment fees. I was shocked, and I mean SHOCKED, when I used the tool to assess my own fees! Click here for a full Empower review and breakdown.