Personal finance is personal – But how much does an average person need to retire early and happily?

For those on a journey to FI (Financial Independence) or FIRE (Financial Independence Retire Early) this is a question you are very very familiar with.

But for those who aren’t, this is something you should be thinking about and planning for now. Sure you could Accidentally Retire, but please don’t count on that.

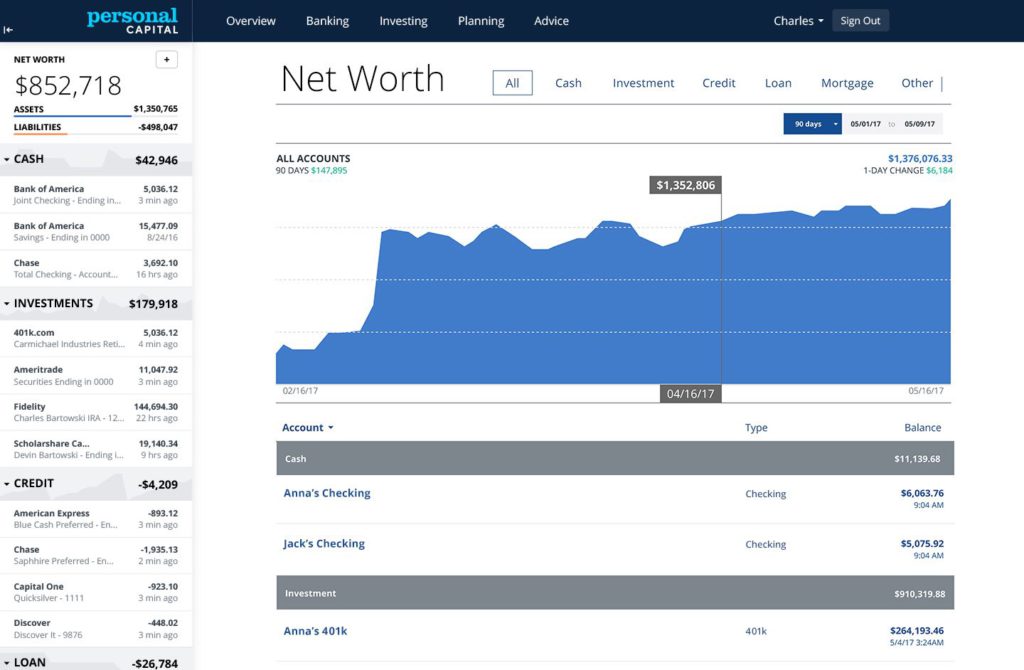

First, you need to know your net worth

I recommend using Empower as a tool to track your net worth. I have been personally using them for the past year and it has made tracking my net worth so much easier.

Simply connect all of your banks and investment accounts and you will have an excellent picture of your net worth. Empower also has a retirement planner, that is IMO the best I have seen in terms of creating your own scenarios.

I also recommend a variety of other calculators and net worth trackers here.

Once you know your net worth, now you can figure out how much YOU need to retire.

How much do YOU need to retire?

I am sure there has been so much debated about this over the years of FI discussions, I can’t possibly dig it all up.

But the generally accepted rule of thumb is going to be 25 times your expenses or a safe withdrawal rate of 4%. Again this is a rule of thumb only. Rule of thumb, folks.

Anyways, Financial Samurai had a great post yesterday pondering if 10 million dollars is the ideal net worth?

If you’ve been able to accumulate $10 million, congratulations! You should be able to retire with little-to-no financial concerns. Go ahead and enjoy life to the maximum today. You’re ahead of 99% of the American population.

Financial Samurai

But I think we can all agree that you don’t need 10 million dollars to retire happily.

Of course everyone would want to aim for a 10 million dollar net worth at retirement? Why not?! You would have a great upper class lifestyle, be a member at a country club, possibly have a vacation home, lavish travel and more.

Clearly with a 10 million net worth, you are going to have an awesome retirement.

How much does an average person need to retire happily?

J.D. Roth has a great article on the relationship with time, money and happiness and more goodness on how to be happy. I think that in general a lot of high achievers get this completely wrong. They earn a lot, and spend it all.

Later on they realize the error of their ways. Time is money, and time with your loved ones will inevitably bring the most happiness.

I want to focus on how much you need to retire happily.

There have been numerous studies, but I like this quote from this Fast Company article;

They found that people’s happiness was correlated with income but only up to incomes of somewhere between $60,000 and $120,000 (though the number was widely reported as $75,000). After that point, the relationship between happiness and income weakened.

Fast Company – How Much Money Do You Need To Be Happy? More Than Most People Are Making

So let’s assume that happiness mostly tops out around $120,000, and then diminishes from that point forward.

So for most people, and probably not anyone living in really high cost of living areas, $120,000 household income is enough for happiness.

And that isn’t even the expense side, but most americans are terrible at saving, so let’s assume that most of the take home pay is being spent on expenses.

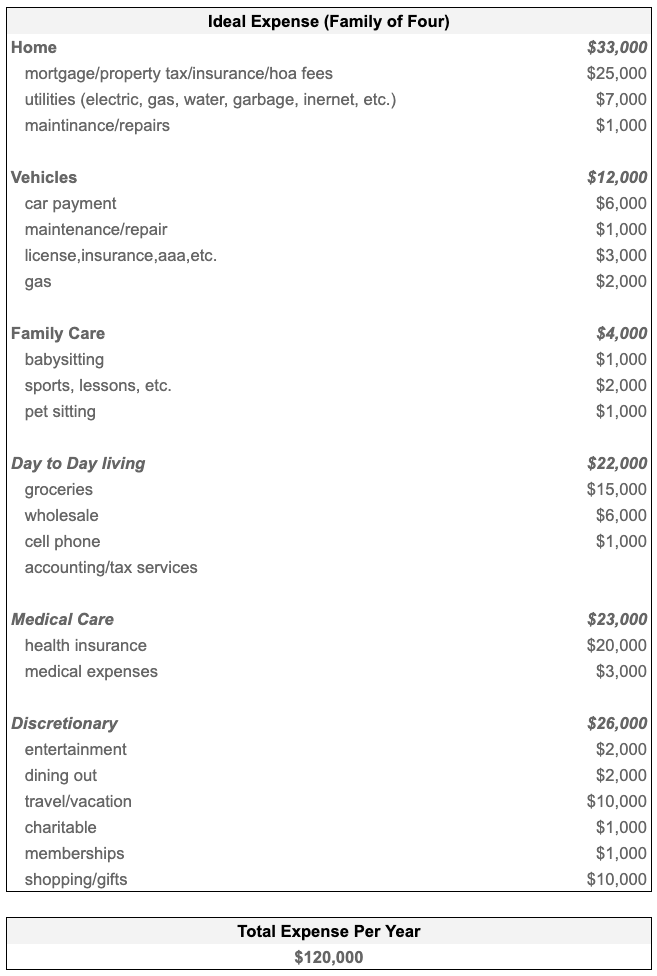

Let’s break down a family of four’s potential expense in early retirement:

I think we can debate all day various aspects of this budget. The bottom line is that certainly a lot can be cut from it to retire even earlier, but this budget does allow for a certain bump up in happiness level.

The ability to travel extravagantly, dine out, attend concerts and shows, gym memberships, zoo memberships, etc. etc.

This budget can provide for a very nice upper middle class life for a family of four.

A $3 million dollar net worth is the ideal early retirement amount

So if $120,000 is going to be the upper limit of happiness for a family of four, with diminishing returns after that, then a $3 million dollar net worth is what you will need to retire early.

From there, a 4% withdrawal rate will do the trick. 4% is not the safest rate, but for our back of the envelope math, $3 million will do the trick.

Nothing about retirement is set in stone, and personal finance is just that. You can achieve Financial Independence and Retire Early with a lot less, or you may need more to retire in a top-tier cost of living city.

The rest of us are in between, and $3 million will do just fine.

It’s 4 percent of investment assets not net worth. Jewelry,personal homes cars etc may be part of net worth but don’t count them as they don’t generate income.

Yes, valid point. In my own net worth calculation, I include my primary residence. The reason is that we have enough equity in the house that It could actually be drawn down via a HELOC and/or downsizing in the future.

But I also personally use 3.5% for my personal targeted withdrawal rate.