Should you pay down your mortgage and live debt free or invest? There is an even better option with a one-time partial payment.

Update – April 13th, 2022

A major calculation error in my spreadsheet has shown that the content in this post is incorrect.

While I still believe that paying down your mortgage provides huge mental benefits, and partial-pay offs are great ways to reduce interest – the case is clear that investing is the superior option.

I’ve updated the spreadsheet to more accurately reflect the pay off calculation, and will full update or remove this post in the future.

Updated – November 12th, 2021

That is the age old question that many ask themselves. When interest rates are lower than investment returns, it always will mathematically make sense to invest over paying it down.

But when you pay down your mortgage, there is a huge feeling of relief, safety and stress that melts away.

Paying off your mortgage is one of the most satisfying feelings, and one you can have early on in life if you plan correctly. Here’s the best way to pay off your mortgage sooner rather than later.

Money Under 30

I always thought that the holy grail of Financial Independence was to one day be able to pay down my entire mortgage and live debt free.

But when the time came to do so, I could not do it, even though we enough cash to pay it down.

If we paid off our mortgage, we would deplete our cash reserves. So our options were to:

- Pay down our mortgage and live debt free

- Invest the money in the market

- Invest in real estate

- Hold the money for a future date

I honestly could not decide what to do.

I ran the numbers, but was analysis paralysis for me. Mathematically it doesn’t make sense to pay down the mortgage vs. investing.

So, we decided to just leave the cash as is at the moment and would “figure it out later.”

Solution: Partial paydown of the mortgage

Then one random evening over dinner with friends, one of my friends mentioned that he had started to “chunk away” at his mortgage.

Basically he meant that he was paying lump sum principle payments to reduce the amount of interest paid and speed up the term of the loan.

I had never thought about a partial payment, only paying it in full vs. investing.

So, I went and ran the numbers with David Ramsey’s nice and easy to use mortgage payoff calculator.

After playing around with his calculator and running various scenarios, I realized the true power in a partial pay-down of the mortgage.

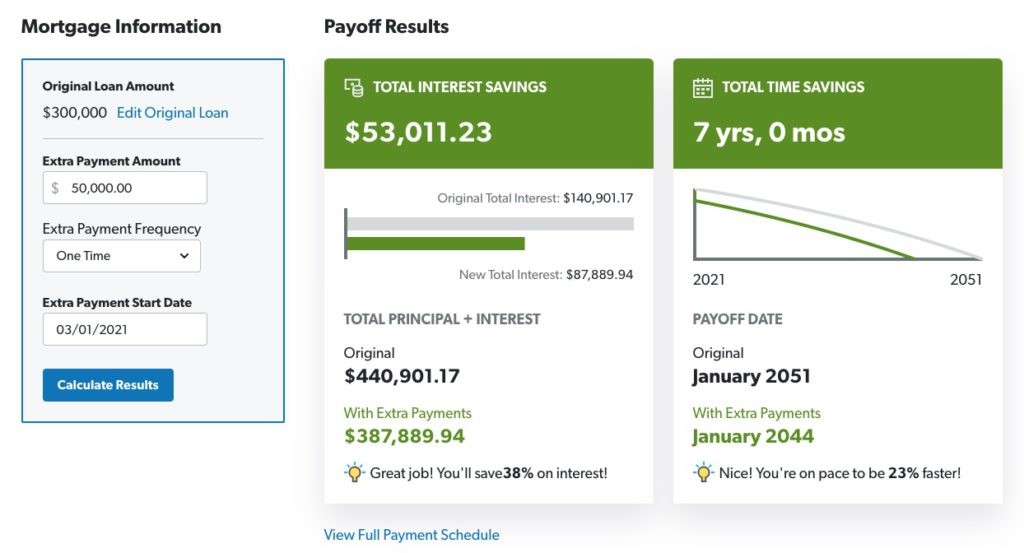

Scenario 1: Partial payment of 16% of the principal:

I will use an example mortgage with the following for all scenarios:

- Original Loan Amount of $300,000

- 2.75% Interest Rate

- First payment date 02/01/2020

For Scenario 1, we will use a lump sum payment of $50,000:

As you can see, the “Extra Payment Amount” of $50,000 resulted in $53,011.23 in “Interest Savings” and cuts this loan down by 7 years!

By taking some of our bloated savings account and “moving the money” to our mortgage via our lump sum payment, we could lower the term of our loan by 7 years.

Our monthly payments will not change, but we will save as much interest as we have now deposited into our mortgage account to pay down the principal.

But what if we did more?

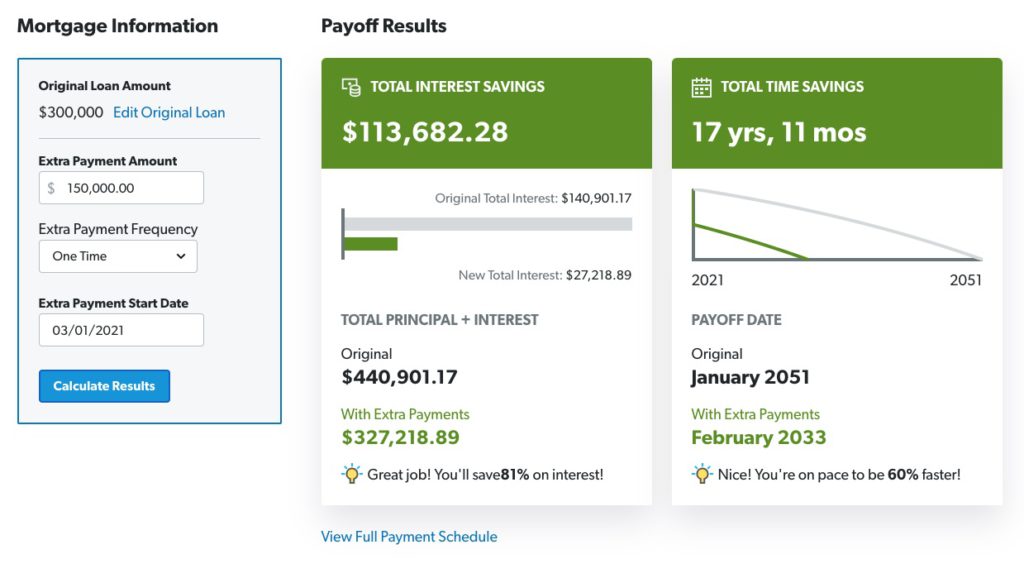

Scenario 2: Partial payment of 50% of the principal:

So my next thought is what if we pay down 50% of the Original Loan Amount or $150,000 instead of $50,000?

Now our results are getting really interesting.

The “Extra Payment Amount “of $150,000 now saves us $113,682 in “Interest Savings”, but even more impressive cuts the loan down by nearly 18 years!

So in only 12 years our new 30 year mortgage would be paid down by depositing 50% of the principal. We would still be paying the same amount each month, but the mortgage would be paid in full in just 12 years.

Not only that, but total interest payments would plummet.

By paying down 50% of our mortgage, we would turn our mortgage into a savings account.

It was pretty clear that if we were willing to commit to the illiquidity of 50% of the mortgage, we would essentially be turning our mortgage into a 12 year savings account.

Plus, by only paying down 50% we would be able to invest the other surplus cash in the market.

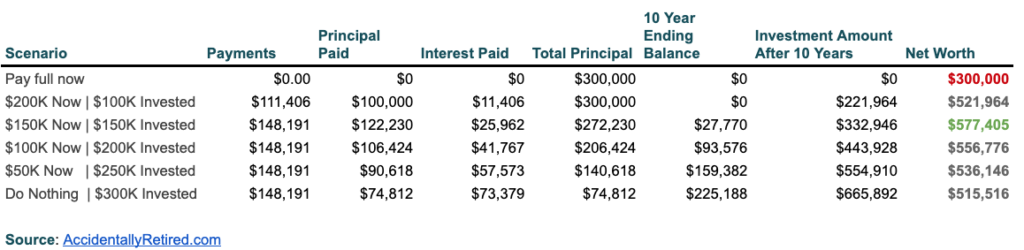

Impact of a Partial Payment on Net Worth

Ok, to come full circle and show just how much paying down any percentage of your mortgage works, I am going to put together a scenario for you to show you the tremendous impact of partially paying down your mortgage.

- $300,000 original principal amount

- $300,000 cash available to pay down or invest

- 10 year time horizon

- 8% annual compounded return on investment

The results are magic; paying 50% of your mortgage gives you the highest net worth in 10 years:

It is pretty clear that paying down your mortgage in full is the big loser here. Your net worth suffers by $215K in the worst scenario.

Surprisingly, over the course of 10 years, the worst two scenarios are paying the mortgage in full and only investing.

Yep, in fact, the clear cut winners are either paying down 50% of your mortgage, OR 33% of your mortgage.

So indeed, paying down ANY percentage of your mortgage is the BEST financial move that you can make:

- It lowers your interest payments for the life the loan

- It shortens the loan

- It speeds up your principal payments

So, if like me you end up trying to decide between paying down your mortgage or investing, you now know that the best option is to split the difference.

Partial mortgage payments turn your mortgage into a savings account and doesn’t compromise investment returns. It is the best of both worlds.

The majority of people who say oh the market at 8% trump’s paying off the mortgage if 2.75% have never had $450,000 cash. Having that much cash and dumping it all in the market at once is very very scary. If splitting the difference helps you sleep at night and also gives a significant financial gain rather then all that money sitting in a savings account then I say heck yeah it’s a great idea!

Hello,

Really enjoyed this article and the associated spreadsheet. However, looking at your spreadsheet it appears there may be an error in how you calculate the investment amount after “X” years. It appears the formula uses a constant of 10 years (i.e changing the value in cell C22 doesn’t change the amount of the initial investment. Shouldn’t the formula in column K be “=-FV($C$21/12,12*$C$22,0,D9,0)-IF(E9<$C$22*12, FV($C$21/12,($C$22*12)-E9,$C$18,0,0),0)"? Changing the second term in the first FV to be 12*$C$22 vice 12*10?

Hmm. I’ll take a look next chance I get…

Hey Brett – sorry for the delay in reply here, but you are correct, and I have fixed the error in column K. This really only affected anyone changing the variable past 10 years.

It also looks like 10 years is the magic number here anyway. Anything longer than a 10 year horizon and investing “wins”. But that is because this isn’t taking into account any cash flow savings and additional investment opportunities created after paying down the mortgage.

AR,

Please revisit your net worth calculation; you are subtracting the outstanding mortgage twice:

Net worth = Investments + property equity – outstanding mortgage

But the equity is the (property value – outstanding mortgage).

The correct net worth calculation is:

Net worth = Investments + value of property – outstanding mortgage

And then not paying off the mortgage is clearly the financial winner.

Invest at 8% return is superior to pay off a 2.75% loan.

In this case, I am ignoring the full property value. It could be $350K or $1M, the property value is the value.

Over 30 years, 8% return will always the clear winner. But there is value and a possible net worth increase in splitting the difference and speeding up your mortgage (depending on your situation).

What is the point in doing a calculator if your property taxes and insurance go up every year?

That is going to happen no matter what. Death and taxes right? This is more about if you have a cash surplus…should you invest it or drop some of it into the house to speed up the mortgage.

This is a great analysis of the mortgage pay down option. I may have missed something here but you’re assuming that after 10 years the net worth on the property is still going to be $300,000? We live in the Miami area and we have a similar example to yours and are contemplating paying it off. We bought a single family rental, 6 years ago for $300,00 and right now it is worth $475,000 (per Zillow).

Right now we are considering just paying off $190 K that remains of the loan which is at 4.6% . However in our case, we’re retired and are just looking to maximize income. We have a big enough cushion in equities to not want to expand on that. But you did a great job of analyzing the different scenarios.

Hey Maria,

In this case, I am ignoring whatever additional market value there is to the home above the mortgage principal amount. No matter what you’ll receive appreciation returns on the asset itself whether it is paid off or not.

There is an additional savings via cash flow if you pay down and complete the loan within the 10 years. I did NOT include in this calculation, but it may make sense to work that in.

Great article. Even rounding up or paying an extra $100 per month in mortgage payments makes a huge difference over time. But the partial payment is a great idea and I have not really thought of that before.

Yeah. I am all about shortening that mortgage and lowering interest payments if/when it makes sense!

Change the scenario length (c22) to 30 years then re-evaluate.

In a 30 year scenario, investing always wins…But peace of mind and financial security comes from paying down the mortgage and that can’t really be quantified. I don’t think I’ve seen anyone who paid off their mortgage say they regretted it. Plus, always something you can undo easily.

I took a quick glance at your spreadsheet – are all of your scenarios equal in terms of cash outflow? If they are, then ignore the following. Your outflows from cash in scenarios 3-6 appears to be 446,967 (300k split between mortgage reduction and investments + 146,967 for mortgage payments over 10 years). For scenario 1 – you need to take that same 146,967 over time and invest it @ 8%. For scenario 2 – you need to take 36,096 over time and invest it as well. Once you account for that, the numbers will be closer, but a partial paydown may still shower a higher net worth. However, the other factor that is impacting the results is the choice of a 10 year time frame, but still having mortgage payments after 10 years in scenarios 3-5. You could equalize that one of 2 ways. First by adjusting your payments in each scenario to have the house paid off in 10 years and then making sure total outflows is equal among all scenarios. The other is to use a time frame longer than 10 years when the mortgage would be paid off (and making cash outflows equal in all scenarios). If you continue to live in the house after 10 years, you will have to make mortgage payments, but in the first 2 scenarios you can continue invest the equivalent of that monthly payment. Even if you decide to sell after 10 years, if you took the equity and invested it for another x years, that would reduce the gap between the scenarios even more.

Ah yes. 100% valid points Alan. I was only taking into consideration the amount you had sitting around in cash vs. the total cash outflow. I did just add in another option to dollar cost average contribute your mortgage payment if you were to pay down the mortgage in full, but will look how to normalize/equalize the scenario.

Ok Alan – made some adjustments here. Take a look and let me know what you think:

https://docs.google.com/spreadsheets/d/1YoGvzK8hv6r-bNrtaBChA9K9CzmXABilykXQnOZ99jY/edit?usp=sharing

Love the blog Accidentally Retired! This is one of the topics I had wondered about for so long but I haven’t seen anyone cover it as well as you did. Thank you for running all of the scenarios. I know it will differ per person but I will be aiming to pay 50% down to maximize net worth in the future! Keep up the great work!!

Awesome thanks! I am working on a spreadsheet calculator to run your own scenarios on. Hope to have that finished up tomorrow.

But I was really shocked at the simple power of paying down even a small portion of your mortgage.

@FreshLifeAdvice – my first pass at a spreadsheet is here. Please take a looksey and let me know if you have any questions or need any adjustments made!

https://docs.google.com/spreadsheets/d/1YoGvzK8hv6r-bNrtaBChA9K9CzmXABilykXQnOZ99jY/edit?usp=sharing