Early retirement without a plan, eventually needs a plan.

When you end up Accidentally Retired at 36, you obviously have done many things right. Even so, I was caught off guard in terms of properly planning for an early retirement.

My plan was to take a mini-retirement and figure out what I’d like to do next.

During that time, I brushed up on my financials, read many books (fiction and nonfiction), and realized that we were close enough to Financial Independence that I did not NEED to go back to work.

How did I wake up one day and realize this?

- By utilizing Empower to track my net worth more closely

- By using the 4% rule ~ 25x our expenses

- By running various retirement scenarios with Empower, Vanguard, cFIREsim and others.

But I’ll be honest….we aren’t full FI…at least not with our current spending level. We are very, very, close, but not quite there. And that is fine. I’d rather live in Partial FIRE, work a little on my own terms, and let the market and compounding do the rest.

Bye Bye CEO gig. Hello Partial FIRE.

I left my CEO job, because I didn’t NEED to be making a ton of money, and I was done living a life that wasn’t fully in my own control.

My job was really good all things considered, but after selling our business to a public company, it was no longer truly in my hands. I had plenty of last minute “we need you on a flight to NYC” type of calls. After five years of this environment, I craved the flexibility.

A lot of these people really could afford to retire if they just do a little soul searching and realize like, “You know what? I don’t need this multi-million-dollar CEO job and it doesn’t really fill my soul very much, so let’s just do something else.”

Mr. Money Mustache Reveals a Huge, Hidden Obstacle to Early Retirement – The Motley Fool

Mr. Money Mustache’s point above is exactly what I was thinking. I wasn’t making multi-millions a year, but my job certainly was not filling my soul as much as it had previously.

I always valued that if nothing else, our company was creating jobs. We created 50+ jobs, and retained thousands of independent contractors in 10 years. For that I am proud.

Decumulation Planning Time

I still needed a plan though, and at the time of making the determination that I could FIRE, I had no good plan. I knew that I could figure this out, but wasn’t sure what exactly to do.

So I started by writing our first ever personal financial plan and creating financial goals.

The goal is simple enough:

The Goal: build up enough passive income to offset all current expenses, and be able to continue to live our current lifestyle.

With that in mind, I needed to figure out where all of this income is going to actually come from.

Early Retirement Withdrawal Strategy 101

So I turned to the best series of articles on the topic — Early Retirement Now’s Safe Withdrawal Series. It is a must read for anyone attempting to retire early.

But it is confusing, even to a former CEO and someone good with numbers. Some of this goes over my head. Still, if you continue to revisit the material and better understand it, it’ll make more sense, the more you dig in.

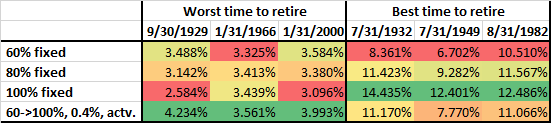

One of the big things that ERN points out is that the 4% is not really safe:

Remember, the Trinity Study would consider a final net worth of $0.01 after 30 years a success. Not very useful if you have a 50-year horizon!

Early Retirement Now

With that in mind, ERN has done many many split tests on how to best allocate and withdraw in early retirement. The best things that I have gleaned are as follows:

- The 4% rule is not safe – A safer withdrawal rate is actually 3.5%

- Is the goal capital preservation or capital depletion? That can make a big difference in the plan. We are fine with depletion.

- There are ways to reduce risk – Increasing equity allocations and risk exposure AFTER you are retired will ensure the safety of the portfolio in the long-term (via equity glidepaths)

- Flexibility is key to the entire thing — “Flexibility through going back to work and pursuing a side hustle will certainly solve some problems”

With some of these key lessons in mind, I was able to piece together a safe withdrawal plan.

Using an Equity Glidepath to Reduce Risk

In order to avoid as much as possible, the Sequence of Return Risk, we are going to utilize a glidepath for our early retirement. This is best explained in the conclusion section of ERN’s glidepath article:

An equity glidepath can alleviate some of the negative effects of Sequence of Return Risk. But it shouldn’t come as a surprise that you will never completely eliminate the risk.

ERN found that the most successful equity glidepath was 60% to 100%. This allows for a higher safe withdrawal rate, while also reducing the risk:

A glidepath helps you when you retire close to an equity market peak but hurts you when you retire at the equity market trough!

Early Retirement Now

With all of that all in mind, we’ll be targeting both as safe a withdrawal rate as possible, retaining flexibility, and utilizing an equity glidepath.

The Starting Asset Allocation

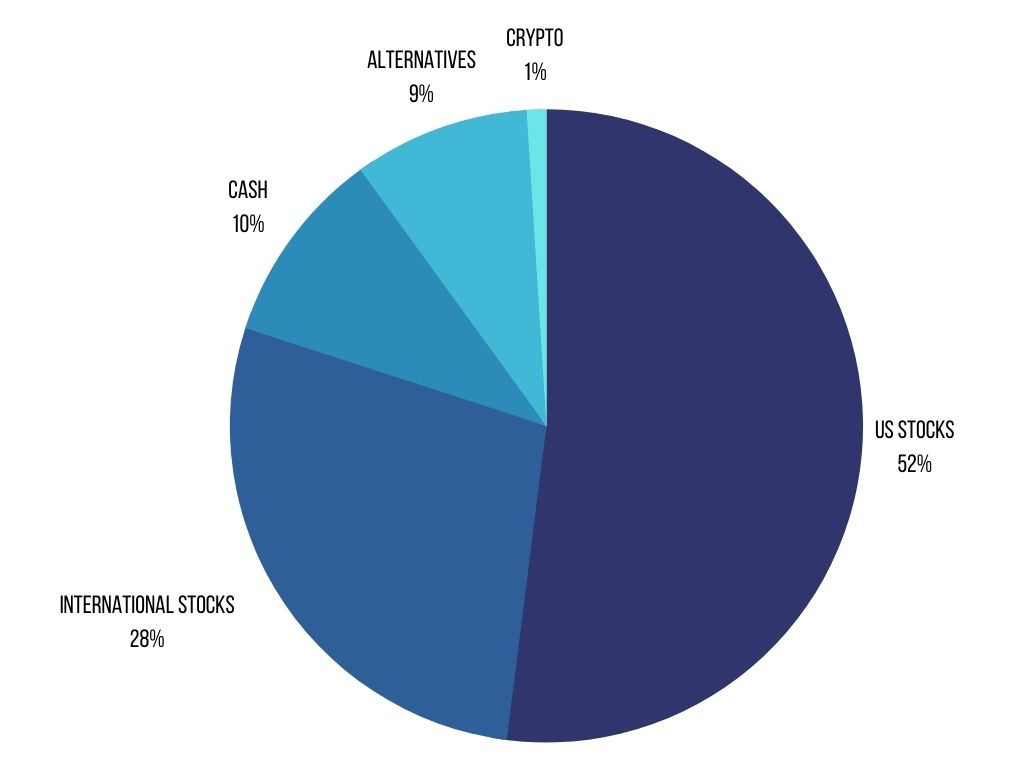

Our current portfolio looks like this:

- 80% Equity

- 52% US Stocks

- 28% International Stocks

- 20% Defensive

- 10% Cash

- 10% Alternatives

And in graph form:

Now, keep in mind, this is our portfolio. This is NOT all of our total assets. When you layer in our primary home our actual allocations look like so:

- 70% Equity

- 14% Real Estate

- 8% Cash

- 8% Alternatives

This feels safer, even though in reality our portfolio is 80% stock, but our primary home does have a significant amount of equity built up in it and it gives us options in the future in the event something went wrong.

This is where flexibility comes into play. We wouldn’t even have to sell our property to realize the equity we have built up. In a dire situation, we could use a HELOC in order to avoid selling stocks during a down market.

Our Holdings

Because we fired our financial advisor in November, we have several options in which we can make adjustments to our allocations in 2021.

Stocks

Individual Stocks

We still hold over 100 individual stocks (EEEK!) The plan is to leave our 100 individual stocks as is and avoid paying capital gains.

The silver lining is that our individual stocks mimic the S&P 500 and are mostly all US, so for now, I have left that as part of our US stock portfolio and not worried about it. At least stocks don’t have fees!

But, if there is a big pull back in the near future, this will give us the opportunity to exit out of some of the individual stocks and switch over to much more satisfying and easy to own Index Funds.

Low-cost Index Funds

A majority of our portfolio is now in VTI and VXUS.

After reading The Little Book of Common Sense Investing, by John Bogle last year, I am convinced that a simple approach is the best approach for us in the long-run.

While we will continue to be dogged with individual stocks for the foreseeable future, anytime we can sell them off and convert into Index Funds, we will.

Alternatives

All of our current alternatives are tied up in an alternative fund still housed at our former brokerage. We’ll be exiting this fund on June 30th, and that will allow us to re-distribute as we see fit. We’ll be looking at everything from REITs to Gold to Commodities.

Cryptocurrency

I wrote a post awhile back, about how I believe that even Bogleheads can invest in Bitcoin. So far, we have less than 1% of our net worth tied up in Cryptocurrency. I believe in blockchain technology, and am looking at Crypto as an Alternative asset.

Bitcoin may be more comparable to Gold, but Ethereum may well end up being the backbone of the internet in 10 years. I don’t know what is going to happen, but for now I feel comfortable with a small amount of assets invested in crypto.

Bonds

I am not opposed to bonds at all and will substitute bonds for any alternatives when it makes sense. But I’ll keep it simple with BND and BNDX. The reason why I am not currently positioned in bonds is simply due to the Alternative Fund that we have 10% of our net worth tied up in.

Cash

Cash at the current moment is our biggest defensive position. We have a 2 year supply expenses, and enjoy the flexibility to both live off of it and deploy it as we see fit.

Stocks can help protect you against long-term inflation while cash can allow you to use any short-term inflationary spikes to redeploy faster at higher rates.

The simplest asset to hedge against inflation – A Wealth of Common Sense

Currently our cash is split between several checking and savings accounts. However, the bulk of it is sitting at a brokerage and invested in a BLF Treasury Trust Fund (BTCXX). This is largely to take advantage of a $1,000 bonus offer for moving some money to this firm.

So while BTCXX has not had very good yields YTD, we will receive the bonus offer after 90 days is up. Following that period, I’ll be looking at other potential bonus offers and/or high-yield savings accounts.

The HMBradley High Yield Account looks very interesting (3% APY), but without payroll deposits, I don’t think we’ll qualify.

Dynamic Asset Allocation

We’ll be roughly following some of the principles outlined by The Accumulator in Dynamic asset allocation and withdrawal in retirement.

Our entire goal around our asset allocation is to remain flexible, and this is going to especially be so around our defensive positions for the next two years.

Adding in the Partial FIRE

Now, if you remember to the very beginning of the article, our portfolio isn’t quite at 25x expenses.

If the market continues this bull run for the next two years, we likely could be at that point. Great! That’ll make things much less stressful after that to potentially be able to go full FIRE.

However, I still do enjoy being productive. I just want to be productive on my own time again, and with less stress.

Accidentally Retired plays into this. Perhaps AR will generate some income for us in the future? That would be great, but I am not going to count on that.

In fact, I want to be more aggressive than that, I am on the lookout to buy an entire website. Yes, buying a website is part of my retirement plan.

As such, I have signed up at the various brokerages and am keeping tabs on things that are out there. The goal would be to buy a website, as one buys a rental property, to generate cash flow.

But the cool part about websites is that they generally have much better cap rates and cash on cash returns than real estate.

I don’t know yet where this will shake out, or if I will even be able to find an appropriate website in my price range, but I am looking. So if you are interested in selling a profitable site to me, let me know!

My target would be to purchase a website that instantly is generating around 20% of the cash flow we need to cover our expenses.

Update – As of October 2021, I have indeed purchased a website!

The Withdrawal Plan

Starting in 2021, we began to actually drawdown from our cash reserves.

Before that, we were living off of severance and earnings from 2020.

And while it feels weird to be living off our cash, we tried to set it up in such a way that it feels more like a paycheck.

- For Q1, I scheduled deposits from one of our brokerage accounts to deposit into our checking account monthly.

- After finishing off the transition away from our financial advisor, I will then re-set up the automatic deposits for Q2 onwards.

- Our entire portfolio, outside of the cash can then continue to grow as is for 2 more years.

This way it helps feel like we are living on a budget and also doesn’t feel like we are just seeing our very large emergency fund/savings run bone dry.

Because we have built flexibility into our plan, we will make any adjustments as necessary, but the goal is that we won’t have to touch our stocks or alternatives for at least a year, and potentially up to the full two years if all goes well.

From that point on, we will pull 3.5% or less based on market conditions.

Uncle Sam wants his share too though…

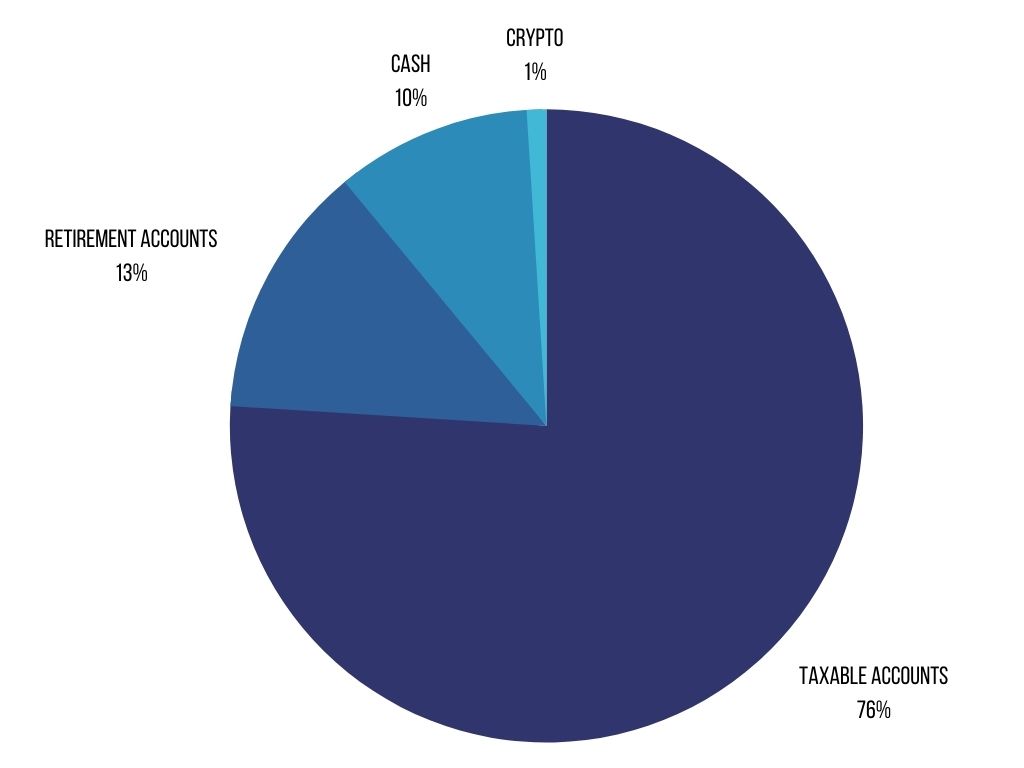

Ok, so let’s talk about taxes. So far, I haven’t covered how I am going to deal with taxes, roth conversions, etc.

The majority of our net worth is in our taxable accounts:

Because of this, we don’t have a huge concern over where the money is coming from. We can continue to grow our retirement accounts, convert Traditional IRAs to Roth when we can, and let them do their thing.

But capital gains is a big big problem for us. Ironically, we could have had even bigger capital gains problems, had we been invested a bit more aggressively leading up to this point. So a silver lining to the whole financial advisor thing, is that we can sell out of all of our expensive funds in 2021, because we weren’t invested properly previously.

In 2021, we are already looking at realizing long-term capital gains just to exit from a few (not even all) of our expensive funds. While we may be able to keep our income low enough to keep us in the 0% tax bracket for capital gains, it is unlikely to happen in 2021.

For 2022, we may be in much better shape to keep our income low enough to pay 0% tax on capital gains (assuming the tax law doesn’t change drastically).

For 2023, we would then begin to sell off assets that have high cost basis, and low capital gains to the tune of 3.5% or less of our portfolio. Still I wouldn’t count on being able to keep our taxes at $0. Especially if we are earning decent money from any web assets that we acquire.

So long-story short. We will be flexible!

Testing the plan!

Ok, so the withdrawal plan is to follow an equity glidepaths from 80% to 100%.

Why 80% to 100%? Because we already have 80% invested in stocks and changing allocations at this point will cost us too much in capital gains tax.

The only other assumption used, is that we will purchase a web business or work enough to generate cash flow to cover 20% of our expenses.

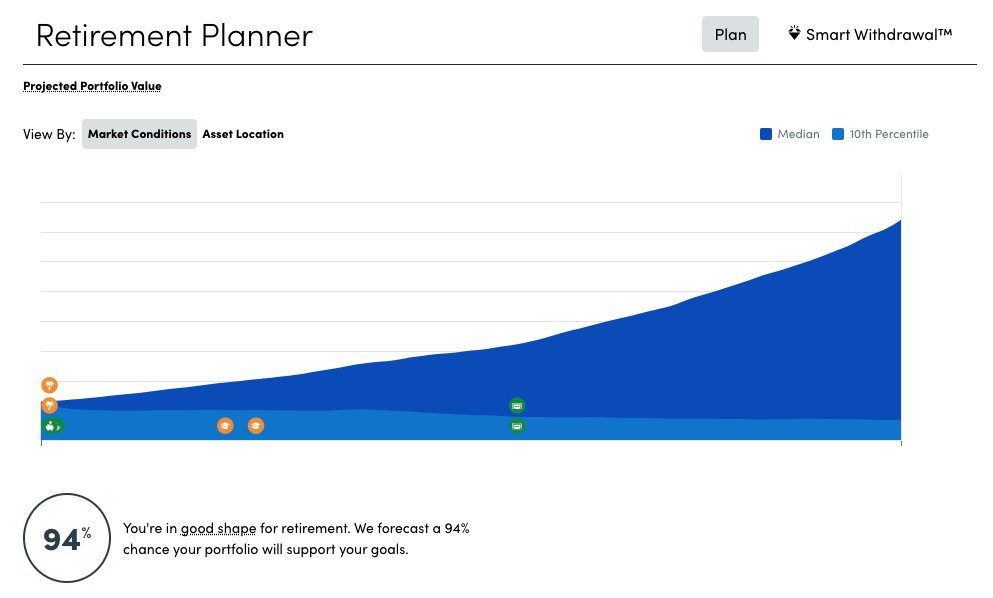

Testing the plan using Empowers’s Retirement Planner

With all of that in mind, let’s start by plugging things into Empower’s Retirement Planner.

You can see the results here:

Overall, this is a great tool. I like it because I can easily enter in future income forecasts, social security forecasts, college for my kids, etc.

With everything I realistically punched in, I was able to attain a 94% success rate from PC’s Retirement Planner.

The only problem with their planner, was there is no way to really adjust the Asset Allocations in a flexible way. Therefore, if we are going to follow a glidepath scenario, there is no way to test this out within their tool (at least as far as I could figure out).

If you aren’t yet using Empower to track your net worth, you should give it a go.

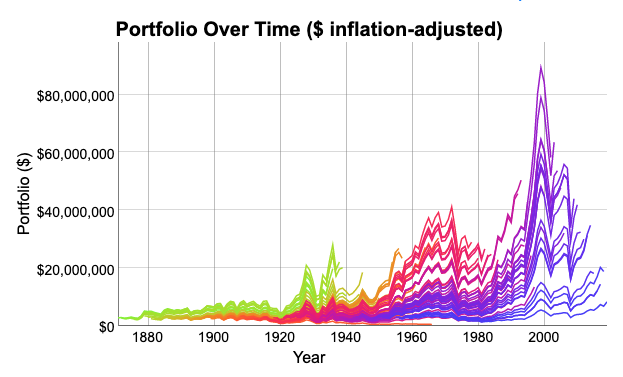

Next I turned to cFIREsim 3.0

The great part about cFIREsim 3.0 retirement simulations you can test/tweak your equity glidepaths.

I was able to easily run 15-20 scenarios to verify what would happen if we made more, or less income. If we bought a website or didn’t, etc.

Here are the results for the 80 to 100 glidepath, plus 20% expenses covered by some sort of income:

100.00% Success Rate – Failed 0 of 89 total cycles.

Boom! So cFIREsim gives this plan a certified fresh rating of 100%.

I am not going to be so naive to think that our plan is foolproof. It is not.

There is still a ton of risk here, but with some flexibility and perhaps a bit of luck we should be just fine.

Conclusion: Flexibility is the key to our early retirement

So as you can see, the plan largely based on flexibility.

We’ll need a lot of flexibility early on in the first two years, and then after that depending upon market conditions we will make appropriate adjustments.

If I have to go back to work part-time, I will. Or perhaps my wife will want to work part-time, once both of our kids are in school full-time?

Maybe none of that will be needed, because investing in a web business will turn out to be a good idea?

I feel confident that at the very least, my FIRE goals are all in my hands.

More Withdrawal Strategies from the PF Blogger Community

I may be 4 years late to this party, but this post was inspired by others in the PF Blogger community. My strategy was built on the shoulders of many of the great PF Blogs out there.

Please check out all of “The Drawdown Chain Series” here:

- Anchor: Physician On Fire: Our Drawdown Plan in Early Retirement

- Link 1: The Retirement Manifesto: Our Retirement Investment Drawdown Strategy

- Link 2: OthalaFehu: Retirement Master Plan

- Link 3: Plan.Invest.Escape: Drawdown vs. Wealth Preservation in Early Retirement

- Link 4: Freedom Is Groovy: The Groovy Drawdown Strategy

- Link 5: The Green Swan: The Nastiest, Hardest Problem In Finance: Decumulation

- Link 6: My Curiosity Lab: Show Me The Money: My Retirement Drawdown Plan

- Link 7: Cracking Retirement: Our Drawdown Strategy

- Link 8: The Financial Journeyman: Early Retirement Portfolio & Plan

- Link 9: Retire by 40: Our Unusual Early Retirement Withdrawal Strategy

- Link 10: Early Retirement Now: The ERN Family Early Retirement Capital Preservation Plan

- Link 11: 39 Months: Mr. 39 Months Drawdown Plan

- Link 12: 7 Circles: Drawdown Strategy – Joining The Chain Gang

- Link 13: Retirement Starts Today: What’s Your Retirement Withdrawal Strategy?

- Link 14: Ms. Liz Money Matters: How I’ll Fund My Retirement

- Link 15a: Dads Dollars Debts: DDD Drawdown Part 1: Living With A Pension

- Link 15b: Dads Dollars Debts: DDD Drawdown Plan Part 2: Retire at 48?

- Link 16: Penny & Rich: Rich’s Retirement Plan

- Link 17: Atypical Life: Our Retirement Drawdown Strategy

- Link 18: New Retirement: 5 Steps For Defining Your Retirement Drawdown Strategy

- Link 19: Maximize Your Money: Practical Retirement Withdrawal Strategies Are Important

- Link 20: ChooseFI: The Retirement Manifesto – Drawdown Strategy Podcast

- Link 21: CoachCarson: My Rental Retirement Strategy

- Link 22: Accidentally Retired: How I Planned my Early Retirement Withdrawal Strategy After I Accidentally Retired Without a Plan

If you’d like to join the chain, share your withdrawal strategy and tweet with #DrawdownStrategy. Then add these links above and new posts on the chain. Please let me know as well.

Do you happen to have an updated link to the Personal Capital’s Retirement Planner? The link appears to go to a dead end. Thank you!

Thanks for letting me know! Here is the correct link (and they have now been rebranded to Empower after being acquired): https://personalcapital.sjv.io/kjoJvz

Cash at the current moment is our biggest defensive position. We have a 2 year supply expenses, and enjoy the flexibility to both live off of it and deploy it as we see fit.

Did you save this 2 year cash supply up while working or withdraw it from your portfolio by selling stock?

We saved by working, and have pretty much always had a 2 year supply of cash for the last 10 or so years before that – just in case. In this case, it proved to be very helpful, though at the time of my Accidental Retirement, we probably had close to 4 years of cash, and I was able to start deploying some of it during the downturn.

If you expect your 2022 income to be very low, why not take advantage of the low tax rates to finish any ROTH conversions before the marginal tax rates are increased? This is the perfect opportunity to do so since you have such a long horizon to enjoy compounded gains post conversion.

Most of my reasons for taking capital gains is to a) move away from more costly management fees 1%+ and b) reallocate into a simpler portfolio.

I do agree it would be nice to finish ROTH conversions first, but the cost savings alone from cutting fees will make it worth my while.

Solid article with good information. Most people think only about accumulation and not withdrawal.

Withdrawal is the hard part, especially if you are toeing the line at 25x-ish like we are!

Don’t forget your goal is no longer 25x if you are using 3.5%. More like 28.6x.

Yep, you are 100% correct. And that is exactly why, we’ve gone out and purchased a website to provide some cash flow and de-risk the potential strain on the portfolio. It’s still too early to say if it worked or not, but certainly so far it has helped to give our cash reserves a longer runway in the event of a bad downturn.

First time here – nice post and all the best.

Will you do an update in one, two or/and a few years? I ask as these always make interesting reading too.

I have seen your comments on others FI blogs and often wondered what exactly your handle (AR) actually meant. Well now I know!

Lastly, the drawdown chain you highlight is a gem – packed full of good practical advice and features posters from both sides of the pond too – which was extremely unusual as recently as just a few years back!

Oh yeah. I’ll definitely update. In fact, this post was originally from March, and I have since bought a website which will hopefully change my cash flow picture quite dramatically. So I think an update in a few months will be in order. But mostly, I’ve stuck with my plan and just let things be.

Great post dude! Mr 1500 did a recent post on their drawdown strategy that I liked. I’ll see if I can find the link.

Interesting to see your asset allocation. Thanks for sharing it all!

Thanks Joel! Send it over if/when you find it.

That’s a good point… I used to always love the 4% withdrawal rule because it was so touted in the personal finance community but after reading your post, I’m thinking that 3.5% withdrawal strategy is more safe.

Someone did a study on how if you retired a millionaire at the height of the tech bubble, you would’ve had to go back to work by 2007 – 2008 crash. Don’t want that happening!

Yeah, the 4% rule is definitely not safe if you are looking at longer time horizon. Even 3.5% is potentially iffy, but depends on if you have sources of cash flow and a variety of other factors.

If I had to go back to work, of course I would, but I’d prefer to have a huge margin of error to work with…which is also why I like to hold a lot of cash.

I’m on somewhat of a blog break but am in awe at how much great content you keep pumping out. Keep the good reads coming!

Thanks! Much appreciated.