What do you do when you are left holding many, many, individual stocks?

I fired my financial advisor last fall, only to find that I now own my own a mutual fund of 80 stocks.

So if you were wondering what happens if you stick your head in the sand. Now you know.

This is what happens when you hire a financial advisor, trusting that person without delving into how they will invest your money.

Don’t get me wrong, I am not hating on financial advisors. I blame only myself. Even if I had inquired and was aware that plan was to invest most of our money in mutual funds combined with a stock portfolio to help with tax management — it would have sounded good at the time.

I also don’t think this is that uncommon either.

This is a strategy that some financial advisory services are using: a majority of your holdings go in funds/index and then a portion is invested in individual stocks for tax-loss harvesting.

However, this also seems to me a strategy to keep the average joe from being able to make an easy decision to manage their own investments. My decision to fire my advisor was not easy because of this.

Yet, after consistently seeing how much my portfolio was underperforming the S&P 500 using Empower’s tools combined with reading The Little Book of Common Sense Investing, by John Bogle my entire investing perspective shifted.

I no longer am going to be a passive bystander in my own wealth creation.

I am going to understand the ins and outs of my portfolio, and I am going to simplify the heck out of that portfolio.

My long-term goal, is to move to a simple 3 fund portfolio. Because that is what a Boglehead does.

And yet I own 80 stocks ~ my very own mutual fund

Unfortunately, there isn’t much that I can do about my Individual Stocks. I am paying much much higher fees on the mutual funds (>1%), so those are the first holdings that I unloaded.

And fortunately/unfortunately the individual stocks have quite a bit of capital gains, so selling them off right now just cannot take priority.

What am I to do? Seriously…I am open to suggestions…

Individual Stock Analysis

I should probably figure out what I own. Let’s take a look. Using Vanguard’s Portfolio Watch tool I was able to pinpoint only the individual stocks in question and do an analysis of my very own mutual fund (let’s call it AR’s Fund).

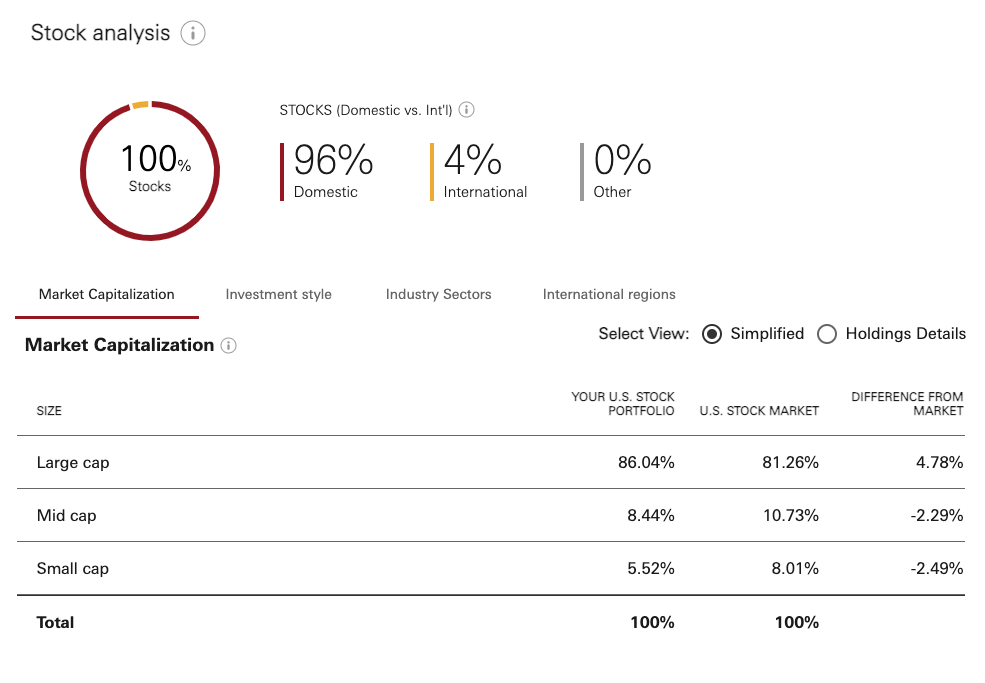

Take a look at Market Capitalization of AR’s Fund:

Ok, so this looks to me to be not so bad. Obviously it’s a tad heavy on Large Cap stocks (+4.78%), but it’s not too far off the mark in general. I am ok with this.

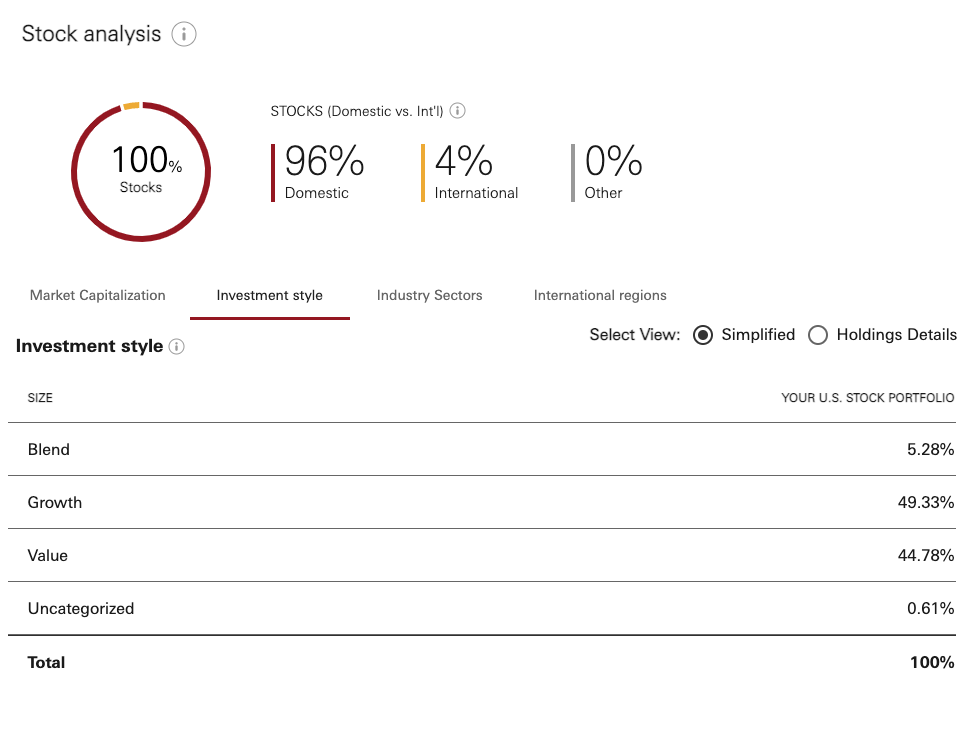

Let’s take a look at Investment Style:

It’s a near a 45/50 mix of Growth and Value. In general I am ok with this.

Some of the Growth stocks include:

- Alphabet

- Etsy

- Paypal

- Regeneron

- Microsoft

- Square

- Netflix

And some of the Value stocks include:

- Walmart

- Bank of America

- Procter & Gamble

- Pepsico

- Home Depot

- Progressive

- Johnson & Johnson

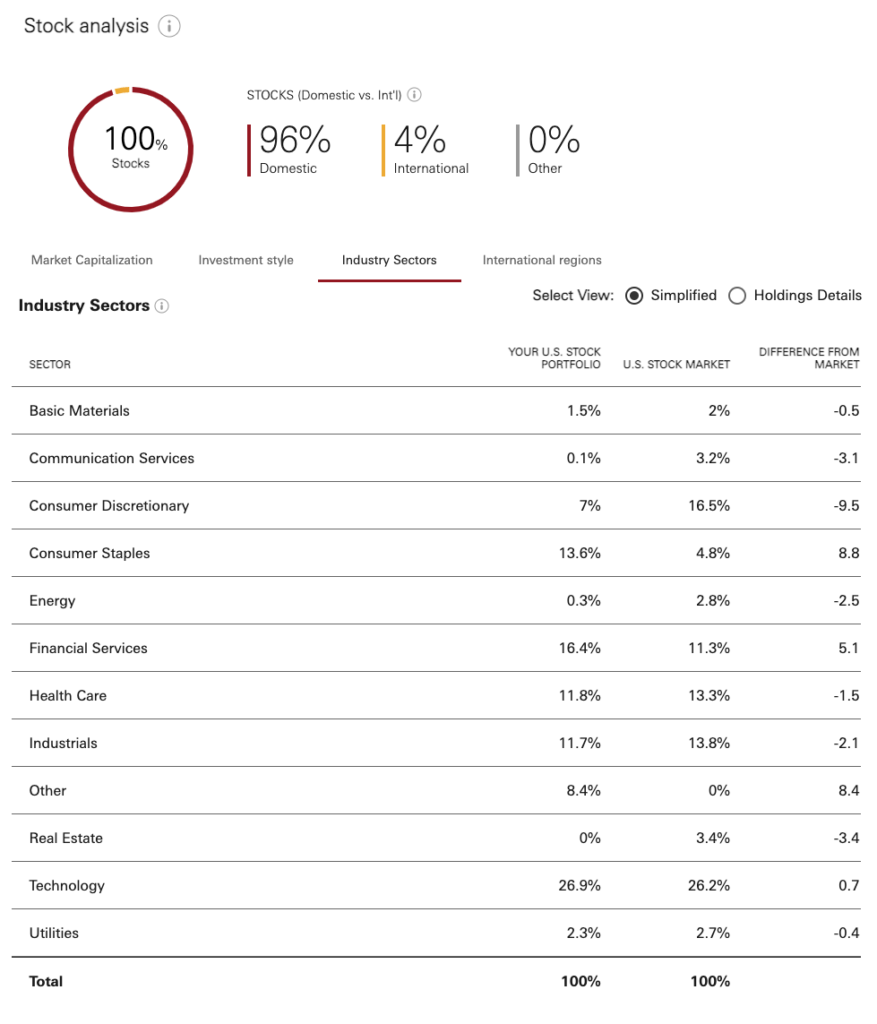

Now, I want to see how comparable to the market AR’s Fund is for Industry Sectors:

Clearly AR’s Fund prefers Consumer Staples and Financial Services more than the U.S. Stock Market.

It is down on Consumer Discretionary, Energy and Real Estate.

Not sure what is up with the Other , which is strange, since the holdings in there are Alphabet and Home Depot. That just seems like Vanguard is misclassifying those for me.

Technology is nearly spot on, but missing Alphabet, so AR’s Fund is a bit heavy on tech.

Single stocks introduce idiosyncratic risk

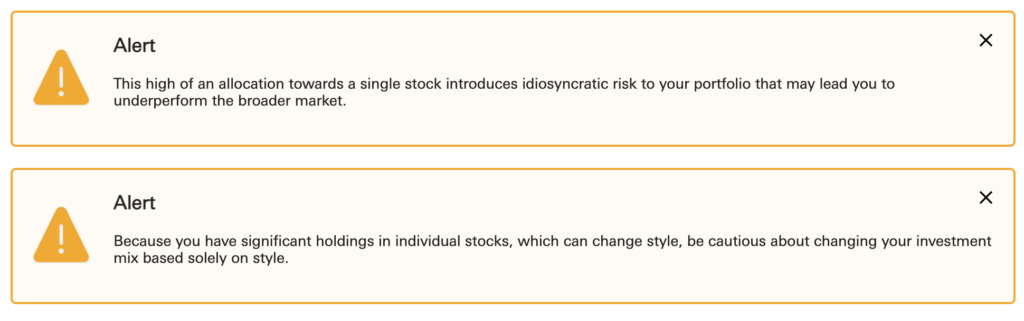

After reviewing the stocks more thoroughly than I ever have, my very non-expert opinion is that AR’s Fund, while somewhat is mimicking the general US Stock market is clearly exposing my portfolio to more risk.

It would be preferred if we were invested in an S&P 500 Index Fund (VOO for instance). Even Vanguard agrees:

This high of an allocation towards a single stock introduces idiosyncratic risk to your portfolio that may lead you to underperform the broader market.

Vanguard Alert in my Account

Because I am not going to be able to actively manage this like a pro (who would fail at it anyway), it is just not worth attempting to continue to build up AR’s Fund.

We must move to eliminate the fund.

Except for those taxable capital gains

Yet, capital gains continues to be a huge elephant in the room.

For 2021, I still need to continue to liquidate the high paying mutual funds. I’ll be capping this out at about $70-80K of long-term capital gains to try to stay in the 0% tax bracket for our first year of early retirement.

So before I can even get into selling any individual stocks with gains, we’ll need to wait yet another year.

Then in 2022, we can finally give it a go. At that point we can focus on the higher cost basis holdings first:

We’ll likely our taxes when we liquidate tax lots with a higher cost basis first.

Early Retirement Now – Principles of Retirement Tax-Planning – SWR Series Part 44

For 2022 and likely 2023, we’ll want to continue to sell as many individual stocks as we can, but within the long-term capital gains 0% tax bracket.

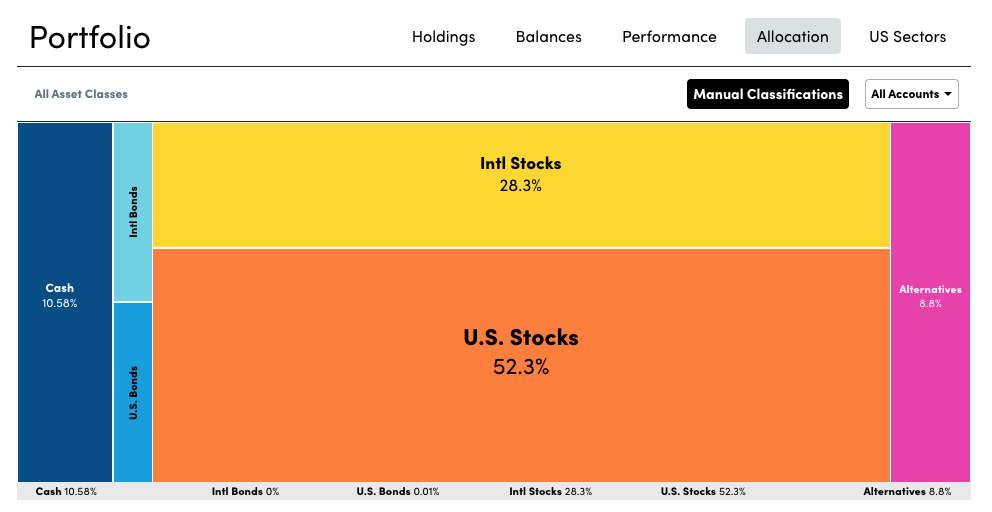

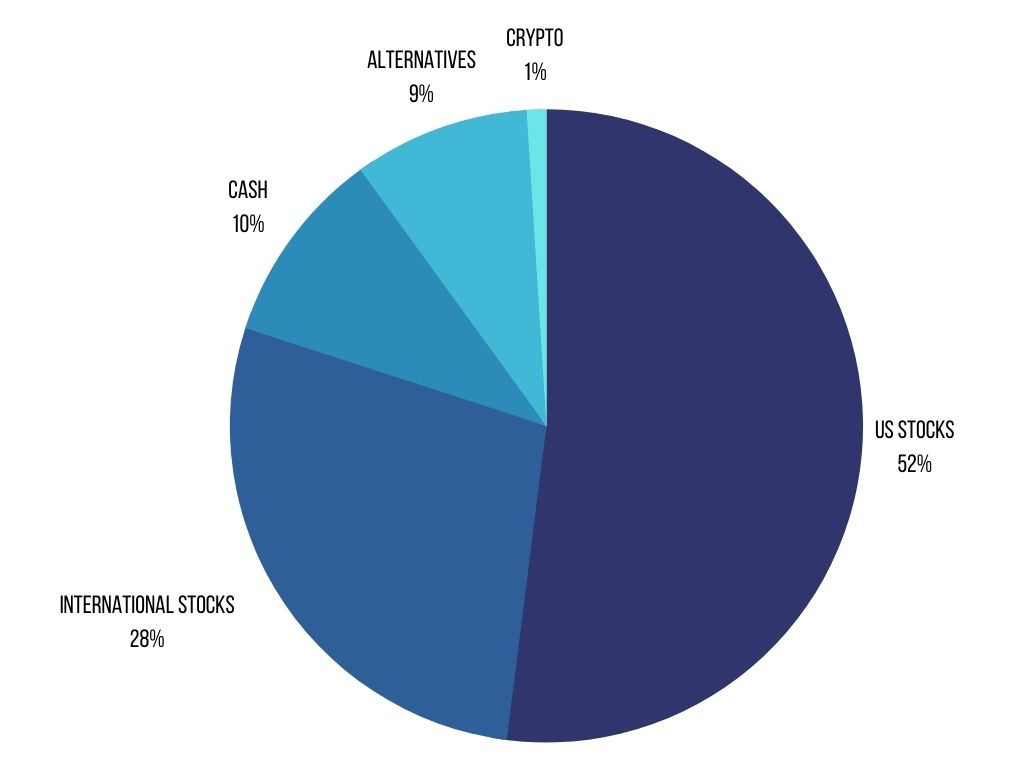

Using Personal Capital for rebalancing

In the meantime, after any liquidation I make, I am utilizing Personal Capital to assist with rebalancing.

I can easily take a look at all of my allocations across multiple Brokerages. Personal Capital does a good job of allocating out the Index Funds into their proper style and sector, allowing me to make easy rebalancing decisions.

This way, I can continue to work to keep my allocations in line with my FIRE plan:

Making small bets

Even though I am now a certified Boglehead and want to simplify my portfolio as much as possible, I don’t mind making small bets.

AR’s Fund might not appropriately mimic the US Stock Market, but we’ll likely have to hold onto certain tech stocks or pay quite a bit of capital gains that are likely to continue to accumulate for two more years.

We’ll just need to follow the philosophy laid out by Even Steven Money:

Personally I invest in index funds. However for me it’s an exciting adventure into owning individual companies and really placing small investments on companies I believe in and follow.

Even Steven Money – Invest in Index Funds and Gamble a Little

Any company that I believe in and follow might have a place in AR’s new and exciting mutual fund AR’s Fund #2.

Yes, I do own a mutual fund

So we’ll see how AR’s Fund performs. Right now, we own 80 stocks. In two years it may still be 30-40 stocks. Perhaps there will be a big enough drawdown to allow us to offload most of the fund.

Only time will tell.

I am huge fan of your portfolio! My investments are also weighted towards Large Cap Stocks and Technology stocks, and those have been performing exceptionally well in the past decade. But as we know, the market is cyclical and other stocks may pick up the pace. Only time will tell, but you are positioned well to capture great returns with your diversification!

Thanks! My overall portfolio is more balanced than just Large Cap Stocks since the rest of it is comprised mostly of ETFs, but my Individual Stocks are clearly very Large Cap. I also did buy some Small and Medium Cap ETFs to offset the Individual Stocks, but within reason.