For the past year, I’ve had some form of AI chatbot open almost anytime I’m working on the computer.

Whether it’s ChatGPT, Gemini, or Claude, I’ve been rotating through them to help with everything from writing and coding to simulating Japanese conversations and, surprisingly, financial planning.

Yep, even, financial planning.

Just two years ago, AI felt hit-or-miss—sometimes helpful, sometimes hilariously wrong.

But recently, the improvements have been dramatic. And in the past few weeks, I’ve used ChatGPT to help with tax planning, gain harvesting, and even mapping out Roth conversions.

And this raises the big question: Should you be using AI to assist with your financial planning?

Should You Be Using AI to Assist With Your Financial Planning?

In my opinion, YES.

Now, I wouldn’t expect to be able to hand your financial data to ChatGPT and expect it to accurately model your early retirement (see below), but I won’t be the least bit surprised when they can do that in the next year or so.

In fact, AI chatbots are now so good to the point that they can accurately answer your questions and help you make faster decisions without the need for a human financial advisor.

Let’s walk through a few examples, starting with something simple…I asked ChatGPT about harvesting gains:

Can we talk about locking in gains? If I sell off some stock today, but then re-buy the same stock the same day, that is legal correct? It is selling off losses and rebuying that is not legal?

ChatGPT then responded:

Yes, you’re exactly right — selling stock to lock in gains and immediately rebuying it is legal, while selling to realize a loss and immediately rebuying it is typically disallowed due to the “wash sale” rule.

✅ Selling for a Gain (No Wash Sale Rules Apply)

If you sell a stock at a gain and buy it back the same day, there’s no IRS rule preventing that.

- You realize the gain, it becomes part of your taxable income (short- or long-term depending on how long you held the stock).

- You reset your cost basis to the new purchase price.

- You reset the holding period for capital gains treatment.

This is commonly done in tax-planning strategies to lock in a gain now (for example, if you expect your tax rate to rise later), or to rebalance your portfolio while still wanting to hold the same stock.

Fantastic! Within seconds, you get excellent information to help you make a decision to lock in the gains, and it is supported by plenty of good background information – which you can of course, find online, but that is summarized up nicely here.

So instead of visiting 3 different websites to find the answer and feel confident, I was able to ask it one quick question.

Next up, I decided to ask ChatGPT about factoring in my IRA to ROTH conversions later this year:

Ok, so it looks like I could lock in about $4-6K of gains and on about $80-90K worth of market value. That would cost me $0 in tax since I am well within the 0% capital gains bracket.

However, I also plan to continue IRA to Roth IRA conversions and will want as much room as possible to do that.

Lastly, I will need to rebalance my portfolio later this year and likely take further gains. So does it make sense for me to lock in gains now, or wait until I need/want to sell later.

The answer ChatGPT provided was detailed and attempted to provide some pros and cons for making the conversion and the sale of the stock to lock in gains:

💡 Key Considerations

1. 0% Long-Term Capital Gains Bracket

For 2025 (based on 2024 IRS limits), the 0% LTCG bracket applies to:

- Up to $94,050 in taxable income for married filing jointly.

- Up to $47,025 for single filers.

If you’re under these limits after deductions, your LTCGs will be taxed at 0%. But any Roth conversion you do adds to that income and could push you into the 15% LTCG bracket.

🔹 So, selling now locks in those gains at 0% while you’re still in that bracket, before your Roth conversion or other income bumps you out.

2. IRA to Roth IRA Conversions

Every dollar you convert:

- Adds to your taxable income (at your marginal tax rate).

- Could push LTCGs into the 15% bracket (if you realize gains later).

So if you lock in gains before your Roth conversion, you’ll likely:

- Capture the gains tax-free,

- And still have more room left to do conversions before hitting a higher tax bracket.

3. Rebalancing Later This Year

If you plan to rebalance later and it might cause more gains:

- Locking in gains now could reduce the tax impact later.

- The gains you realize later may not qualify for 0% LTCG if your Roth conversion or other income pushes you up.

So selling now gives you a bit more flexibility later.

Boom! Financial assistance at the push of a button!

Now, let’s change course a bit and ask ChatGPT how much I should expect to pay in taxes when I sell my affiliate website:

I have an asset that I am selling for my LLC that I file personally (not as a S-corp).

I bought the asset for $50,000 in October 2021, and have depreciated it on a 10-year timeline since.

If I was to sell the business for $40,000 would I take losses on this?

And then it answered:

Your original cost was $50,000, purchased in October 2021 and depreciated over 10 years.

Assuming straight-line depreciation with no Section 179 or bonus depreciation, you’ve had:

- 2021 depreciation (partial year, ~3 months): approx. $1,250

- 2022 depreciation: $5,000

- 2023 depreciation: $5,000

➡️ Total depreciation to date = $11,250

➡️ Adjusted basis = $50,000 – $11,250 = $38,750[…]

This $1,250 gain is Section 1245 depreciation recapture since the asset was used in a business and depreciated.

The recaptured depreciation is taxed as ordinary income, not capital gain.

If you had sold it for less than $38,750, you’d have taken a Section 1231 loss, which generally gets capital loss treatment (or ordinary depending on facts).

Of course, this is something that I would most certainly run by my accountant as well, but to spare myself the $300 bill from contacting him for one question –> this is the perfect use case for an AI-based chatbot.

So, as you can see,e AI Chatbots can be used as financial advisors and accountants. There are many great examples of them being used as lawyers as well.

Of course, I still always think it is best to double-check your advice, but we are getting to the point where even that may not be needed.

Even so, let’s see if ChatGPT can do more advanced financial analysis. As you’ll see, this is where I ran into a few roadblocks…

What AI Chatbots Aren’t Great at Yet

Next up, I tried to have ChatGPT do some hardcore early retirement financial analysis, and that is where I finally hit its current limit.

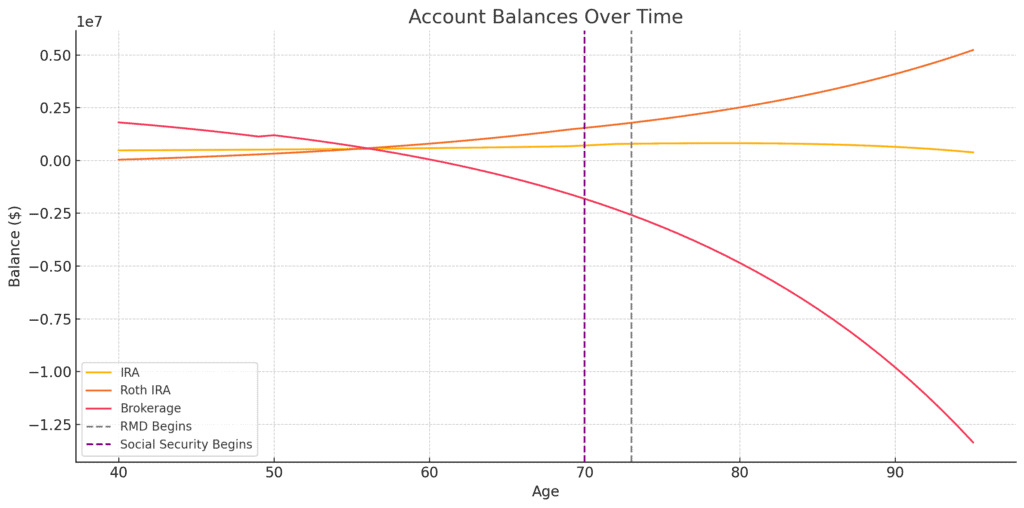

It easily understood that my financial strategy is that of a typical FIRE scenario, and it attempted to help model out ROTH conversions, RMDs, and social security from age 40 to 100.

The attempt was pretty solid but limited. I got a nice-looking chart, but ChatGPT was limited to running ONE scenario for me based on flat-line growth of 5% per year:

That just isn’t good enough.

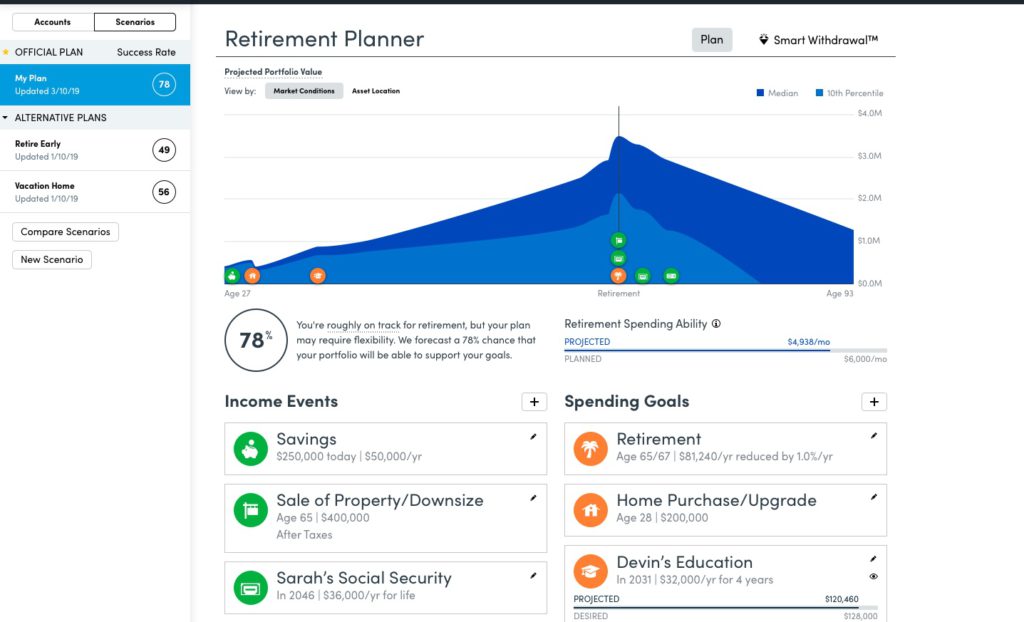

When trying to make an early retirement decision (or any retirement decision), you want to look at various scenarios based on real-world information.

For example, when you run an early retirement financial simulation over at Empower or cFIREsim, you get hundreds of simulations to help better model the data:

However, ChatGPT, on the other hand, was only capable of barely putting ONE together, and that was with many tweaks and confirmations back and forth.

After two runs of the simulation to correct the data, the advanced data analysis ran out for the day, and I had to wait another day to run it again.

Then the following day, I ran it ONE time, and it timed out again.

So without paying for ChatGPT, I think its going to be pretty hard to truly see how much more it can do.

However, I imagine that with more prompting, you can get it there, but I don’t think it would be any better than the other already free resources we have available to us.

So clearly, ChatGPT is useful as a financial planner, but only up to a point.

For that reason, I still recommend Empower and cFIREsim for tracking, simulating, and planning early retirement.

AI Chatbots: Your Financial Planning Assistants

So, all in all, AI Chatbots can now be used as Financial Planning Virtual Assistants.

They are not yet capable enough to model full-scale financial plans for you, but they can accurately answer questions and make quick tax and capital gains calculations for you.

AI Chatbots can save you on some accounting and legal costs and certainly help you to learn faster and make better decisions.

And in the coming months and years, I expect they will be getting better and better.

AGI may not yet be here, but in the next few years, you should be able to harness AI Chatbots to do all sorts of complex financial analysis for you as needed.

For now, ChatGPT and other AI chatbots can assist with the financial planning process.

Yep, I’d even daresay that you can use them as a limited Financial Advisor. I mean, why not?

Have you used an AI Chatbot for financial planning of any sort? Let me know in the comments below!